THIS IS THE MANHATTAN PROJECT 2.0

DeepSeek Deep-Sixes Semis & Investor Confidence

China World Domination Was Not On My 2025 Bingo Card

While most are focused on DeepSeek’s impact on the AI market in general and NVDA in particular, this post will highlight why I believe it is much bigger than that.

Given that I never forecasted a recession until June of 2024 for 2nd half of 2025 - regardless of who won the US election - I am laser-focused on the macro triggers that can interrupt the bullish market flows (positioning, policies, liquidity, etc).

Not on my 2025 bingo card: CHINA WORLD DOMINATION.

That sounds more hyperbolic when I put it in caps, but it’s pretty much how my brain sees it - in capital letters and in flashing neon colors.

Never had that thought before this weekend. So I wanted to lay out some thoughts that focus more on the game China is playing that is supremely dangerous to US, but which markets are curiously applauding. I also want to warn: I don’t think Trump sees it yet - despite how strongly China is sending him signals.

Tops Are A Process Not An Event

My job is to let clients know when it’s safe - on both a trading and investment horizon. I size up mis-priced opportunities in the short-term while zooming out big picture to the potential risks the market is ignoring. I only warn when I see a picture forming. It’s not a trade thesis. It falls in the category: Ignorance Is Not Bliss.

With that, this post is not “what’s the trade”, which I cover daily for clients in my live trading room across Chase, Swing & Trend timeframes. This thought exercise is a place to document what I see as a potential major turning point for America’s fortunes and the challenges Trump will have navigating them.

I will be more direct: I think Trump is doing a lot right as it relates to fiscal restructuring, reduction of taxes and regulations. However, I have my sincere doubts about the transition to a tariff-driven trade policy. And specifically I think he will mis-handle China, like he mis-handled Covid - which I called out in mid-January 2020 specifically as a reason market would fall.

Fast forward to today, and Trump has an agenda on “rebalancing International Trade, and reigniting American Manufacturing”.

Hate to use a cliche, but this is much easier said than done. Let’s look at the US Trade Balance in Goods post 2008. The U.S. has lost competitiveness in manufacturing in a big way, and the only way to save them is to force the USD to fall & pull rates lower with it. But not too much! Or Trump risks a big deflation event (read: recession of size).

Geoffrey Fouvre, our macro economics advisor for LaDucTrading EDGE clients, explains the dilemma:

Higher US rates & inflation make terms of trade ugly- especially with USD as reserve currency. It has to stop or we risk an abrupt devaluation - like the UK in 1927.

Logically, this is one really big reason why Gold is rising past year. And ironically, this is why China has risen the past few decades.

"If the US did not have FX as reserve, CHINA would probably never have been able to advance so much like they did.

Speaking of China, how have they made out, really?

China Has Built A Large Moat In “Physical” Dominance

Globally, China is undeniably #1 in INDUTRIAL PRODUCTION & TRADE, dominating in the physical product markets:

#1 in MANUFACTURING - FROM CARS TO ELECTRONICS TO TEXTILES

#1 in STEEL & CEMENT PRODUCTION

#1 in SHIP BUILDING & HIGH-SPEED RAIL

#1 in INDUSTRIAL & COMMODITIY CHEMICAL PRODUCTION

#1 in RARE EARTHS & LITHIUM

#1 in BATTERIES & SOLAR

#1 in EV GLOBAL SALES

The US is the world’s sole military superpower. It spends more on its military than the ten next highest spending countries combined. China is now the world’s sole manufacturing superpower. Its production exceeds that of the nine next largest manufacturers combined. CEPR

