WE. ARE. THERE.

Let's go back before we go forward: review my calls on equities, bonds, gold, oil, dollar

SPX $6666. So Now What?

As I posted for clients Mon/Tues:

We could easily get SPX 6666 into/soon after the FOMC decision and then the market has to choose.

And so far it chooses not to roll over.

Not even my coveted growth:value ratio.

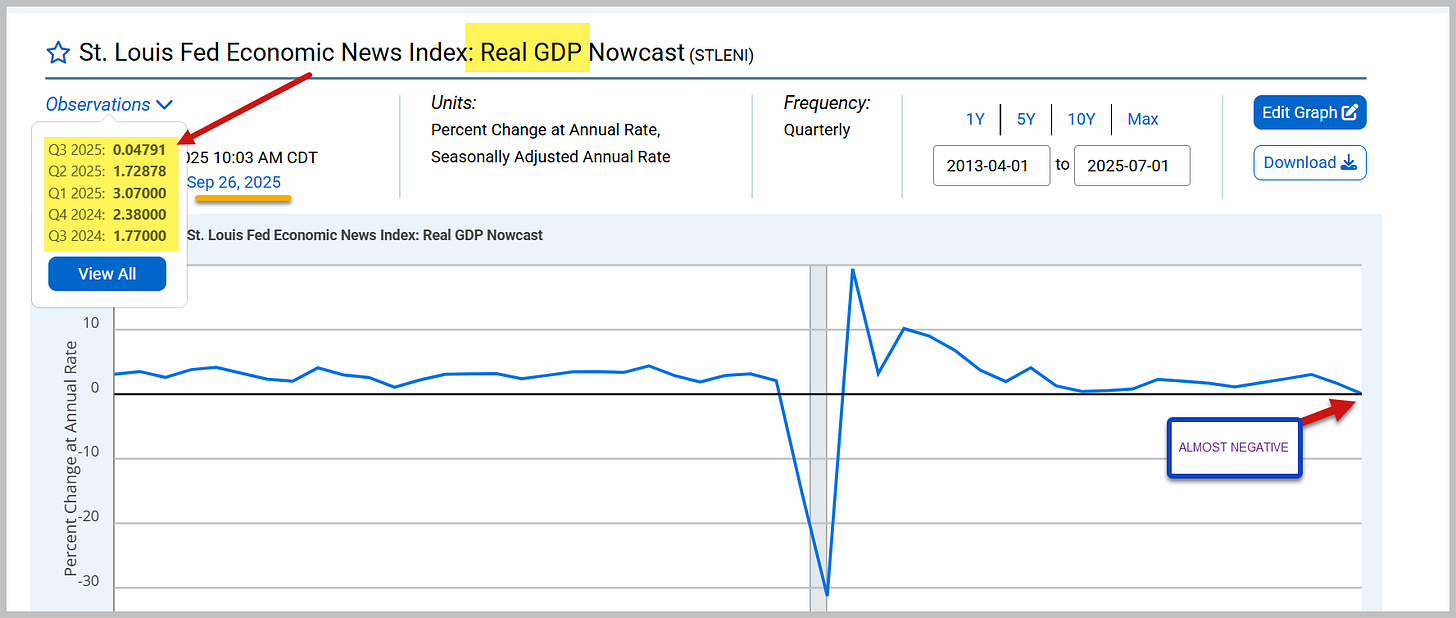

Not even my real GDP indicator which is skirting just a hair above negative.

Not even with bonds dumping post FOMC 25bp rate cut.

Not even with Government Shutdown risks almost assured.

Not even with Gold & Silver screaming higher because they know what’s coming.

My VIP Charts to watch are posted under Market Catch for subscribers.

