SPECULATING LIKE IT'S 2021

I'm baaaack...

OK, I did a cameo appearance last week (trading room) and sized up markets live Wednesday/Thursday, but I haven't assembled written thoughts for two weeks!

Before I left for vacation on June 20th, I detailed the three scenarios ahead of Trump's weekend 'bunker bombing' on Iran, which I proposed would cause markets to react based on the outcome of "Truce, True Regime Change, or Troops" - of which 2 out of 3 would be bullish and and hedging a long portfolio ahead of potential escalation important.

Well, June 23rd (Monday), markets gapped down and then promptly got bought on de-escalation/truce between Iran and Israel. My three key liquidity indicators fired higher that afternoon as SPX bounced off its 21D to gap and go on Tuesday. Then Trump's BBB passed extending the treasury debt limit and corporate tax cuts - all in time for July 4th fireworks. Market has bullishly priced in both, but I contend it is the "All Gas, No Brakes" fiscal spending that is the biggest reason for the season.

Since late April I've warned clients that “I don't see volatility until ~15.50 about mid-July/Aug”. With Trump's Trade Tariffs continuing to get pushed out, it could extend the VIX bottoming process. Translation: we are still in the grips of a MELT-UP INTO MELT-DOWN baseline bet.

MACRO-TO-MICRO CONSIDERATIONS

Trump Tariffs: The TACO trade deadline that was pushed from April 9th to July 9th for R.O.W. was again pushed out to AUG 1st - with Canada (12th) and China (15th) still in play potentially. Big picture, market will have a hard time correcting with this manipulation at the same time the threat of countries falling to reach agreements by August 1st to face full "Liberation Day Tariffs" from April 2nd. Today's pullback was part-and-parcel of the headline risk from today's Trump "letters" which included higher tariffs against several trading partners, with notable attention given to the 25% tariffs assessed against Japan today. Let's see if they stick.

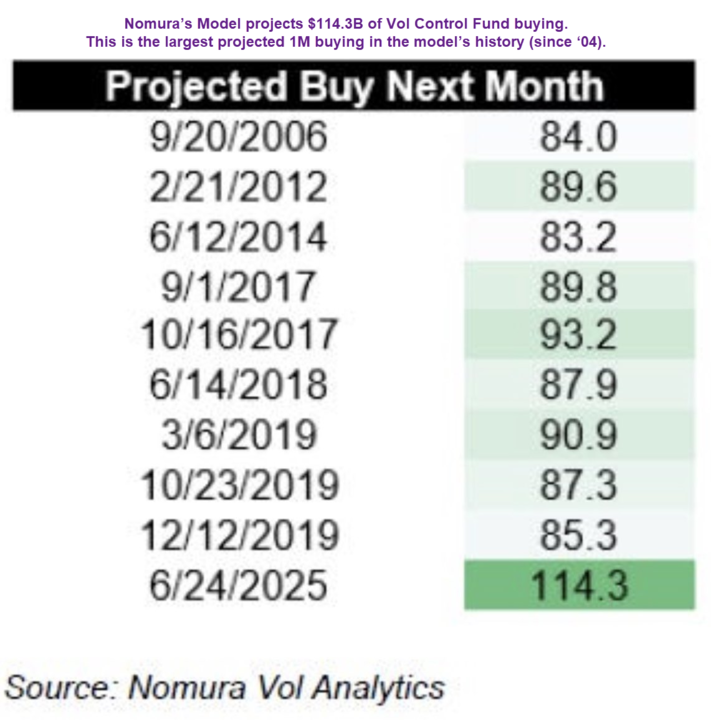

Bullish Flows: I often repeat that "we need macro triggers to interrupt the bullish flows". I'm not just talking about the usual short-term fatigue, profit-taking, reversion to mean pullback we need for a healthy market to digest out-sized gains. I'm talking mechanical buyers, dealer positioning and organic buyers who keep the market lifted big picture. To that end, Nomura projects a hefty amount of quants buying the market - the largest projected 1 month buying since 2004! Should they materialize, we are looking at more FOMO & FOMU!

