How To Play China's Parabola

Important Update - before China opens October 7th from its Golden Week holiday.

» CLUB/EDGE client post OCTOBER 5TH, 3:00 PM ET.

SPECIAL OFFER UNTIL MONDAY: 15% OFF CLUB - code SUBSTACK at checkout!

China Hitting The Wall

China is hitting a wall - technically speaking, but that doesn’t mean buyers can’t get above it!

MONTHLY VIEW

WEEKLY VIEW

Prior to mainland Chinese markets closing for holiday October 1, the Hang Seng (Hong Kong index) continued to rise an additional 8.6% this past week. The “Golden Dragon Index” of Chinese companies that trade in the US rose nearly 10.5% last week - after surging 24% the previous week!

This doesn’t even take into consideration the ‘baby China’ plays like CHSN that exploded 400% in a week because it is low-float play (easy to manipulate), despite reporting 14.4% lower income just 3 days before.

Day traders are like sharks that smell blood! They are first to arrive. They don’t even need a theme (macro tailwinds ), but it helps. Now, combine their feeding frenzy with some low-float +/or high-short interest (check) and money flow (check, check), and the exuberance can continue for awhile.

David Tepper’s “Buy Everything China” came two days after China delivered monetary easing and promised fiscal stimulus, but 10-Ks showed he was really talking his book.

* TEPPER: MASSIVE GLOBAL STIMULUS DONT BE SHORT ASIA OR ANYTHING ELSE

My point: both legitimate + illegitimate China names were en vogue with all the reasons I presented in these two detailed posts, well worth reviewing:

The China "Bazooka" - September 24th

Is The China Bazooka Sticky Enough? - October 4th

SPY Outplayed by FXI

Since I recommended FXI (among others) Monday September 23rd, I have reviewed it often in my live trading room for clients, and kept X on notifications for alerts in activity.

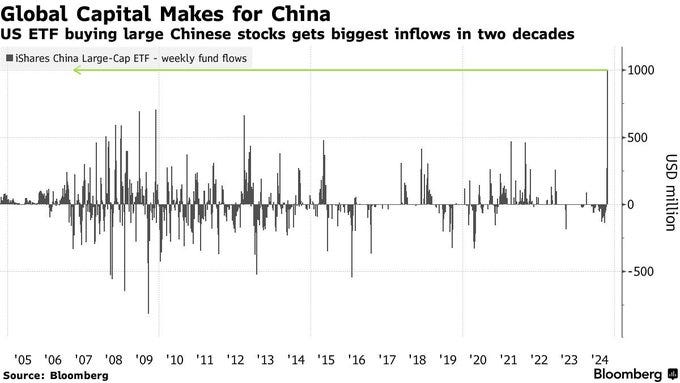

Money flow into China past two weeks has been out-sized:

BlackRock Inc.’s iShares #China Large-Cap ETF received $577 million of inflows yesterday, taking this week’s inflows to more than $1 billion, the biggest for any week since the fund’s inception in 2004, according to data compiled by Bloomberg.

AFTER FXI gained 35% in 10 days, I spotted a trade for $1.2B in stock at $35.48 on Oct 2nd. No, I do not know if they are long or short, but I do know it’s 35.7M shares, when FXI is ~5 standard deviations above its 200D! (Chart H/t VolumeLeaders.com). Note: this is the largest trade since inception of FXI.

AFTER FXI gained 25%, I spotted a buyer of 400,000 contracts in FXI with March $41/$44 call spreads for 0.24 back on Sept 30th. The last day before the China stock market closed for Golden Week.

There are 2230 stocks in the Shanghai Composite. Not a single one fell today. - Joe Weisenthal, Bloomberg

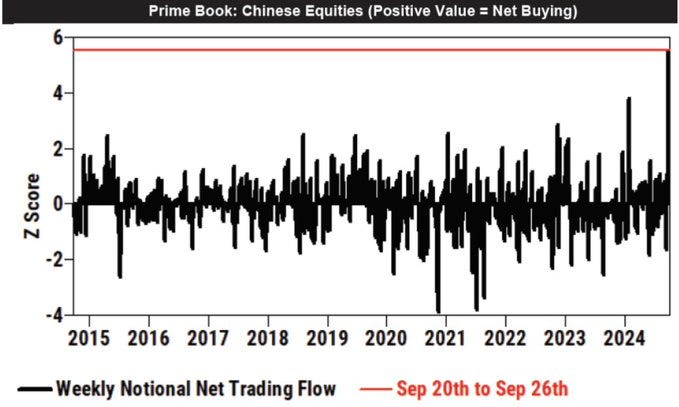

With that, I read but couldn’t confirm, that 60% of the FXI float was sold short. Another source said FXI had 86 million shares short as of September 25th. If so, that would explain a lot! Prime Book on Chinese Equities as of September 26th:

With that, trading in FXI beat SPY!.

