Waiting To Exhale

Bears reminding my market thoughts from last week for CLUB/EDGE clients:

Last week I presented my most recent #intermarket-tells for clients in my live trading room:

Intermarket Review: Key inflection point for growth stocks Jan 08, 2024

I explained that the market is extended after an historic two-month advance in Nov/Dec of 2023, but that didn’t mean market was bearish. Even after we caught the first week of pullback, and the second week of bounce, I reiterated that I still expected to see a choppy market for January, as we need a reason to rally or break-down.

Getting through January OpEx, and major tech earnings, ahead of the really important macro events of FOMC February 1st and Treasury’s Quarterly Refunding Announcement Jan 29th, will require more patience as we are overbought technically (by many accounts as you will hopefully see in my charts), but not broken enough to trigger high-conviction swing shorts.

We will get there and these tells will help me time the turn.

In a nutshell: We are still bullish until we have a reason not to be...

Earnings Season Thoughts

Banks kicked us off on Friday before the long weekend.

Here's a pretty snarky but stark reminder by @philstockworld on those bank earnings that many may be missing:

$314 Million!

That’s how much Bank of America (BAC) reported as its net income for the fourth quarter of 2023, a whopping 56% drop from the $713 million it made in Q2 of 2022.

BUT before you write off BAC as a bad investment, you should know that this dismal figure is largely due to a one-time charge of $1.6 Billion related to its transition away from the London Interbank Offered Rate (LIBOR), the scandal-ridden benchmark rate that is being phased out by the end of 2023.

BAC is not the only bank that is taking a hit from the LIBOR switch. JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) also reported lower earnings due to similar charges, ranging from $500M to $1.1Bn. These charges reflect the costs of updating contracts, systems, and models that use LIBOR as a reference rate for various financial products, such as loans, derivatives, and bonds.

Here’s the catch: these charges are not really losses, they are simply deferred gains. By taking these charges now, the banks are able to lower their taxable income for 2023, and defer the recognition of the corresponding revenue to future years, when they expect to pay lower taxes under the Biden administration’s proposed tax reforms. In other words, the banks are playing an accounting game to boost their earnings in the long run – isn’t banking fun?!?

Earnings season really ramps up with 58 companies in total reporting this week.

But let's agree for companies as a whole reporting earnings: It’s Less About Q4 ’23 Results and More About ’24 Guidance

Brian Gilmartin @TrinityAssetMan, one of my fave fundamental analysts, is stuck like glue on the data. Here's a summary:

Q4 ’23 EPS growth (estimate) has come down sharply since Sept 30 ’23. Estimated GDP growth is expected to slow from the 3rd quarter ’23’s torrid pace of +5%, to Q4 ’23’s 2.5% pace, which might have resulted in some of the sharply lower estimate revision to Q4 ’23 expectations, but we also saw weaker quarters and guidance from global brands like Nike and FedEx at the end of December ’23.

Remember Q4 ’22 is a very easy comp:

This blog post from late November ’23 detailed the very easy compares the SP 500 faces in Q4 ’23.

I highlight these easy comps as the bar has been lowered and on easier comps. And to remember the actual reports and guidance matter more than the comps.

Options Flow, Quant & Fund Positioning

In did a whole section for clients in my Intermarket Video on how the Big Money is positioned along with dealer and non-dealer flows. Suffice it to say, like the charts, they are "overbought but not broken".

But that is not spotting one whale from grabbing a large hedge:

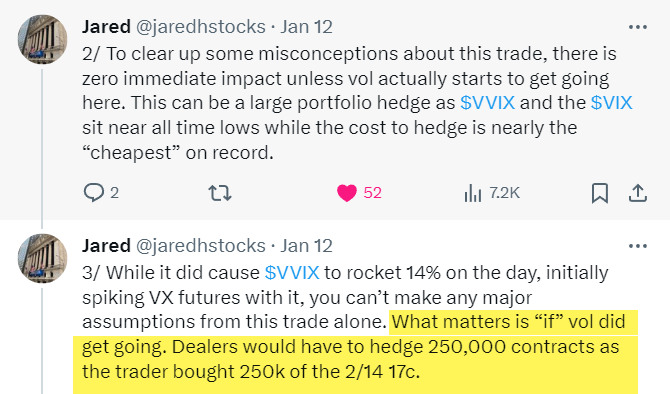

A trader bought about 250,000 call contracts on the VIX Index with a strike price of 17 that expire on Feb. 14. The trader spent about $16.7 million in premium, with each contract costing between roughly $0.63 and $0.67. The VIX hasn’t traded above the 17 level since early November. BNNBloomberg

THIS - is a good hedge. VIX is cheap. It's not a timing tool.

Jared @jaredhstocks does a superb job of explaining why.

Now contrast that whale of a trade with Nomura strategist Charlie McElligott, one of my fave quants, who "warns" we could have a parabolic move higher if:

Yellen issues more Tbills than bonds this Jan 29th - sending stock and bonds higher/yields lower - similar to what happened Nov 1st NOT Aug 1st.