For now, a reminder…

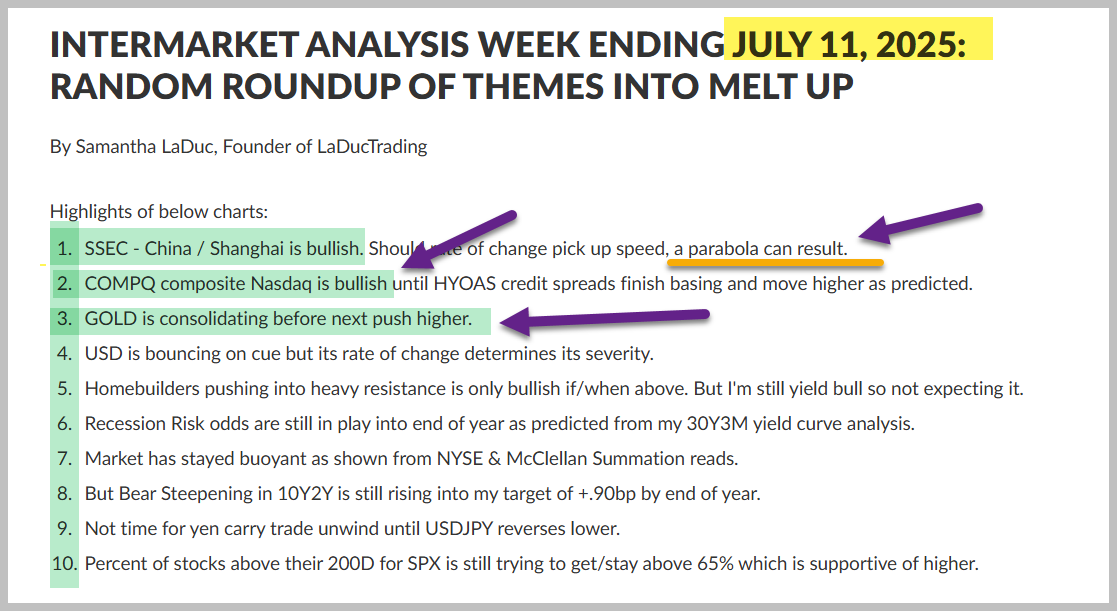

This print has been long expected - after my SPX $4878 short price target was reached on policy intervention April 9th, then further supported from my line-in-sand April 23 liquidity breakout, before the warned May 12th Birthday Rally gap up, to my early July ALL GAS, NO BREAKS meets ALL CUTS, NO INFLATION, meets ALL BUYERS, NO SELLERS client posts - where I focused on higher NDX, GOLD & CHINA sector rotations.

Let’s face it: my TOP 3 THEMES have crushed it!

It’s So Old It’s New

In fact, this $6666 print had been forecasted back on December 2nd, 2024 for CLUB/EDGE clients.

Last year I penned a piece with my upside 2025 price target - along with some other macro predictions: $666 to $6666?

Let’s see how that looks even after the Trump Bump of Feb-to-April crash which I timed with precision from selling under the surface that resulted in Tariff Terrors causing the bond, credit, and equity markets to convulse, triggering a VIX spike to 60 before Trump came in April 9th to delay tariffs and goose markets with passing of the BIG fiscal spending bill (OBBA) and promises of fiscal easing.

Here were my cross asset convictions in support of my MACRO VIEWS (bolded emphasis is mine to highlight if they worked) - and about 95% have:

Remember, I warned about the falling value of the dollar in Nov of 2023, and posted in Dec of last year how I expected a "1999-esque" market run. I even gave SPX $6010 as my target for 2024!

We had a taste of how quickly VIX can unwind back in July-August with the yen carry trade unwound. Most are content we will not have a repeat.

I'm actually counting on it.

I went on to focus on my macro, sector, market direction calls:

But in the meantime, we should have a tail-wind for a further advance in ...

SMH in general and NVDA in particular

Hedge fund factor rotation into year-end from highly-shorted plays.

Small caps can rise, but I'm more fond of those tied to industrials, financials, materials, energy - think interest-rate sensitive.

China can base and move higher, also on short-covering and fiscal stimulus (should it be announced), but otherwise, it needs a trigger.

