September 3, 2025 Live Trading Room Market Recap & Trades

Unlocked - so you can see what you're missing & upgrade to PRO!

PART 1: Premarket Review +/or Rant

From Tuesday's Market Thoughts Client Post:

Yield Curve Steepener Risk: Still the #1 macro tell. Watching scoop pattern on weekly for trigger above 0.64 bps. A sustained breakout = tighter financial conditions, forward recession risk, pressure on growth equities and credit spreads.

Job Growth Revision Risk: All eyes on Sept 9 when revisions hit (same day as Apple event). A sharp negative revision could “greenlight” Fed cuts; modest disappointment complicates Fed’s stance which complicates market pricing in/out rate cuts.

Growth Scare Risk: Head & shoulders setups in QQQ/NVDA remain intact; decisive break of 2.20 Growth:Value ratio would confirm.

BONUS: Government Shutdown Risk: Not going away; not priced in; more an end-of-Sept (before Oct 1st) event risk.

Offsetting Bullish Tailwinds:

Corporate Bond Issuance: $1.8T YTD (record). Add $1T+ buybacks YTD → strongest bullish liquidity bid in market for year-end run. Results expected late September.

Dealer/Option Flows: Option flow still bullish. Buybacks in play until Sept 14. Breadth intact; no real breakdown in internals.

Seasonality / Key Dates:

Sept 9: Apple event + job revisions

Sept 16–17: FOMC

Sept 19: OpEx (likely relief bid)

Oct 1: Government shutdown risk

Liquidity & Dollar: Dollar chopping, holding above 97.39, no dramatic spike. No systemic liquidity stress.

Volatility: VIX/VVIX weak; no fear keeps markets bid especially with VIX >19.29.

Bottom line: Macro risks (steepener, revisions, growth scare) are real, but liquidity + flows + buybacks keep the tape supported short-term. Expect chop from NFP to FOMC

PART 2. Macro Matters & Intermarket Review

Rates / Curve / Bonds

10Y “sweet spot” 4.1–4.5% so only interested outside this range; we have time.

Curve steepener risk only if >0.643 bps 10Y2Y

Bonds remain a chop fest with USDJPY

Gold spiking higher post Trump firing Fed Governor Lisa Cook

FX / Global

JPY: MOF/BOJ interventions keep yen weak, which helps US equities

USD: Holding 97.39 area; tactical chop, big-picture bearish.

BRICS / China: Military display underscores dedollarization movement; Trump/Bessent greatly underestimate China

Germany: SAP trend break, EWG/DAX weakness, DB reversion to mean short → first real inflection lower in EU leadership equities since 2022.

Commodities / Energy

NatGas: Bullish structure for a trade into year-end, but for a trend long ONLY once >4.2; triggering potential doubling move.

Crude/Refiners: XLE hit 90 target then stalled; refiners (VLO, PBF, MPC) still strong but now digesting highs.

Gold/Silver/Miners: Parabolic move; GDX 67–68 = exhaustion zone → caution for shakeout. SIL also going parabolic. No macro/technical trigger to short.

Copper/FCX: Structural bull if >46 weekly.

Equities / Breadth / Positioning

Breadth expansion still intact; no durable net selling under surface.

