Forced Selling Met Panic Buying

CLUB/EDGE client post Monday, August 19, 2024. Focus on REFLEXIVE RALLY, macro event risks, and "ONE MORE HIGH".

» CLUB/EDGE client post AUGUST 19th, 7:08 PM.

Outliers Revert With Velocity

VIX has never fallen so quickly. My BXM indicator has never risen so strongly!

It was exciting to chase this reflexive rally off solid support levels August 5th, as talk of September Fed rate cuts and stronger July retail sales triggered even more buying.

But Forced Buying is NOT Organic Buying:

1. CTAs + corporate buybacks - GS estimates that price insensitive quants have bought back 50% of their sold stocks with ~$10B per day expected of more buying over the next 2 wks in ultra-thin liquidity markets.

2. Vol Control reallocation to Equities - Nomura estimates that post VIX crush, these funds could buy ~$192B over next 3 months, triggering some to front-run this move.

3. Leveraged ETF flows - McElligott of Nomura estimates 'cumulative 5d rebalancing as largest 1 week “BUY FLOW” in the history of our data at +$34B ... They sold around $64bn from mid July to Aug 5th ...and have since then bought around $35bn."

4. Short VIX Positioning are now on one side of the boat which contributed to the fastest VIX retracement in history.

5. Positive Gamma continues for now - Nomura highlights that dealers are 'choking on theta', but 73% of gamma is short dated and expiring FRIDAY, taking dealers back to zero gamma.

Reminder: SYSTEMATIC buying has nothing to do with fundamentals; AND we need a macro trigger to disrupt the flows.

Macro Event Risks

Cue Jackson Hole, NVDA earnings, NFP... or any of these upcoming macro-moving events:

August 23rd: Fed Chair Powell speaks at Jackson Hole

August 28th: Nvidia (NVDA) earnings

August 30th: Core PCE

September 6th: August Nonfarm Payrolls and Unemployment

September 11th: CPI

September 12th: PPI

September 18th: FOMC Announcement

Also, August 23rd is the day the Japan CPI comes out which could push the BOJ to raise rates again as is being pressured by the Japanese parliament (Diet). That parliament meeting is also Aug 23rd. This is not bullish US equities if they succeed.

Long story short, given VIX measures the 30-day expected volatility of SPX, it is strange, don't you think, that considering the events that are due in the coming 30-day period, VIX doesn't seem worried?

Again, this reflexive rally we've had is more about systemic buying than organic, and that will matter when a MACRO trigger like Jackson Hole or NFP, or FUNDAMENTAL trigger like NVDA earnings disappoints. If they don't, then full steam ahead, but be mindful that my SPX + QQQ + NVDA interim gaps I called out last Monday, daily and under #trading-room-notes, have all hit as of today.

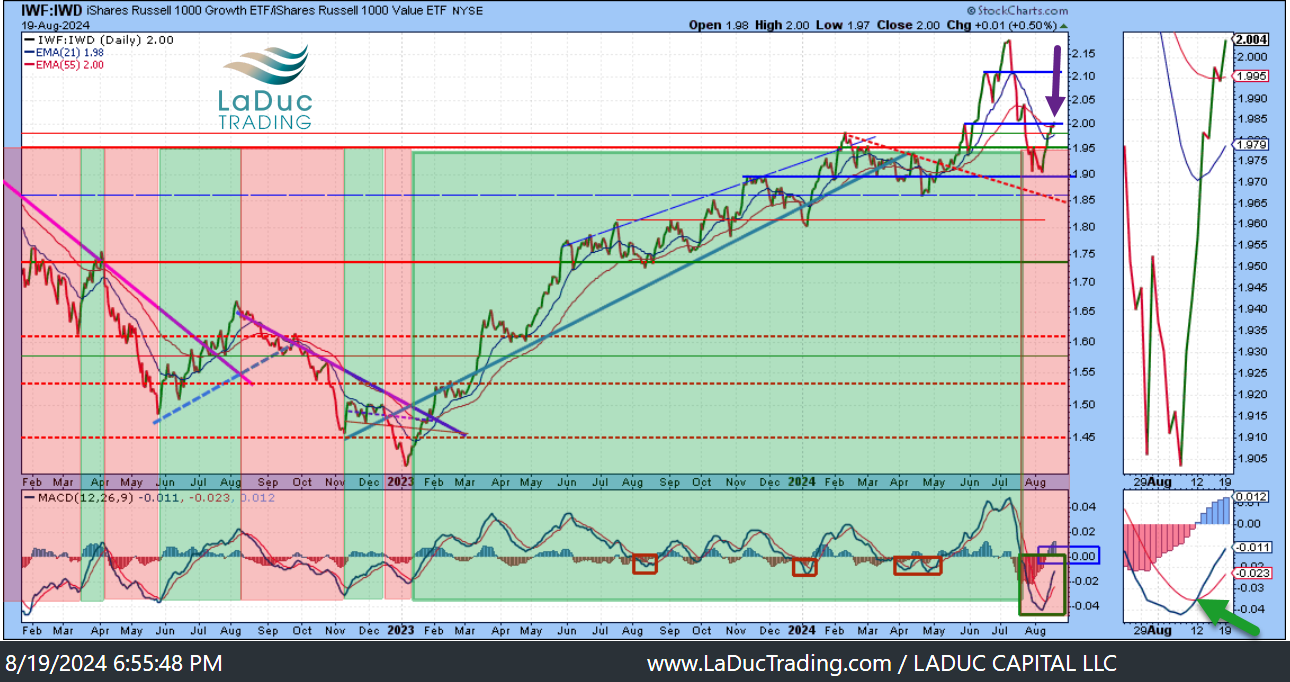

THAT, and my Growth:Value ratio that I have shown daily in my live trading room with an expected "price target" of 2.00 has also hit as of today.

We are due for some shake-n-bake, and that also should include some volatility again in September and October.

"One More High"

That market call from my interview with Jason Burack last month escalated quickly!!

I could not have known THEN that the reflexive bounce would be V-shaped, but I did see the very strong support FOR a bounce - in advance.

But this is what I talk and write about daily from my live trading room and trading-room-notes, so please follow there for the more shorter-duration market moves and calls!

Then put into perspective my my call for "ONE MORE HIGH" was made because I see recession risk getting pulled forward and the leverage trade unwinding more, which will force markets to roll over and move lower into the Fed Pause & Yellen Yahtzee low of November 1st of $4300.

I know it is hard to see a reversal top NOW given the USD falling is SO VERY bullish equities.

And the USD falling WITH oil AND yields is so seemingly bullish equities.

But I must remind that this is not really the case.

In fact, the combination is uber-bearish equities should they follow through as they signal an underlying problem with the economy.

The market just doesn't see it yet.

Fear Of Recession?

The equities options market is not pricing in “fear of recession”.

And the SAHM rule isn’t pricing in “fear of recession”.

And the Bond market is simply unwinding some of the massive basis trade treasury shorts, which is distorting “fear of recession”.

I will again share how I tell when “fear of recession“ gets pulled forward AND triggers:

1. 10Y US yield stays below 3.8%

2. Crude oil crashes + stays below $70.

3. Jobless claims get/stay above 267K

Obviously, we’re not there yet, but we’re getting closer.

These are the guardrails that I believe will help you protect capital and seize profits from a directional turn as the de-risking in the CONCENTRATION RISK of markets is getting more volatile not less, regardless of what systematic buying machines do in the short-term.