Gold and Silver can trend higher after some more digestion, especially if silver shorts cover. I would look for Dec 18th FOMC/BOJ as triggers.

TLT + FXY / longer-duration US bonds and yen - should be volatile to higher, especially if oil falls below $65 WTIC - but not quite ready for the "Yen Carry Trade Unwind Part 2" yet.

Speculative crypto plays are in play, especially BTC & next ETH, kinda like I suggested early MSTR & then mid-Oct MARA.

Equities can melt-up on option positioning, short-covering as well as on softening of dollar and yields, but don't be complacent about what follows a melt-up...

The macro data on the economic front is still good, but approaching "as good as it gets" before new policies get rolled out under the new administration. Govt expansion is good for stocks; contraction is not typically. It will be very hard to thread the needle around fiscal restructuring and higher unemployment as "pro-growth" strategy.

Any bad economic data could ignite a bid in bonds, yen and precious metals - especially as war and tariffs and late cycle is not priced in.

Weakening US economy as indicated by Jobless Claims > 267K should pull forward recession risk and equity de-risking.

DBA should continue with metals as USD has strengthened against FX but weakened against soft and hard commodities.

Oil likely stays weak while Nat Gas strengthens.

BTC + ETH serve as off-ramps, for now, from bidding up industrial commodities.

Expecting inflationary prices to stay firm/rise while economic data deteriorates (aka Stagflationary Recession) is Geoffrey's baseline bet.

So Where Are We?

Fed is embarking on a rate cutting cycle after a year’s break. My strong view is that it is an accommodative cut not normative like last Sept 2024. The economy is weakening, in particular the labor market, while inflation stays entrenched. Even the Fed is revising expectations in anticipation of “Stagflation Lite”. It needs to cut very little and very slowly or else market will get spooked. Or worse, inflation will spike with yields.

The dollar has fallen out of bed and longer-duration yields haven’t. I have written & spoken about this non-stop about this so I need not repeat myself here. Just read:

Oil continues to be the short-the-rip trade I set up for you in April 2024 when $85 crude, seeing $60-40 as new range for crude.

Gold continues to delight, as expected/posted to clients APRIL 5, 2024 (Pre-Substack) in our CLUB/EDGE Slack workspace. I called it a TREND REVERSAL that could “last many months if not years”.