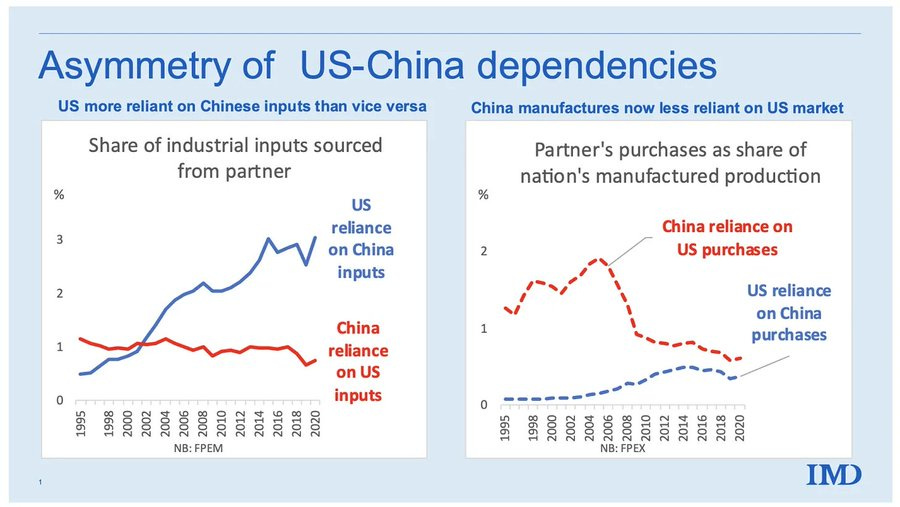

I present all of the above data to show how asymmetric the relationship between China and US has become - even before diving into the DeepSeek threat on America’s AI Tech Dominance.

As a nation, we are much more dependent on China for goods than is reasonable, economically prudent or safe. By definition, that is why Trump wants to incentivize (read: force) companies to manufacture on US shores.

I’m highlighting the scale of our manufacturing loss and their gain, at the same time I am mindful of the great disruption that China would cause if they were to retaliate against Trump’s tariffs by shutting us out of needed supplies. Especially if that followed a launch of their own Chinese tech that competes with US.

Enter DeepSeek - The Disruptor

Lucky or good, Wednesday Jan 22nd in an after-market webinar I noted how I had seen no signs of a market turn lower but still felt it was a “sucker’s rally”. That proved prescient as SPX fell -3% premarket Monday, with NVDA crashing -17%, and many of the previous high-flyers within the AI ecosystem - from hardware/semis to energy/datacenters - falling from -7 to -27%.

This was a snapshot of the ‘boring’ utilities sector - many that had been bid up in the ravenous feast on all-things-data-centers!

It was a bloodbath for many semi players too. But as the AI ecosystem was drowning in a sea of red, the IGV software sector was running up hard. The new “free & Open AI” spurred a mad-dash out of chips and into cloud. Thank goodness we had rotation, because clients know my mantra:

IN LIEU OF ROTATION, THERE WILL BE VOLATILITY

While market was noisy - both from the bifurcated market action as well as all the hot takes from the market analysts & traders racing to conclusions about the impact of DeepSeek on NVDA chip demand, data center CAPEX spending, MAG7 applications, even OpenAIs valuation. Instead, I assembled what I saw were the bigger signals through the noise.

1. For Me, It’s Not About The Tech!

Some see DeepSeek’s disruption to our AI ecosystem as bullish hardware; others not so much. Ben Thompson did a solid summary on how he sees DeepSeek impact on our MAG7 royalty - taking the opportunity to wax mostly bullish on the China tech breakthrough and how it would benefit each of the MAG7 players:

Longer term, "model commoditization and cheaper inference...is great" for the companies but to differing degrees:

Microsoft: Win as need to spend less on data centres/GPUs (but customer demand still grows)

Amazon: Big winner because it hasn't been able to make its own AI model but now will be very high-quality ones available at very low cost, that get served through AWS.

Apple: "Dramatically decreased memory requirements for inference makes edge inference much more viable, and Apple has best hardware for that.”

Meta: Biggest winner because it has most consumer touch points for AI and can serve all users even cheaper.

Google: "Probably worse off", because specialized TPU hardware less valuable and cheaper inference increases likelihood of more AI alternatives to search.

Nvidia: Two main Moats (CUDA, networking multiple GPUs) are challenged. Company "isn't going anywhere...however, [NVDA] is suddenly facing a lot more uncertainty”. But still three factors in Nvidia’s favour: 1) DeepSeek methods may improve performance of H100 and future chips; 2) greater AI usage overall is positive for Nvidia; and 3) r1/o1 type reasoning models are compute hungry.

Ben Thomas ends his article with:

“If we choose to compete we can still win, and, if we do, we will have a Chinese company to thank.”

I’m not interested or qualified to debate the pros/cons of the tech itself or defend/debate how it helps or hurts NVDA etc. I trust @natebjones when he says that if "Demand for Intelligence" is your AI investment thesis, it is still a strong one. That and "we still need the chips to build and SERVE the next model"

But I am absolutely focused on the fact that the DeepSeek AI disruption was precisely- timed, is very real to investors, and represents a real risk of growing tech dominance from China that few are discussing.

