Volatility Is Not Done

Powell saves the day! Exactly at my SPX 5670 target! Doesn't mean we can't crash.

“Over the last 12 days, the S&P 500 High Beta Index has lost 14.4%. Meanwhile, the Low Volatility Index is up 1.4% over the same time period. All over Wall Street, folks are selling risk and buying security.” Eddy Elfenbein March 6th.

Color Me Skeptical

Markets are wired to go up over time. That’s why “consensus” stays bullish. My job is to time the turns for active traders and investors - to let clients know when it’s safe to press long or short, to identify the sector rotation themes for maximizing returns, and to pick the strongest/weakest stocks for alpha generation.

I have told clients that I am really good at timing tops, as they are a process and I can see the breadth destruction and selling under the surface. But bottoms are events and tougher to time. But I’ll know it when I see it!

Some are “the big intervention” events like GFC, the post-Covid-crash intervention, the Oct 2022 Gilt blow-out intervention - even the March 2023 bank backstop (that timed with NVDA AI euphoria) or the Nov 1st 2023 “Fed Pause & Yellen Yahtzee”. Long story short, I am always looking for the macro trigger to interrupt the bullish flows AND the policy intervention to interrupt the bearish flows.

And I don’t see a compelling enough macro trigger to interrupt the bearish flows in the near future - short of Trump reversing his policies on Tariffs or DOGE (which is a pipe-dream). Add to that, both Fed and Treasury (as reviewed in prior posts) are impotent to really help reverse the confidence crisis that has gripped both corporations and consumers. At best, Fed slowing/pausing QT of their balance sheet and or Fed rate cuts moved forward would slow the descent, but the re-rating that has begun in concentration risk is still underway, and this will make all the difference to investor confidence and returns moving forward.

Add to that China stealing the US Tech Dominance limelight!

Not to mention investors are rightfully nervous about a US Govt Shutdown at the same time War escalation in Iran builds and US policy direction is chaotic and distrusted. Most are not watching how credit spreads have started to widen from US growth slowdown (as shown to clients). And few see the yen carry trade unwind part 2 as a strong under-current risk.

Mostly, bulls are excited about bullish March seasonality, a technical bounce on the 200D to new all-time-highs, and picking up tech/AI/semi stocks on sale.

Color me skeptical.

Let’s Talk About Seasonality

Many are pointing to bullish seasonality:

To which I would remind, how’s that working out on the assumptions for Trump 2.0”?

I’m going to stick with the process I have employed that helped navigate clients from QQQ $539 short into $487.20 / SPX $6100 short into $5670 - all set up nicely in advance.

Even through that Friday 2/26 bounce:

to trounce:

to expectation of short-term bottom once we reached these price targets given 2/28:

to sizing up the risk 3/7 from my live trading room after these targets hit:

"Remember, this was my bet: We'd come back down here. This is major support $5670. We don't bounce, then we crash.

and remember:

"The next time we have a -3% down day, we will have a VIX spike."

With that, the short into the 200D was a great trade, but now it could snake for weeks (above/below) without resuming its up or down trend (unless we get a macro trigger).