China stock markets' trading volume hit a record high of RMB 2.59 TRILLION today. That's equivalent to $370 billion. To put it into context, the US trading volume on 9/27 was $285 billion. - @BrianTycangco

Highlighted FXI Option Review

My favorite option tactic was put on September 26th:

34K December $28 puts sold at $0.53 to finance 34K of the $34/$38 call spreads for $0.73.

THIS is my absolute favorite structure to put on for a $.25 debit. I have recommended these types of trades when I have a strong directional view, WHEN IV IS LOW, using monthly options 45-60 days out - but expecting volatility to come in within 2-3 weeks.

Here is another advanced option trade put on Friday that is expecting a continuation of the parabola or crash. The biggest difference is that it was put on after nearly a 2-week advance in the underlying, while OPTION IV IS SKY HIGH - making it very dangerous if stock digests sideways, which is my baseline bet.

H/t @VolatilityWiz for the chart:

Our derivatives expert, Hans Albrecht, examined it closely:

That's a massive backspread. Which in this case is a long volatility upside call strategy that uses a near the money call to finance it. He calls it a slingshot because if FXI keeps going parabolic it can make a ton. But if FXI completely collapses, he collects $1.87. So it's win-win if FXI moves big.

Now, what is the negative.

It's dangerous because #1 backspreads are good when volatility is low: option pricing is sky high right now. #2 they do better when upside skew is flat (people are not paying up for cheap calls). Right now, both are the opposite. Option pricing is really high even in January (100% percentile) and skew is steep. What that means is they can get killed if volatility drops.

Option Greek profile:

This trade is long 139000 vega. So if option pricing drops one point they will lose 139K. Jan pricing hasn't moved up as insanely as the near month but it is still a big risk. Implied vol in January has probably gone up 10 points on this move. So it could easily drop 2 or 3, which would cost this trad $400-500K even if FXI doesn’t move.

So this trader is betting FXI doesn't calm down - preferably up big but down big is covered. AND that the option pricing in Jan doesn’t drop much.

IMPORTANT with backspreads: you don't hold on to them too long because you can enter the "valley of death" which is where the sharp drop in the tent is on your chart.

Here are the takeaways Hans will detail in our Macro-to-Micro OPTIONS Power Hour Wednesday:

It's a very aggressive strategy that is betting more on a parabolic continuation of FXI BUT will also do fine if it collapses.

It does not want things to suddenly sit - if option pricing drops they will get very hurt (as they are long tons of Vega)

They probably won't hold this for longer than a week or so as they are looking for a quick resolution of possibilities.