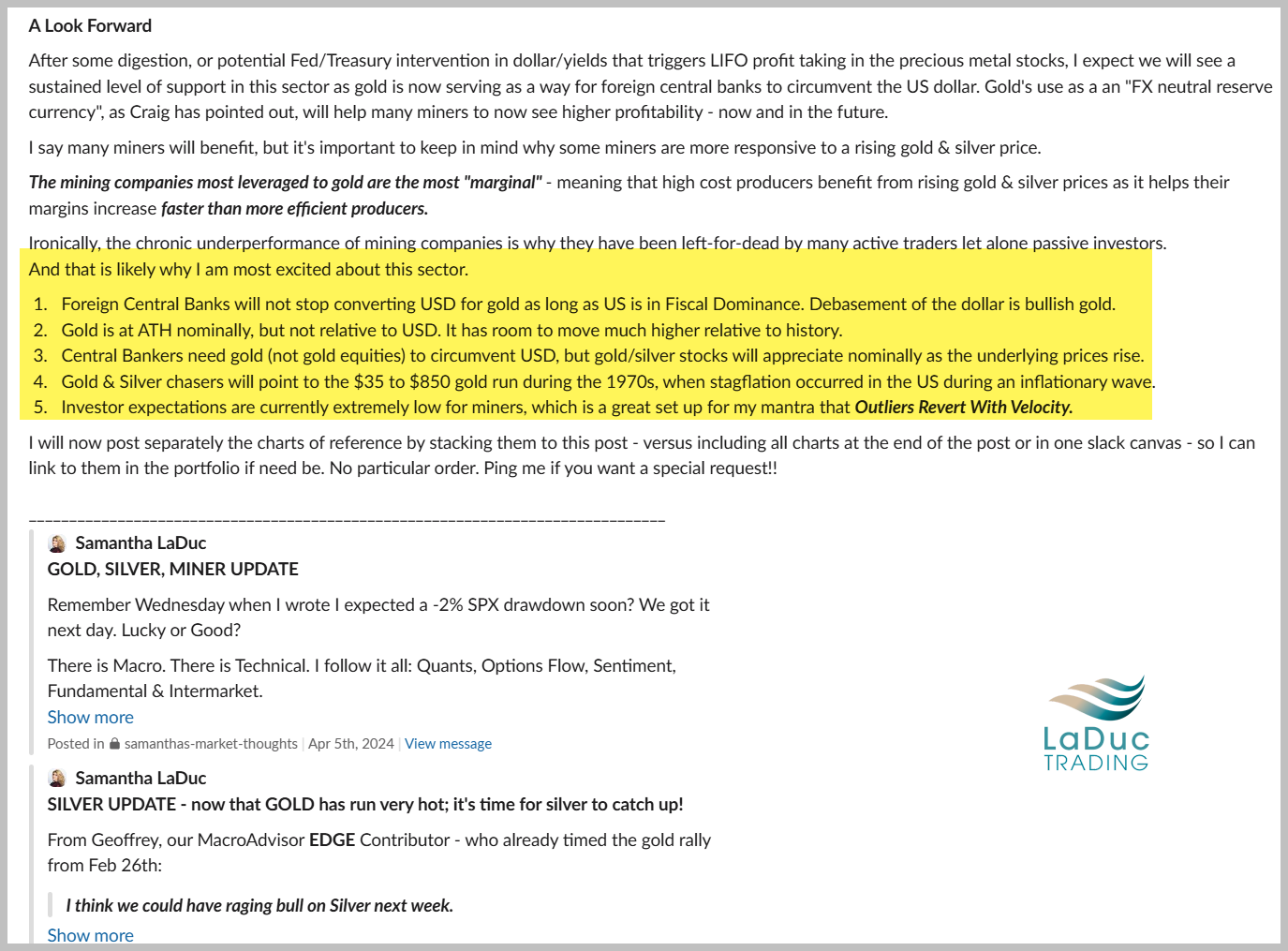

Everyword still holds true as rationale to hold gold/silver long:

Ironically, the chronic underperformance of mining companies is why they have been left-for-dead by many active traders let alone passive investors.

And that is likely why I am most excited about this sector.

Foreign Central Banks will not stop converting USD for gold as long as US is in Fiscal Dominance. Debasement of the dollar is bullish gold.

Gold is at ATH nominally, but not relative to USD. It has room to move much higher relative to history.

Central Bankers need gold (not gold equities) to circumvent USD, but gold/silver stocks will appreciate nominally as the underlying prices rise.

Gold & Silver chasers will point to the $35 to $850 gold run during the 1970s, when stagflation occurred in the US during an inflationary wave.

Investor expectations are currently extremely low for miners, which is a great set up for my mantra that Outliers Revert With Velocity.

Where To From Here?

Well, no reason to panic until we have a reason to. But also no reason to be complacent. Know what you own!!

"Capital Markets are a mad house. You can choose to the Psychiatrist watching the patients or be part of the patients. It's up to you." Geoffrey

St. Louis Fed shows economic contraction that has not yet printed negative, at the same time jobless claims are moving higher but have not gotten above my ‘recession risk pulled forward’ level of 267K,

BIS is also warning on many fronts of slowing consumer demand and rising risks of economic weakness, but I will leave that for Geoffrey to explain.

Let’s just say, that aside from a US Government Shutdown which approaches, the market has yet to really test this thesis of Fed cutting into rising yields into recession (a Monday post to look for), because market doesn’t believe it given the backdrop of the Trump-Bessent-Miran ‘put’. But I contend we may be getting closer…

UBS puts the recession probability at 93%, per FORTUNE

And as I have been warning, Q4 is where the rubber meets the road with tariff impacts and jobs.

