MONEY GOES HOME

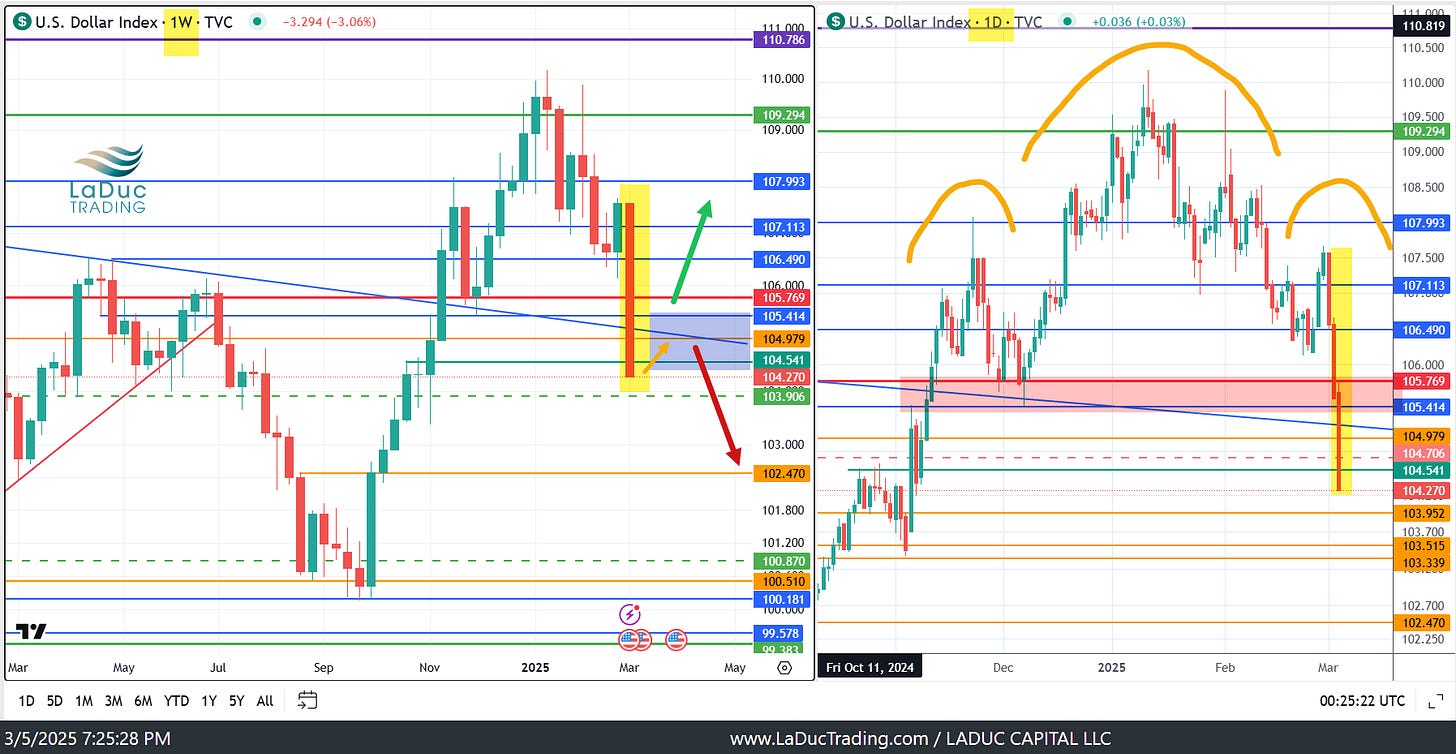

Dollar Dumps. And Not A Little Bit.

The USD just had its largest 3-day sell-off since November 2022 when major global central bank intervention infused $1.5 trillion (according to Matt King of Citibank) in an effort to tap down rising dollar and yields that were causing equity and bond volatility. The reason this time?

After Trump/Vance met Zelensky last Friday, and kicked him out of the White House for not wearing the proper attire, Zelensky flew home into the arms of a very warm embrace by … most of the EU leadership - vowing support including military and financial aid.

With that, whether by design or coincidence, Germany announced a surprise stimulus measure Tuesday:

“The German stimulus is huge and right: €500bn infrastructure spend over 10 years + private follow-ons + defence = ~1.5-2% GDP more growth p.a.

Compare this to ave. 0% GDP growth since 2016 (!)” Florian Knonawitter

At the same time, the EU announced it is discussing granting “fiscal flexibility” worth ~650 bln euros over the next four years.

The result was a blow out of this rate spread differential, sending EURUSD sharply higher against USD. [Chart h/t Brent Donnelly]

The irony is that while US risks economic growth slowdown under Tariffs and DOGE amidst sticky inflation and rising labor shedding - causing US yields to fall with oil and equities - China and Germany are stimulating.