FALSE SENSE OF CALM

Just Another Bear Market Rally

The first few weeks of April were full-on tariff terrors, & tracking all the headlines & equity/bond/FX gyrations were all-consuming. I kept clients well-informed & prepared for the sell-off into my SPX $4878 price target. Lots of hand-holding required with clients as well to protect, position & profit.

I’m use to working 12hr days to properly support clients, analyze/post my deep-dive macro market thoughts, weekly intermarket analysis, and run my daily live trading room. Oh yeah, and engage on twittah ;-). I just didn’t expect I would also have my five fintech projects bubbling up with issues all at the same time. That put me over the top! Anyway, we are through that wormhole for the most part, and into the wormhole of earnings! Oh joy! I will be getting back into posting daily ditties under Market Catch for PRO subscribers.

In practice, not much has changed since posting that “Policy Intervention has entered the building” to put a bid in equities:

4/9/25 Live Trading Room Market Recap & Trades

I also reminded last week that as Gold softens, equities can further catch a bid:

4/22/25 Live Trading Room Market Recap & Trades

In a nutshell, the past month I reminded clients almost daily that given the $600+ SPX moves in each of the 1st two weeks of April, the next 3-4 weeks would see smaller ranges. Not a lot of edge during this period where volatility and price action compact and earnings takes center stage. All of this digesting is sorely needed to repair the breadth destruciton and selling that took place under the surface since mid-February - but actually started back on December 2nd when I warned ;-).

Fast forward to today, and the bullish bent continues:

4/28/25 Live Trading Room Market Recap & Trades

But big picture, Capital Flows & Confidence still suffer. The grinding higher action in indices gives bulls a false sense of calm and recovery.

We’re in a bear market; the market just doesn’t see it yet.

Despite SPY up 14% since April’s 7th intraday low - and trading back above 20x PE as MAG7 had its best week in 3 years - it's time to remind that ...

"Looking at 19 global bear market rallies since the early 1980s…

on average, they have lasted 44 days and the MSCI AC World return was 10% to 15%.

For context the SPX is up 11% in the 17 days since its lowest close of 4983 on 8 April this yr." (GS sales)

Add to that, an earnings recession hasn't arrived yet as expectations got marked down in advance for each week of Q1. MAG7 earnings are also expected to delight, as usual.

But Concentration of Power in large tech names may help keep equities bid, but it will not help the US economy grow.

Falling USD may help keep equities bid, but it will not help the US economy grow.

And Treasury Secretary Bessent may go on TV every day, and twice on Sundays, boasting of tax cuts and trade deals, but there is still much that is not priced in.

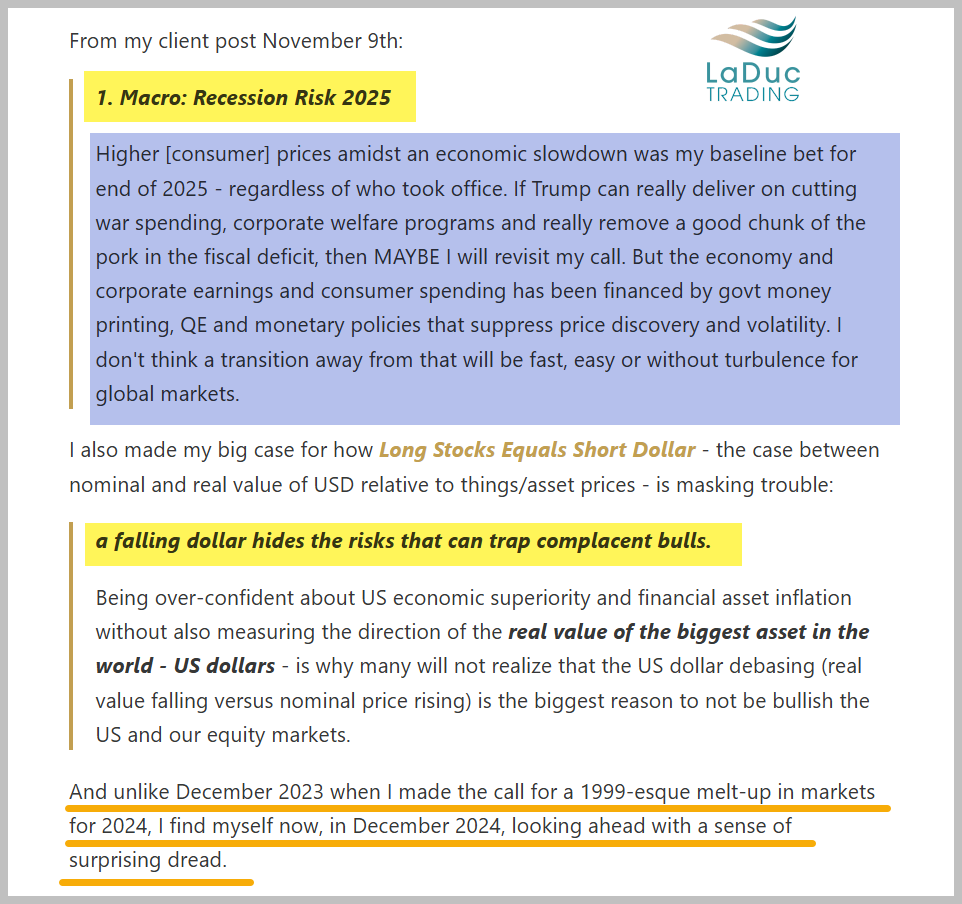

From my December 14th client post: 2024 MACRO PREDICTION REVIEW AND LOOK AHEAD TO 2025

And don’t forget my warning NOVEMBER 9TH, 2025:

Point is:

The market is not pricing in recession.

Or an "unsustainable" trade war with China.

Or MONEY GOES HOME™️

The equity market is pricing:

Trump folding.

Congress over-ruling the tariffs.

POWELL CAPITUATION (by bet: June FOMC).

My bet, given we are starting to see the hard data for the real economic consequences from Trump's tariffs & trade wars, the market prices in recession when Jobless Claims spike to 264K.

Apollo isn’t waiting. They are predicting Summer Recession.

Here is a slide-deck published by Apollo this weekend. Here’s my top five:

Sharpest decline in earnings outlook since 2020.

New orders collapsing.

Sharp reversal in corp capex spending plans.

Prices paid rising.

Consumer confidence at record-lows.

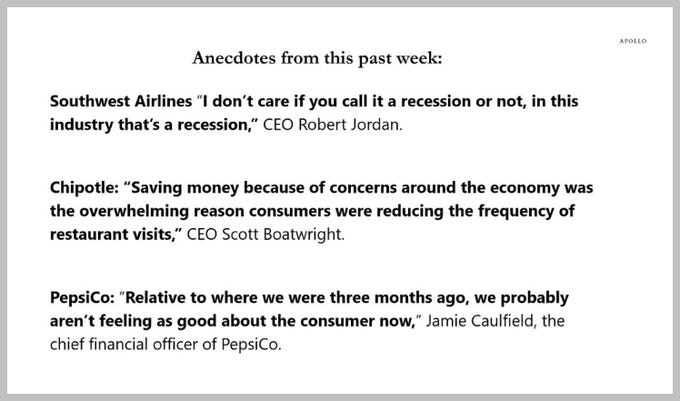

Companies are nervous:

But long before the recession calls of late, and the revised lower SPY 2025 price targets, I posted for clients my $4800 SPX price target. I still see it.