They’re not hedging. 🎯 Just selling. 😉

Mechanical Flows Vs MONEY GOES HOME

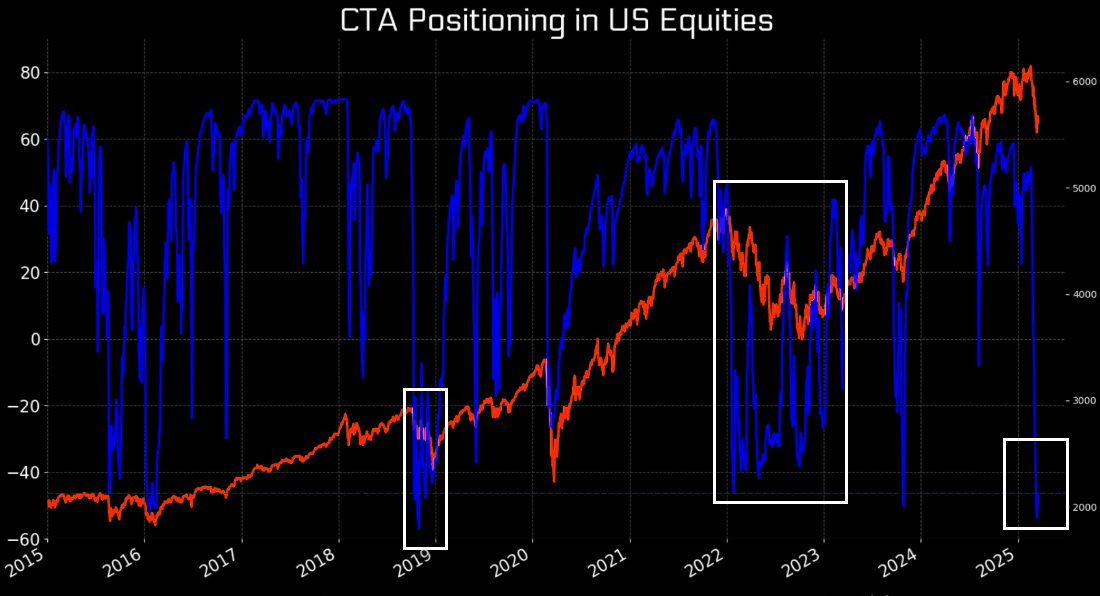

There is a chart making the rounds on FinTwit that has bad data on the inset and so the assumption around the data is misleading:

First, there is a LOT more data on mechanical flows than just CTAs. That and the data above is incorrect. But most importantly, data in context matters!! Let's drill down for a correct take…

BIG BULLISH or BIG BEARISH:

CTAs buy $45bn IF next month is up. >>>IF flat, then they have $59bn to sell!!

That’s what the above chart inset should read, as the the data posted in that chart is wrong. Here is the corrected flow - from 3/19 via ZH/TheMarketEar:

BULLISH POTENTIAL: Pensions need to buy per GS (but doesn’t say stocks/bond breakdown):

"$29bn to buy ranks in the 89th percentile amongst all buy and sell estimates in absolute dollar value over the past three years and in the 91st percentile going back to Jan 2000."

BULLISH POTENTIAL: Month-end rebalancing also offers up potential buying:

"QDS estimates that into March month/quarter-end, asset allocator rebalancing could provide some support to US equities – assuming they rebalance 100% back to target weights – given the significant MTD underperformance gap between US equities and other assets like fixed income, non-US equities, and real assets. QDS estimates ~$34bn of US equity demand into month-end (the 94th %ile since 2005) from US defined benefit rebalancing." (MS QDS)

BULLISH POTENTIAL: On CTA positioning, Bloomberg posts:

CTAs are now net short US stocks — Goldman says they’ll turn buyers at SPX 5,870 (+4%), Nomura sees 6,014 (+7%) needed for a full long flip. $70B in sidelined flow waits.

Clear as mud? So you see my point? CTAs buying of SPX is only a small piece of the puzzle. And we haven't even discussed vol control & risk parity funds!

BIG BEARISH POTENTIAL

Now let's discuss the elephant in the room!! A large, natural seller - aka FOREIGN MONEY GOES HOME (my baseline bet for 2025) - has a lot more room to go.

"Foreigners hold a record amount of US stocks. And they have just started selling. Deutsche Bank says that there could easily be one trillion dollars of foreign selling. This is way bigger than the corporate demand (=the biggest buyer) estimated this year."

The foreign investor ownership share of the US equity market is 18%. But in USD, it equals $25%. So what they do matters.

And they have been selling. Not hedging. Just selling.

Kris Sidial who runs a quant fund has this to say:

TLDR: option pricing and every metric on the planet showcases that nobody is aggressively hedging / panicking.

And they aren’t the only ones selling…

"This year, we forecast corporates will be the largest buyer of equities - $675 billion of net corporate demand. We forecast households will buy $425 billion of equities. In contrast, mutual funds will be sellers of $550 billion of equities due to persistent active mutual fund outflows and low cash balances." (GS)"

And in the same way that mechanical flows from price-insensitive CTAs can help a market sell-off and help it reverse higher, they can also just keep selling.

For more details on the macro reasons I see them selling, not hedging, here's a recent interview I did with MacroEdgeRadio.

finally another piece!