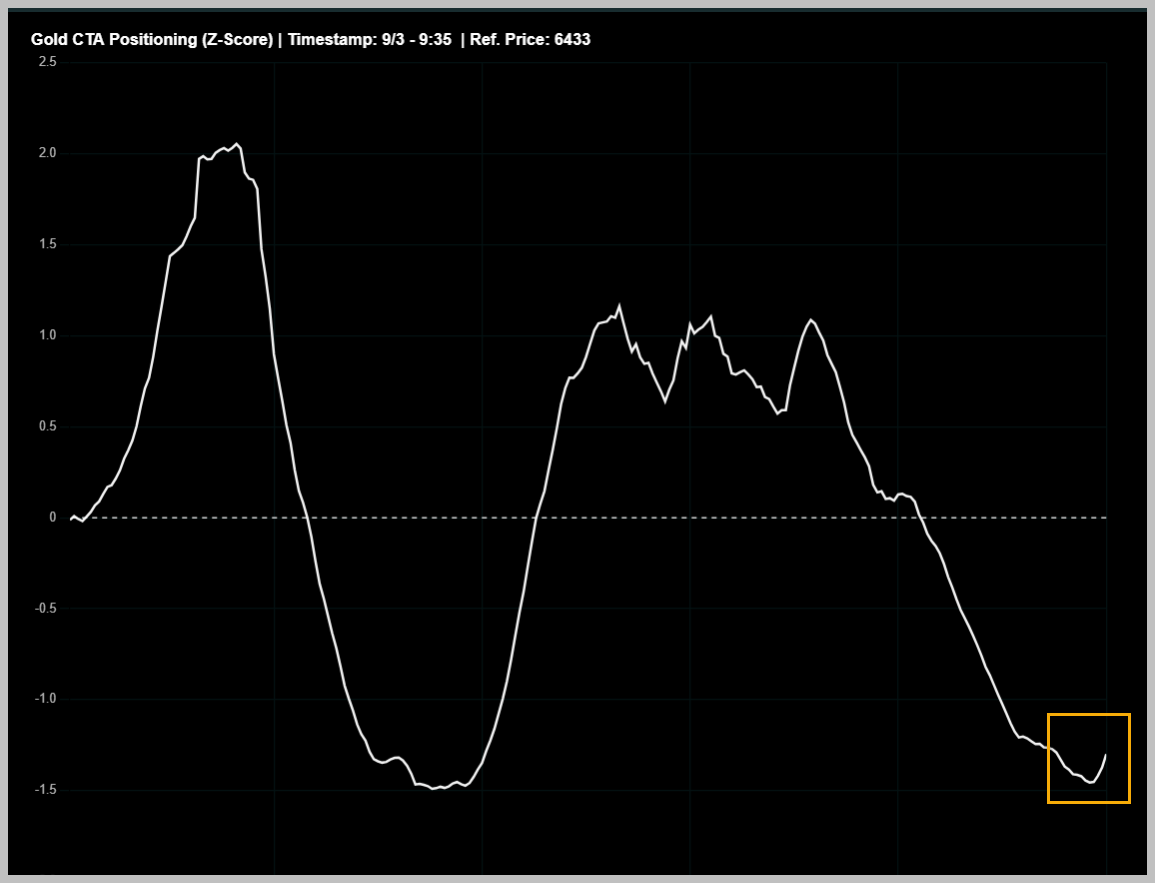

CTAs near 100% long; risk ~$70B of selling if weakness accelerates but they need market selling to trigger.

FANG / MAG7: None have broken 10-week MAs yet; NASDAQ AD weak but no breakdown on trend.

VIX/VXN: Need VIX >19.29 and VXN >200-day to confirm bearish market regime.

Liquidity proxies (BTC, SOL, ETH) basing sideways, not broking down.

Key Market “If/Then” Momo Stocks:

If GOOGL fails back <~225 and AAPL rejects 237, QQQ gap-fill pop likely fades.

If NVDA cannot reclaim 173, downside path remains open toward 167–165.

PART 3. Stocks & Assets Covered (with Levels)

Refiners (VLO, PBF, MPC)

VLO: Gorgeous 400-week bounce from April; with new bullish cradle reversal on weekly this August. Supported above 145.33 with 160.48 then 16 next target.

PBF: Holding 22 level; Needs more time; 200-day flattening is bullish in time for trend reversal higher.

MPC: Similar structure; at highs, now digesting.

NatGas

Bullish > 2.94 with 3.6 as gap fill target.

XLE

Hit 90 target, then faded. Call spread to 90 worked/warned. Now needs time to get/stay above.

Germany Weakness

SAP: Broke 200-day for first time since 2022; weekly trend broken. Support watch at 264; better short entry on bounce into 280.

EWG: Following SAP; threatening broken trend.

DB: Weak, recommended short.

DAX: Weekly gap-down, confirming weakness.

FCX (Freeport Copper)

Gift at 400-week in April; must now >46 to confirm continuation higher.

AZN (AstraZeneca)

Trend intact since 2017 (10/21 EMAs never broke). Key level: >78 keeps structure intact; resistance 87.68.

RIVN (Rivian)

Must clear 15.34 → opens path to 16.50. Amazon/VW sponsorship supportive, but volatile gap structure.

GDX (Gold Miners ETF)

Target = 67 (possible overshoot to 68) to treat as exhaustion zone; digestion expected after tag.

JD/BABA:

JD coiled; >32.80 → 35 target; BABA up 15% off lows.

MAG7 Ratio Still Bullish

AAPL: 237.23 = key monthly resistance. Weekly rejection risks downside.

GOOGL: Resistance near 230/225; failure = pullback toward 207.

QQQ: Must break 568.54 to trigger downside daily gap fill at 565.97; otherwise moving into 574.44 pre-NFP.

NVDA: Gap down below 173; risk to 169 → 167–165 unless 173 reclaimed.

PART 4: Other Mentions & Client Requests

Hospitals: HCA improving; UNH stable above 288; THC fine unless <171.

APA: Weak long-term trend, but bounce >18 can target 25–30. Only bullish kicker = profitability at $40 oil.

GFI (Gold Fields): Attractive >27 monthly breakout.

WPM, AEM, AGI, FNV: Still my fave miners in metals space.

Macy’s: large short covering bounce; not a trend reversal.

WDC / STX: Extreme runs (30 → 90); overbought but no short yet until WDC <82.20.

Snow: Strong earnings; pullback still needs to hold >220.

SE: Strong earnings; nice breakout if holds >165 support

Palantir: Digesting after Citron short; channel chop 148–161.

TSM: Rolling; below 226.40 = bearish.

ORCL: Rolled short on cue to 218.63 support (214.65 overshoot before bounce).

TSLA: Supported at 10-week/200-day; nothing new yet.

CAT: Sitting on 10-week; breakdown < 410 risks → 382.

DE: Fading; needs <469 to trigger short to 447

EBAY: Short from 100 → 88 worked; now likely bounces 87.75 to 93.5 rejection zone.

PART 5: Charts Of Interest

Bullish Gold Charts...

Gold Miners Bullish Percent Index

Gold and Q-CTA Position

Gold CTA Positioning

Samantha can you make sure Michael puts up the correct video link today? third time in the last few days an old YouTube link has been put up!