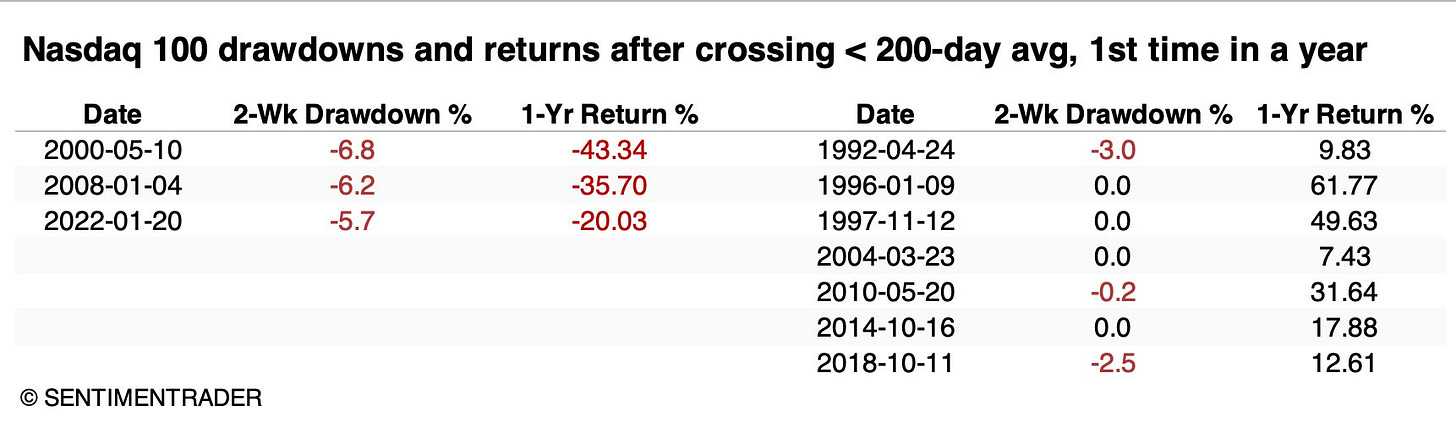

But given it has broken for the 1st time in 2 years, this stat bears watching:

"Every time it lost its 200-day after an extended run and suffered at least a -3.5% drawdown within the next 2 weeks, it led to a bear market. When the 2-week drawdown was less than -3.5%, 1-year returns were positive every time." Jason Goepfert

Volatility Is Not Done

To review: SPX has just retraced ALL of its gains since 🥁the July 16, 2024 high before the yen carry trade unwind caused $QQQ to dump -15%, $SMH -25% + $NVDA -35%

AND🥁before VIX spiked to 65 premarket Aug 5th triggering the convexity-short-covering rally.

We have had such controlled demolition from…

Profit taking.

Leverage unwind.

All the while, VIX is 20~25 (when normal is 15~20). VIX hasn’t even really TRIGGERED a spike higher yet!

But we have massive internal volatility, way outside normal parameters, and my bet is volatility will work from the inside out.

Above is an intraday chart of SPY on Monday and Tuesday of this week presented by iVolatility.

“…a move of just under 6 points is one percent. There were four moves in two days over 1%. In fact, they were roughly 1.5%, 2%, 2.5%, and 4% in alternating directions. For perspective, a long-term average move for a full month is around .6%. Over the last week, we have been having moves of that magnitude in minutes!”

As Russell Rhoads points out, the

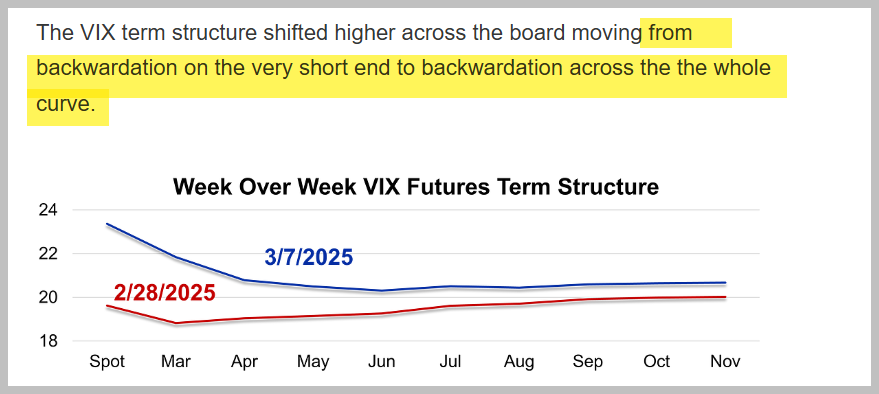

“The VIX term structure shifted higher across the board moving from backwardation on the very short end to backwardation across the the whole curve.”

I have warned and shown clients how backwardation is often ‘garden-variety’, but other times it is more durable. To date, my intermarket analysis read I have shared with clients is the durable kind.

The Powell Put

Friday morning Powell was straight hawk: economy is fine, labor market is strong, cost of caution is low... blah blah blah. With that dollar stabilized and US yields reversed higher - the exact tell I gave clients earlier that equities would force short covering/monetization intraday. VIX pushed back below 25.20 - my key tell given to clients - and a bounce at the expected 200D for QQQ commenced and all bulls raced in to say bears would be toast. Same ol’ same ol’.

Before Powell I had already expected probabilities of bounce were high but so too is the trounce after the bounce - and that includes bitcoin…