THE STRATEGY OF CHAOS

Falling dollar & Rising Volatility are not done.

Global Returns Leaderboard Since Trump Election 11/5/2024:

If you had Trump Tariffs Trigger Trade Wars resulting in MONEY GOES HOME, congrats!

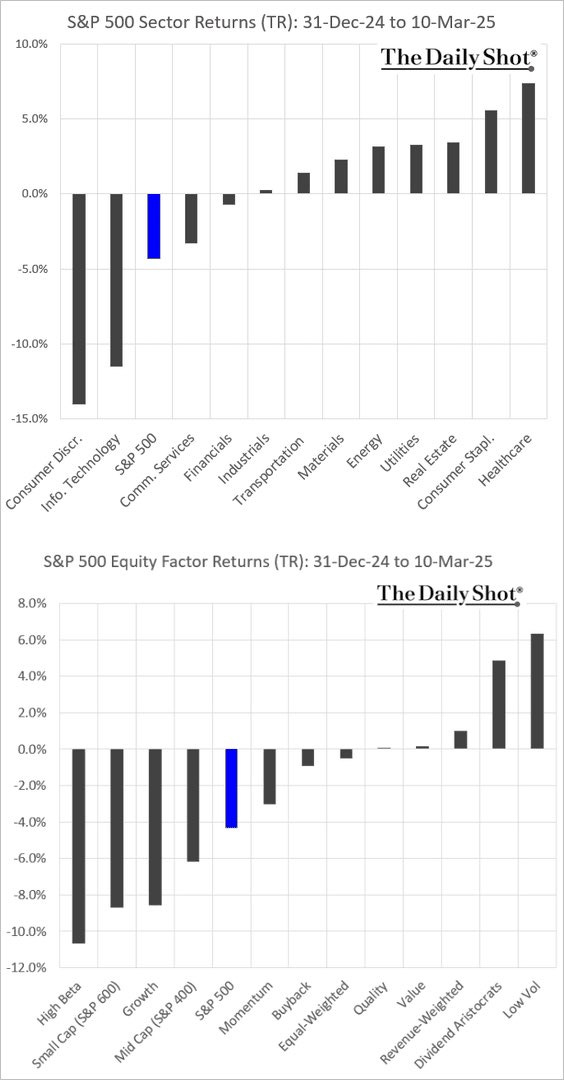

Staying stateside, here’s what this looks like for year-to-date performance of US sectors and equity factors/styles.

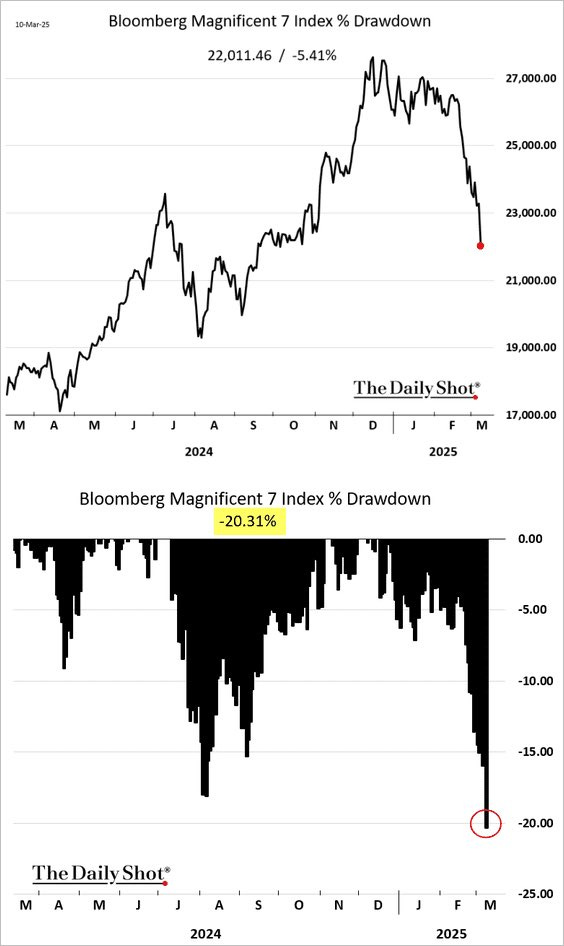

Note: MAG7 is in a bear market with fastest fall for NDX since COVID crash.

And while all of this has occurred, VIX hasn’t even triggered 2 standard deviation move yet, which is historically typical in a sell-off of this intensity and duration.

VOLATILITY IS STILL NOT DONE GOING UP

I’m not talking about intraday volatility for timing a bounce. Example, this is what I posted earlier today for LADUCTRADING.COM clients:

VIX staying below 29.56 - sized it up as 2bar reversal on daily this morning and said, 'VIX IS DONE FOR TODAY". Also noted how very extended on wkly it was so below 28.53 resistance would confirm. Lastly, noted how VIX cycle peaks today for MARCH EXPIRY before a gradual decrease in implied volatility moving into OpEx next week.

I’m talking big picture volatility as a trend that has gripped markets and the White House.

CLUB/EDGE clients have my one-hour long INTERMARKET ANALYSIS: BUYERS STEPPING AWAY video as my reasons why we can continue to experience elevated & spikey volatility all year - not just Govt shutdown risks, Iran escalation risks, headline risk from aggravated Trade Wars and so on and so forth.

For more immediate-term risk levels, I have SPX 5524 low for "this leg", but if gold/commodities start to sell off in earnest, we enter next leg down with MAJOR crash support at 5265.

With that, my US-JP rate spread analysis is what triggered my warning to clients Feb 19th! Before the Feb 21st Friday OpEx sell-off that triggered:

Leverage Unwind

Profit Taking

Money Going Home

and here we are - with SPX -10% LOWER:

Long story short, this is a rate spread differential that is heavily dependent on USDJPY, and is a tight fractal with US equity risk. It has much work to do to digest and move higher. USDJPY breaking below 147 will further put pressure on US equities and foreign sellers.