MELT-UP INTO MELT-DOWN

War Is Not Priced In

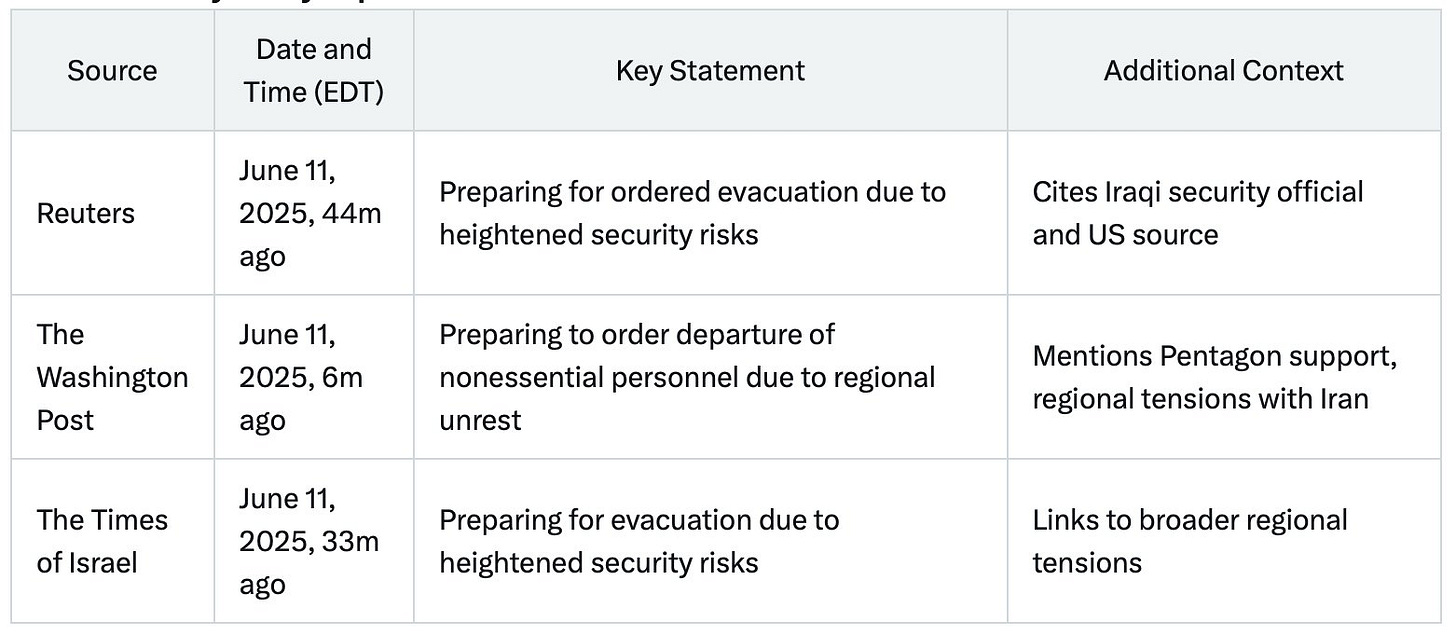

I was literally working on my VIX indicator timing chart for clients ahead of my 4PM Macro-to-Micro Options Webinar today, when news hit that US was ordering evacuation from multiple Middle East embassies.

Not sure if US is preparing for ordered departure as Reuters claims, or preparing to order departure as Washington Post suggests, but either way: VIX SPIKED 6% & SPX dumped -.95% from 6059 to 6002 quickly & WTI oil spiked 4%.

Ironically, I gave SPX 6044 to clients as the monthly resistance level to target this week where I said to expect digestion/pushback.

My VIX Tell Still Says July/August For Sustained Volatility

Now, here’s the chart I have used to help me time bottoms in VIX for years. Notice it’s on a weekly timeframe and really gives great signals about ~twice a year. It’s a swing long VIX signal. Basically it warns when to pay attention & take care for an ascending VIX - even if it is weeks in the future. It’s a reminder to even more closely track net selling under the surface with upcoming macro event risks as triggers for outsized volatility.

Reminder: I said/wrote APRIL 22ND when VIX broke below 29.56 that I saw it falling with RV (realized volatility) into May Opex: 25 then 20. Then I wrote right after May Opex I saw VIX reverting back into 15.50 area by June OpEx. Translation: as VIX falls, stocks rise. It was very helpful for keeping clients on the right side of the trade these past few months.

But I have also been insistent that I was not worried about a sustainable base forming in VIX until July/Aug. So does the news of escalation in the Middle East change all that? Have a look for yourself…