2. The Confidence Tipping Point

Bogachan Ozdemir (@Bogachan_1971) on Saturday (Jan 25th) summarized the history of AI on X, snarkly, so we’ll start there and build up.

AI is a giant matrix of vectors with parameters around 600-700 billion values. The way it works is they tokenize words, usually 1 to 3 token for each word as English is supreme language for this and then you multiply those tokens with this matrix. The matrix had to be trained to be useful. Here, when building OpenAI, @elonmusk had the right idea and made it open to public where people were able to download the parameters.

Then the crooks stole it and sold it to #Microsoft and hid the parameters. That stopped the evolution of AI and gave the opening to #China to catch up.

When dumbass Americans used this gigantic matrix to sell Nvidia chips and their congress people bought Nvidia stocks and #Trump talked about sinking $500 billion on it, what the Chinese did was to optimize the matrix. Deepseek AI matrix is also as big as OpenAI but it can be used as if it has 30-40 billion parameters and give nearly the same performance as the most sophisticated version of the crooks' AI.

Deepseek is MIT licensed, so u don't need to pay anyone anything. Moreover, the game just started. So many brains will download the parameters, and that parallel processing will destroy OpenAI -which is more like ClosedAI- in a few months as Deepseek will get more and more optimized.

Will you need the Nvidia chips with an optimized AI network?

As the weekend continued, memes were swirling about and investors realized their investment in AI wasn’t so safe, and maybe not so smart, after all.

And then this winning idea of DeepSeek spread so quickly that it became the #1 downloaded app in the AAPL store by Sunday afternoon!

I stayed glued to the story - some really good reporting and some horrendous - as the NVDA investor confidence quietly collapsed in the background.

It was a confidence tipping point - for NVDA, for AI.

One thing everyone agreed on was clear: DeepSeek was a disruptor! Where they didn’t agree was the impact of the threat of this new Chinese AI-tool - from it’s role challenging American AI leadership in general to the U.S. chipmaker space specifically.

Sunday night futures showed only a -5% NVDA pull-back - very reasonable. But Monday morning showed something far more scary - 14% with another 3-4% drip lower as the reaction was clearly: “sell now, ask questions later”.

3. The End Of American Tech Dominance

I awoke Sunday morning, after staying up way too late scanning and reading everything on this latest Chinese techfare, and reached for my phone. I posted this before I even got out of bed:

Imagine this:

All that CONCENTRATION RISK that US built up in the financialization of markets (and politics) past 15 years backfires big time.

Instead of the brightest minds coming here, they stay in China. And those here go home. And they sell US assets and bring that money back too.

Imagine the best prospects for tech, science, defense innovation find a better place to build value - in a country that incentivizes, rewards and values society over selfishness.

Imagine America has lost its best advantage - tech dominance. The other advantage starts to fall - USD hegemony.

Trump can’t do anything about it, because 1) he promised MAGA base American isolationist policies, and 2) it’s too damn late.

America’s stock market is overvalued. China’s is undervalued. Imagine this changes - in a big way.

Imagine our falling US dollar and yields only expedite the rotation of money to ROW.

Imagine it now before the market does.

All day I thought about our U.S. military, energy, scientific, technological and money dominance.

China has likely already caught up in military preparedness, but we haven’t had to test that thankfully. China’s dependence on imported oil is why they mandated a transition to EV and alternative energy sources. We’ve seen the images of the expansive solar farms, dramatic collapse in air pollution, and countries have been caught off guard with how fast they have catapulted to #1 in global sales for EV sales.

Their scientific advances are stunning as well - including but not limited to a recent announcement of China’s success pushing into the ‘clean energy’ of fusion.

It hard for many to fathom what this can actually mean, but we haven’t heard anything of its kind coming from America:

"A nuclear fusion reactor in China, dubbed the "artificial sun," has broken its own record to bring humanity one step closer to near-limitless clean energy."

And even China’s “semiconductor revolution” is being touted as no longer a dream.

With China focusing on advancing fusion to aid nuclear weapons design and power generation, while building its own AI tech and semiconductor industry to replace the products US has sanctioned, hopefully the US private and public investment to build out data centers for MAG7 companies on Ai Tech that China is giving away is not in vein.

