The Aftershocks

CLUB/EDGE client post Tuesday, August 20, 2024. Focus on a very relaxed VIX, a yen carry trade trigger, and 30Y mortgages holding the key.

» CLUB/EDGE client post AUGUST 20th, 8:17 PM ET.

VIX Is Not Pricing In Any Risk 30 Days Out

What typically follows - after a large volatility move - are aftershocks.

We had but a mere tremor today, and on cue after warning yday - both in my live trading room with VIX 14.29 target hit, as well as in my market thoughts.

Will we see follow-through? We sure have reason to... USD, yields + oil have stuck near their August 5th lows, while equities had systematic flows inorganically forcing them higher. (See yday's post for the detailed mechanical flow data.)

I didn't know the flow was coming for equities. But on Monday, Aug 12th, I showed clients my bullish growth rotation ratio that was my tell we could push $SPX into $5639 + $QQQ into $493 - their daily gap fills - before $NVDA earnings OR a macro trigger interrupts.

Almost there, but first, we have some "shake-n-bake", as I called it yday; otherwise known as profit-taking.

Given we have gone from wicked oversold to wicked overbought (my technical terms), is it any wonder hedges were blown out and 'no one is hedged'?

How can I tell? VIX is not pricing in any risk 30D out!

This will change.

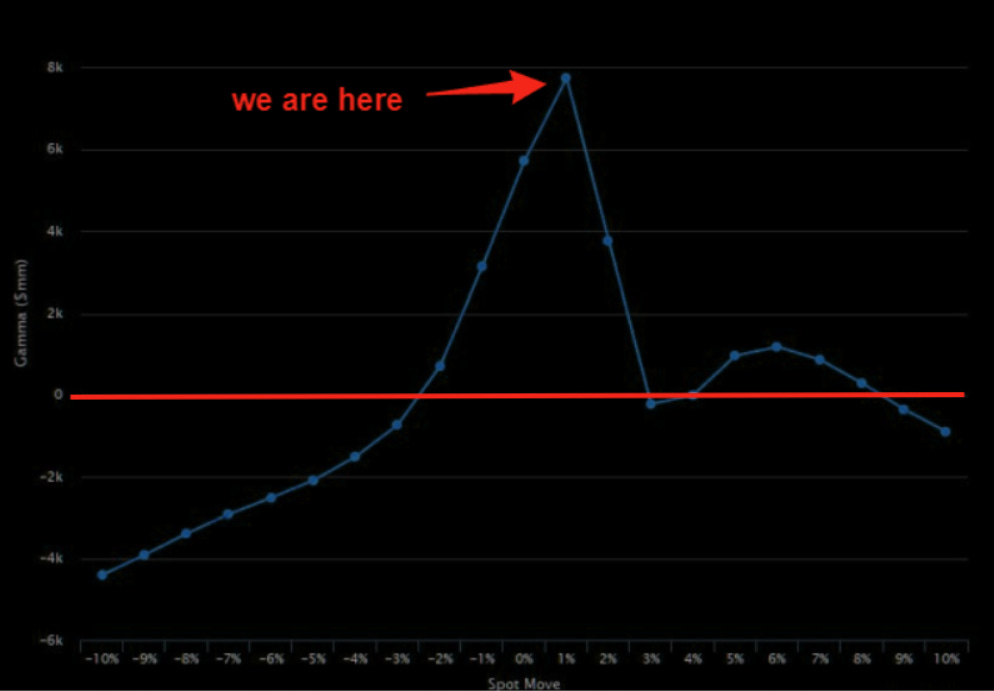

Especially since dealers are at peak long gamma here (see chart).

They lose gamma on moves higher as well as moves lower (approx up/down 2-3% and short gamma kicks in).

SpotGamma

Let's see if we get any excitement tomorrow on the job revisions & then Thursday premarket in jobless claims data.

More likely we have to wait for OpEx Friday to remove 73% of gamma off the board, and then really get through NVDA earnings next Wednesday.

Setting up nicely for a "buy the rumor, sell the news" event.

But even before that, we have another test...

Yen carry trade unwind really over?

No, is a complete sentence. Not only did I warn early July of yen moving higher with USDJPY pulling back to 152 (it then broke down firmly July 31st), I am still warning: Yen looks to be in a multi-month base that will likely result in a trend reversal higher. Similar to the 10Y bond I have been tracking, which led.

Besides the little ol' issue of USD weakening to the yen since AUG 5th low, we have the macro-event risk of Japan's Parliament meeting this Friday 23rd - same day as their CPI print. Imagine the Diet pressures BOJ to hike rates!

Nah. They wouldn't do that. Everything BOJ does must be coordinated with Fed/Treasury. If it isn't, then September 2022 happens!

That required $1.5 trillion in global central bank intervention, according to Matt King of Citibank.

So no, BOJ is not allowed to make policy decisions on its own.

And, it is not a coincidence Powell presents same day at Jackson Hole as the BOJ will be front-and-center...

These events should be volatility suppressing.. UNLESS the 10Y yields breaks 3.8% or 30Y breaks below 4.05%.

Do 30 Year Mortgage Rates Hold The Key?

First, you know my bet: we invert now that we got rejected at dis-inversion on the 10Y2Y yield curve. My bet is that we head down to that -.60!

David Levinson says I am right, but for the wrong reasons.

Here are his:

"With out (yield curve) steepening, the bond yield leads lower and that's dollar supportive and drives mortgage rates lower and takes UMBS up which is shorted by some equity longs. The problem is the 5.5% UMBS coupon will shift to the 5% coupon which produces 5.99 mortgage rates.

Once the 5% is above Par + .5, that gets the 10Y under 3.75 ..."

@levenson_david

I can say "10Y < 3.8% will trigger volatility", as I have for months, but David can explain WHY we are going < 3.8%.

I can also warn that this is not your typical volatility...

We already had VIX crash up to 67 premarket Monday August 5th, and retrace back in 7 days. It normally takes 17.6 days minimum, so we know we have entered a new kind of crash-up boom market.

Proof of that is record SVIX AUM at a time VIX is not pricing in any risk 30D out - despite $NVDA earnings, CPI, NFP, FOMC...

"Everyone who buys equity is shorting volatility. The short volatility funds are just using more leverage." @levenson_david

Translation: This crowded trade in short VIX I talked about yesterday can be very disruptive on a macro trigger.

And we need one to disrupt the bullish equity flows.

My bet: This crowded trade in VIX and Notes/Bond shorts (paired with Nasdaq MAG 7 long) will amplify market shocks.

And "growth fears" will transition into recession fears when:

1. 10Y US yield stays below 3.8%

2. Crude oil crashes + stays below $70.

3. Jobless claims get/stay above 267K