Technical Levers: Overbought can stay overbought. As my intermarket analysis has shown, breadth has continued to expand - staying in overbought territory (stochastics on daily) since April 30th! Ed Clissold of Ned Davis posted Saturday that the % of SPX stocks > their 200D has risen to 62%. I have repeatedly reviewed this chart weekly for clients with the very bullish level of 65% once it gets/stays above

This also aligns with my regular mantra for clients when it comes to stocks or markets:

"Don’t short all-time-highs or buy all-time lows"

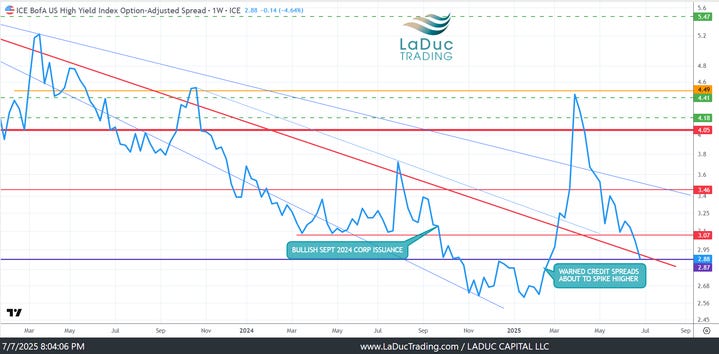

Credit Spreads: High Yield OAS have retreated in full since I warned mid-Feb that credit spreads were about to rise 200bp.

Fast forward since April 9th policy intervention when credit spreads peaked, the action of spreads tightening has been equity bullish. Basing here is also bullish. In short, we need a macro trigger to cause credit spreads to widen again.

Fiscal Spend: The passing of the BBB is another case of "All Gas, No Brakes" fiscal spending which helps sentiment & storied stocks. It also contributes to a bullish liquidity backdrop needed for speculation which can further support the market advance. As Michael Hartnett of BofA aptly writes,

"Can’t cut spending, can’t cut defense, can’t cut debt, go big with tariffs, so only way they can pay for One Big Beautiful Bill is with One Big Beautiful Bubble."

Dollar Dedollarization: Falling dollar (down -11% YTD) 'makes objects appear larger' then they are. As USD is devalued, asset prices will rise and gold/commodities stay bid. It also makes it harder for IMPORTERS (Trump's plan) given 1. Rising US tariffs, 2. Falling USD, 3. Falling US consumption. The DXY is on channel support, as I highlighted way in advance was coming.

DOLLAR & YIELDS bouncing are potential risks to the equity advance, but much depends on their rate of change. Also, zoom out: the DXY can easily reach lower levels still - even if yields move higher.

Yields/Yield Curve Stable: the 10Y US yield is still in the goldilocks' zone where it's neither too hot (4.8%) nor too cold (3.8%). When the 10Y yield gets/stays above 4.8%, that's when Fed/Treasury liquidity infusions/backstops isn't market bullish but spikes inflation. And against a backdrop of rising prices and slowing global economic growth, QE is inflationary with all of the corresponding troubles that accompany it.

The 10Y2Y yield curve continues to flatten/move sideways (+.45bp) - again, until there is a macro trigger to interrupt the Trump Admin's pressure/policies to push dollar & yields lower with oil.

Until an inflation shock hits, or term premium rises in revolt of Trump-Bessent yield curve controls/bullying, markets can climb higher on expected policy intervention & the Trump put (aka "TACO").

Corporate Profits Stable: Q2 Earnings season begins next week with banks, with corp margins on the aggregate expected to grow as long as tariffs were delayed. AND falling dollar helps currency conversion for exporters. What we need to watch for are signs of bank lending and corporate earnings in general starting to contract. That and an inflation spike

Employment Stable: Recession risk is not pulled forward without a growth scare. A growth scare often prices in falling corporate margins. Jobless claims getting above 267K will also push a slowing narrative that can morph into a deflation growth impulse or stagflationary economic growth slowdown. We aren't there yet. I have said since JUNE of last year that I would be looking for this by end of 2025.

In summary, markets are back to speculating like it's 2021, front-running rate cuts, and pricing in melt-up not melt-down.

And truth be told, the market can go parabolic into Q3/4 which would set up for a 'fake breakout, fast failure' pattern of concern into the new year - as discussed this morning live with levels: $6500, $7000, $8200.

Another words: "Outliers Revert With Velocity" and "parabolas are trapped longs that trigger volatility and liquidation events," but first we have to get there.

A retest of the breakout high in SPX about 100 pts lower that holds & reverses higher would be a good place to test the melt-up thesis. A break below $6147 that sticks, and we know that answer as well!

The projected numbers chart refers to the sixth month isn’t that June, talking about July?