And hopefully US investors don’t doubt US dominance in technology in general, that would further erode confidence in the future growth of our Magnificent 7 most-highly valued and owned stocks in the world not just US stock market.

And hopefully, China won’t unleash any more competing tech that could upend the CAPEX investment and earnings growth for MAG7 - which has already started to roll over.

It’s not like China has a reputation for flooding a market with a a low-cost commodity or competing product to massively disrupt it.

Oh wait.

I vaguely remember reading about some sort of economic warfare they unleased for cheap solar panels, overproduction of steel, mass exporting of inexpensive electric vehicles and undercutting suppliers on low-priced textiles and electronics.

I’m being facetious, obviously, but lo and behold, China just flooded the world market with free and open Artificial Intelligence products in direct competition to the U.S.!

And so many are underestimating their ability to pull other tech rabbits out of their hat!

Geoffrey is not one of them:

China is the largest market for Chips.

China bought a lot of lower end DUV because the Sanctions gave a fantastic impulse to build-out the China ecosystem.

The sanctions changed everything.

Now the Chinese companies CAN NOT defend buying Western Equipment when there is a China alternative.

They have 2 advantages: Low cost of capital (low rates to invest in capex and invest in R&D), and they have 10X the amount of STEM graduates than the US.

I think in 10 years the Chip industry in the West will be destroyed and China will be a net exporter of Chips."

I have worked closely with Geoffrey for two years and he has proven to be a master of classical economics, fundamental analysis and technology assessment. He has presented deep-dives on all of this for our clients and the data he has presented as been nothing short of compelling.

The points I want to make are these:

Could DeepSeek be the proverbial shot-across-the-bow to disrupt our precious MAG 7 royalty with an investor confidence test?

Could it be a pre-emptive push-back to Trump and his tariffs that he promises will be higher against our adversaries?

Ironically, the U.S. is intensely dependent on China for supplies from life-saving drugs to military components, and everything in between. Has Trump really thought about their recent advancements and weighed it against possible trade war retaliation by a country that is catching up much faster - across military, science, energy, AI and technology domains - then Trump can control?

Add to that the risk of BRICS growing - not a focus of this post - and China also puts at risk America’s “exorbitant privilege” of money.

4. Curious Timing

Year Of The Snake, indeed.

DeepSeek r1 was released on Inauguration Day

Right before the week-long Chinese holiday

And right after the Stargate pump-show that is Ellison, Altman, Masayoshi-son & Trump

Likely in payback to CIA publishing their official report blaming China/Wuhan lab for Covid (which they warned never to do)

Exactly on the same day as this nuclear fusion accomplishment in China referenced above

And precisely the moment Trump "eliminated the reporting requirements established under the 2023 Biden executive order for AI developers regarding safety tests for AI systems that could impact national security, the economy, public health, or safety" so DeepSeek is FULLY EXPORT CONTROL COMPLIANT!

On top of all those coincidences, DeepSeek was released a day after a show of financial pandering (grift) and wealth-bragging ($56 billion overnight) on a meme coin that delivers zero value to anyone but our incoming President and his loyalist friends.

If I was China and saw this political financialization of markets, I would launch DeepSeek just in spite too.

Color me skeptical, but there are no coincidences in markets - especially given DeepSeek’s origins as a reincarnated Chinese hedge-fund trading algorithm.

My job as a market analyst for clients is to follow the money and the motivations. After presenting my suspicions, Client Anne dubbed DeepSeek a Red Swan:

"My version of things we can't imagine China doing, until they do."

5. Good Luck Tariffing China, Mr. President!

Let’s revisit this theme again:

What are the chances DeepSeek was launched as a pre-emptive strike against Trump Tariffs?

If so, this isn’t just about China threatening our MAG7 tech moat with suddenly free assets by our communist adversary. This has the potential to unwind the concentration risk of crowded buyers in the most sought-after asset class of the decade - AI.

The US stock market is now 63% of global market cap, up from 60.5% at the beginning of the year.

MAG7 by itself is 60% US GDP

Q2 US GDP Value: $28.6 trillion

Q2 MAG7 Market Cap: $15.4 trillion

If China wants to attack our technology dominance, they have to attack MAG7. If they attack MAG7, our stock market falls. If our stock market falls, so too does our economy.