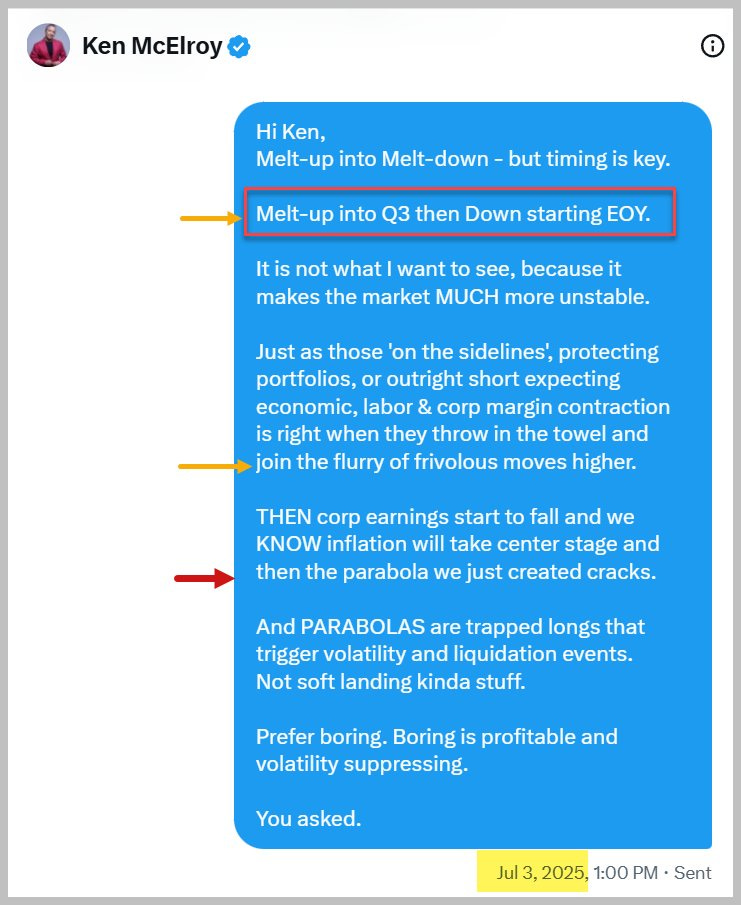

I have been talking about this since JUNE 2024 FOR END OF 2025. I have written, and spoken and tweeted about it so I’m nothing if not persistent!

And now that we are getting closer, I have no idea how long the market can continue to ignore the risks, which is why I often say to clients:

“There’s lots the market isn’t pricing in. That’s why it’s bullish.”