Money Market Funds buy those bills which triggers less cash at RRP forcing Fed to lighten up on QT, which adds liquidity into markets.

Fed follows through with cuts (75-100 bps)

Fiscal stimulus doesn't slow. Tech in particular loves that.

Stocks go parabolic - again, a thesis: IF/THEN kinda thinking we've already done.

The Rise of Deflation Narrative

Hail the impact of base effects:

CPI - Inflation was 3.4% for the full year of 2023.

Market Reaction:

Real Fed Policy Rate: While the core CPI cooled slightly less than expected, it nonetheless edged lower to 3.9%, from 4% the previous month. Therefore, the inflation-adjusted Fed fund rate actually increased. Currently, it stands at 1.6%, the highest since 2007. If the trend continues, the Fed needs to ease just to keep the real policy rate from tightening further. That’s perhaps why today’s report hasn’t moved the market expectations much. @MenthorQPro

But reminder: Inflation Compounds!

And main street inflation vs. wall street inflation is measured WAY differently.

Now consider that the economists' measure of CPI inflation "stopped" decelerating with this print, for now. But PCE (Fed's fave measure) is now ~1%/yr below CPI.

Since the Fed reaction function is focused on PCE. I still say they cut in March.

But after: We Trigger an Inflation Resurgence

Disinflationary and Inflationary drivers will compete for our attention, as they impact inflation expectations, but especially yields.

Demand destruction and Supply disruption will continue to be weighed in all things, but especially oil.

Sticky inflation (prices of things used by Main St) against Decelerating Inflation (rate of change measured by Wall St), will continue to confuse.

So even if CPI came in strong-ish and PPI weak-ish, both against base effects, the market narrative turns to "Deflation Risk".

It's not really a risk for prices of THINGS, but more for the price of demand (PAPER).

And it's not unusual for a deflation risk to follow an inflation shock - outliers revert - and then reverse again.

How I do wish commentary came with defined timeframes. Here's mine:

Secular Inflation - we have no deflation big picture

Disinflation Impulse - we have a big deceleration in headline inflation since June 2022.

Inflation Resurgence Risk - that's what is coming, whether from bond issuance, political change, geo-political risk, manufacturing growth turnaround, etc.

The point is: the story can change, and quickly at times.

Right now the labor market is tight and wage inflation has helped delay recession as consumers have continued to spend.

But when that changes, the disruption it causes can be fast. Chart h/t @TopDownCharts

Trend Long Theme Working: Nikkei Breaks Out

Nikkei 225 index has reached highs not seen since the 1990s!

My "Buffett Bet" on Japan is still working for CLUB/EDGE clients - as pitched in April 2023 on Yahoo Finance.

2024 Update:

Earthquake = Stimulus = Expected Dovish BOJ...

Add to that: Last Wednesday's data showed Japanese workers' real wages kept shrinking for a 20th month in November, falling some 3% over the year as total cash earnings grew only 0.2%.

Gentle inflation/wage growth = Strong Company Margins

The Buffett Bet continues: STAYING TREND LONG

Swing Long Theme Working: Healthcare Flows Lead

Fund flows have been strong this start of the year.

Health Care was by far the most net bought sector on the US Prime book this week and saw the largest net buying in nearly 5 months. GS Prime

According to DB, Healthcare positioning is only at 28%-tile. And on valuation, Healthcare is now trading at a ~5% discount to the S&P.

We had already traded ISRG (me) and DXCM (Archna) last Nov/Dec for outsized gains, but this space continues to be hot: Baby bios, CRSP stocks and even Gilead - the best widow maker of long-term traders in this drug manufacture.

Point is: We will will continue to fish here but XBI is now up almost ~50% from the October ’23 bottom. Stock selection matters!

Luckily for those in my live trading room, we have our "resident doctor", Alexander, who has the hottest hand for spotting and TRADING these plays - large cap and small - before they move!

He has shared his Top Picks - from science, to management; technical analysis to event risk - of the best healthcare stocks within these categories in CLUB/EDGE #swing-ideas channel in slack:

Gene Editing

GLP 1 (weight loss)

Liver disease

Kidney

Muscular dystrophy

Schizophrenia

Alzheimer’s

Artificial intelligence

Cancer

Autoimmune Disease

Eye Disease

Acromegaly

Psychedelic

Rare lung disease

Epidermolysis bullosa

Osteogenesis imperfectA

RNA and vaccine

Pharma royalties

Big Shout-Out

I truly have the best clients who share their top conviction ideas so we can review them in my live trading room for other clients!

Like in the healthcare/drug space, we are very fortunate to have Alexander help us combine his science knowledge, cash burn and event risk analysis with my chart read and option flow.

Ditto with Tim on Bank, REITS, EV & AI - with the added benefit he is a master of how to structure options around his core positions.

Blessings to Anne and Brian on their deep-deep expertise on refiners, energy, shipping space!

And many more!!

Sincere thanks for the outstanding shares! It's a Win-Win-Win!