China’s stock market doesn’t matter so much to their real economy. In the U.S., we have the largest percentage of our household wealth in history tied to market returns. Not to mention the tax receipts the government receives from taxing it. Long story short, U.S. is a tech innovation wrapped in the closed-loop financialization of our equity and bond markets. If MAG7 goes down, our economic prosperity goes with it.

So tariffs on China could trigger a blowback that Trump may not fully see or appreciate. And the market most definitely doesn’t see it yet.

This Is The Manhattan Project 2.0

US businesses have a bigger problem than tariffs. And George @Vera_Icona_23 helped me see it.

The Finish Line is ASI - Artificial Superintelligence. Using AI to make all kinds of intelligence and defense technologies...

Whoever gets there first will be King of the Mountain over all others in being able to call upon an intelligence far greater than ours to conduct war, and in particular to crush other foreign AI efforts in the cradle.

As with the atomic bomb, it all hinges on who gets there first. But even more so.

This would be like a neutron bomb of information.

If it behaves.

We are in incredibly dangerous territory in this arms race. Electric grids could stop. Hospitals paralyzed. Flights grounded.

We've all seen the movies. We are there.

This IS Manhattan Project 2.

Some others can see it too.

Now let’s talk about sea cables.

Yes, really, sea cables, because I think it sums up what I see happening with the Passive-Aggressive behavior that is this Chinese tech entry into the US.

China's Undersea Cable Sabotage

"What we are witnessing is a much more brazen Beijing now employing full-spectrum #grayzone tactics behind vanishingly thin facades of opacity or deniability. China seems much less concerned about reputational costs, calculating that any international outrage will be limited and manageable.

"This reflects both its strategy and its experience. China’s experience has been that international outrage is fleeting and of minimal real cost, while its strategy is to normalize increasingly aggressive behavior so that lower levels of aggression become routine and barely noted.

We’ve seen this play out across many domains, including in the air, on or under the sea, in cyberspace, and through lawfare. So accustomed has the world become to it that incidents that used to generate headlines now barely receive public mention."

What China is doing to undersea cables is stealth warfare. So is what they are doing with America’s tech dominance.

Sanctions were a bad idea and adding more is too late to make a difference for good. Export controls with teeth are likely coming from the Trump administration. So are tariffs. But these policies won’t reverse the path that China is on for AI World Dominance, or reverse the damage of loss of confidence if China plans to manipulate our stock market by draining wealth from it while waging an economic war and getting praised for it in the process.

The AI chip battle will continue. US restrictions have already forced a rapid acceleration of China's domestic chip strategy, as Geoffrey has already documented for our clients.

This announcement Tuesday (Jan 28th) is not going to help:

"TRUMP OFFICIALS DISCUSS TIGHTENING CURBS ON NVIDIA CHINA SALES."

And others can see it too:

I agree with Rebecca Fernandez (@Rebecca98869736):

I think the market is in the process of realizing that China has avoided our bottleneck and it’s only a matter of months before they’re gonna release their own high-end chips and other tech. Trump admin seems clueless and the more I’m looking the more I’m inclined to fade them.

Jon Stewart makes light of the same observation.

But few on Wall Street are saying it out loud:

“US exceptionalism was the argument to make 15 years ago. It’s not an argument for today.” Richard Bernstein of Richard Bernstein Advisors

The more who do see it and discuss, the more investors and Washington will potentially heed their warnings. The problem is we are approaching a confidence tipping point in US tech dominance, which puts us at risk for more than just an unwind in our wealth affect. This is the Manhattan Project 2.0.

What an amazing write up, Samantha, you have done an exceptional job here. There are so many pearls of wisdom here, I will have to read this a few more times to make sure I think more about it.

Hitting Mag7 (60% of US GDP) as a way of hitting US economy, Chinese reverse brain drain, asymmetry between Chinese and US stock markets and how their households are impacted by stock prices, asymmetry between Chinese and US manufacturing and why tariffs on China will be Trump's blunder, the interesting timing of Deepseek release. How you have connected the dots is just amazing.

Just upgraded to paid subscriber. Keep up the great work!

After reading this a second time through per your recommendation, I am in awe.

You're operating at another level. Just incredible insight. Capturing the 'shadow warfare' of the undersea cable cutting associated with your thesis is leaving no stone unturned.