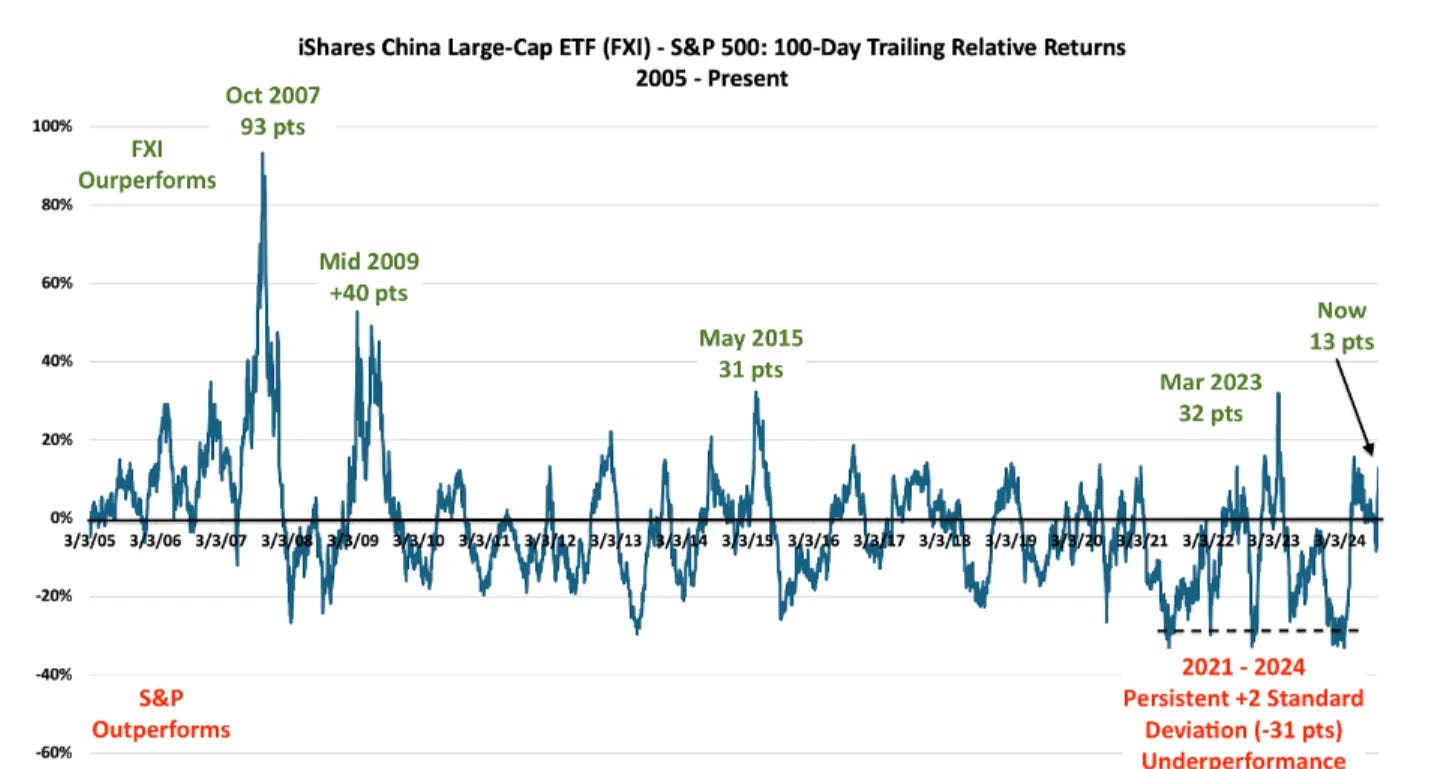

Despite The Rally, China Stocks Still Underperforming Prior Periods

In keeping with the first chart I posted of SSEC on monthly timeframe, here is a look at how prior periods have performed:

During periods of “positive shifts in Chinese policy” — such as 2009, 2015 and 2023 — local stocks typically outperform by 30 points or more. Right now, the relative outperformance sits at only 13 percentage points. - Nicholas Colas, co-founder of DataTrek

I have discussed the macro/fundamental bullishness of Geoffrey Fouvry, our Economics Advisor who was long and strong China/Hong Kong months before the stimulus announcements - and whose portfolio is up 200% as a result.

I have discussed How China’s 2024 stimulus compares with past packages, and what’s next?

In nominal terms, the massive package has the potential to be China’s biggest ever

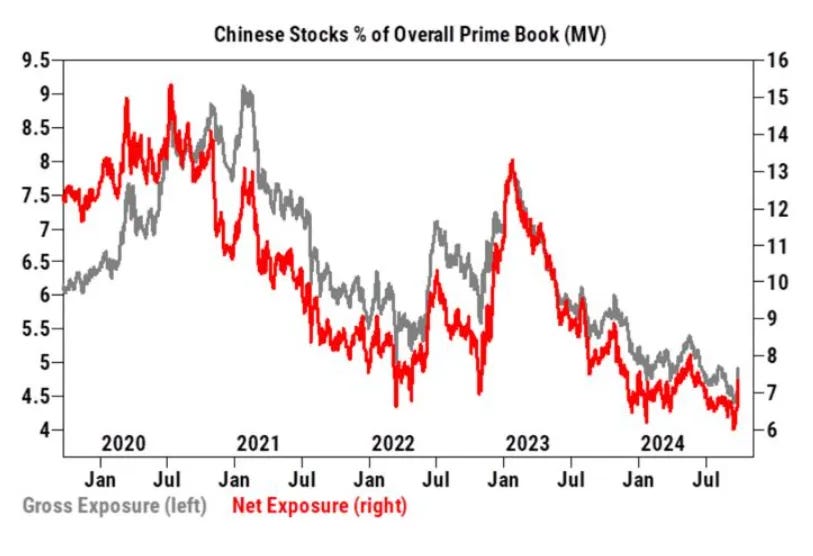

So for China bulls, which is not Drukenmiller by the way, this rally looks set to continue because of government intervention/stimulus which will help improving corporate fundamentals and capital market sentiment - in China. Stateside, it appears hedge funds have quickly rotated into China based on the theme of “undervalued” and “global easing creating future economic growth”.

But big picture, much more government action will be needed (read: fiscal stimulus) before US institutions trust that China can deliver long-term results. Very hard to do given the tense geopolitical relations between US and China, not to mention tariffs and investment regulations (current and proposed) coming after a “China is uninvestible” mindset past few years.

As a result, net allocations are still at the lowest level in five years.

So given we have most investors underweight China, the extreme moves in this “catch up” trade are clearly in play. But that is exactly how parabolas are formed and what makes the move extremely dangerous to chase - unless you understand and structure your trade with this advice in mind:

Parabolas are Trapped Longs, that trigger Volatility, resulting in a Liquidation event. - Samantha LaDuc

I wish you every success as you trade the Chinese equities this 2024.

It is, after all, the #YearOfTheDragon.