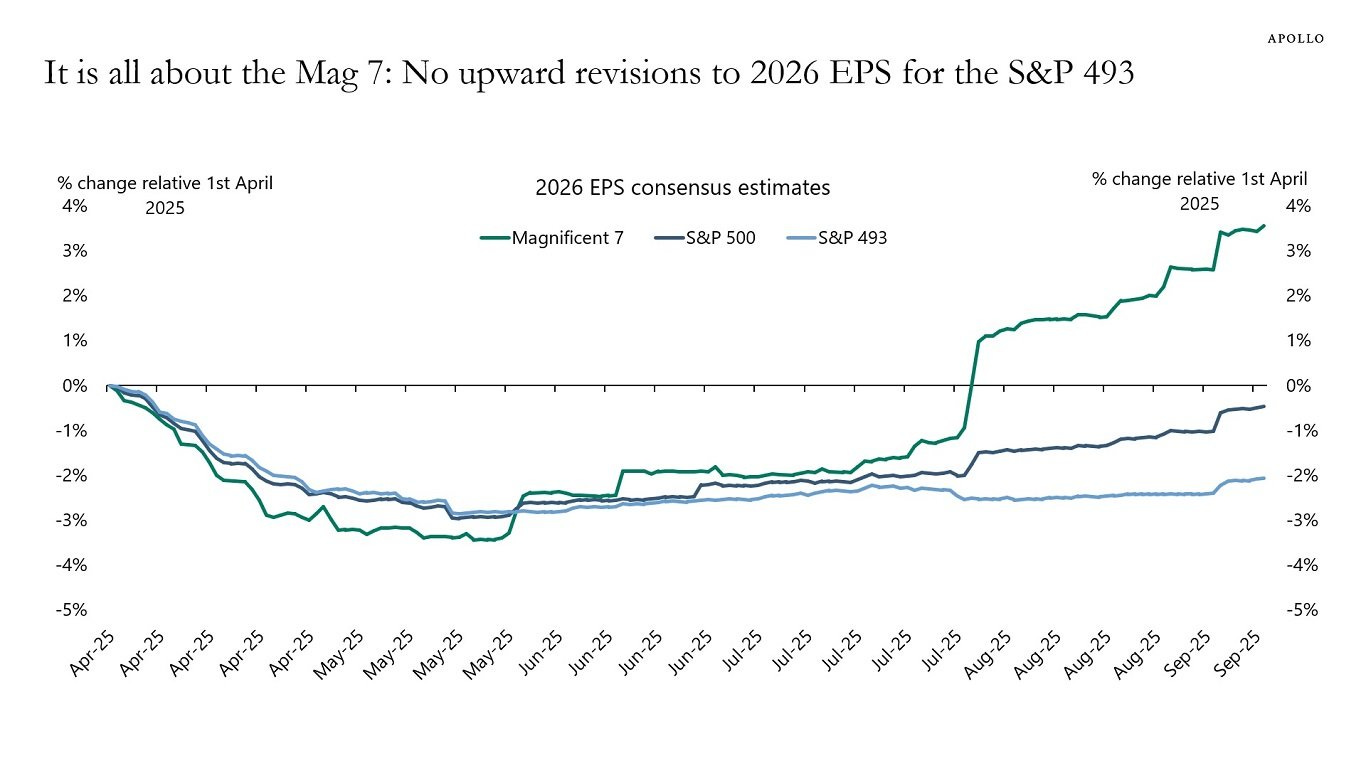

I mean, check out this outperformance!

Clearly, there is an extreme degree of concentration in the S&P 500 that makes equity investors dramatically overexposed to AI -masking the weakness underneath. But who cares if:

The upward consensus revision to 2026 earnings for the S&P 500 since Liberation Day comes entirely from the Magnificent 7.

The outlook for the rest of the economy is much more bearish.

Earnings expectations for the S&P 493 have remained suppressed and are not moving higher.

Well, the gold market sees what’s coming.

The failure of the dollar is the reason for inflationary assets to advance - with the help of the AI narrative. But the Treasury market’s plan for rolling short-term UST debt every few months just keeps Fed trapped from cutting too much OR hiking if needed, so inflation will rise with interest expense.

In a nutshell, market is enjoying this mark-up, but don't forget that NOTHING is priced in on what could go wrong...

because US policy changes have not been priced in…

because BRICS effect on USD monetary and military hegemony is not priced in…

because concentration risk unwind in the Magnificent 7 has not been priced in …

because yen carry trade round 2 and the global margin call it will create is not priced in…

because war is not priced in.

Fascinating, as always. The July 3rd '25 tweet box is sobering. "Not soft landing kinda stuff"

Does the music stop suddenly or gradually slow down? Perhaps we won't have long to find out.

I had been thinking only a 'global margin call' could stop the GOLD train. I am starting to think not even that can do it. This is not like 2008. Sovereign debt is no longer a safe haven, so what is? Gold and... that's it. Trillions will have to go somewhere safe in the panic. Some will still reflexively choose treasuries, but many will not. I bet the buying pressure > forced margin call selling. A quick and steep dip in gold maybe, but if you blink you will miss it. It will not be like 2008.