Complacency Has Ended!

CLUB/EDGE client post Saturday April 20th; Focus on "Bounce Monday"

» CLUB/EDGE client post Saturday April 20th 9:00 AM

Anyone not in front of their computer past two weeks will return to ask: "What just happened to markets?"

To which I would answer:

SPY & IWM erased all of February and March gains.

QQQ & DIA erased all gains from January 18th.

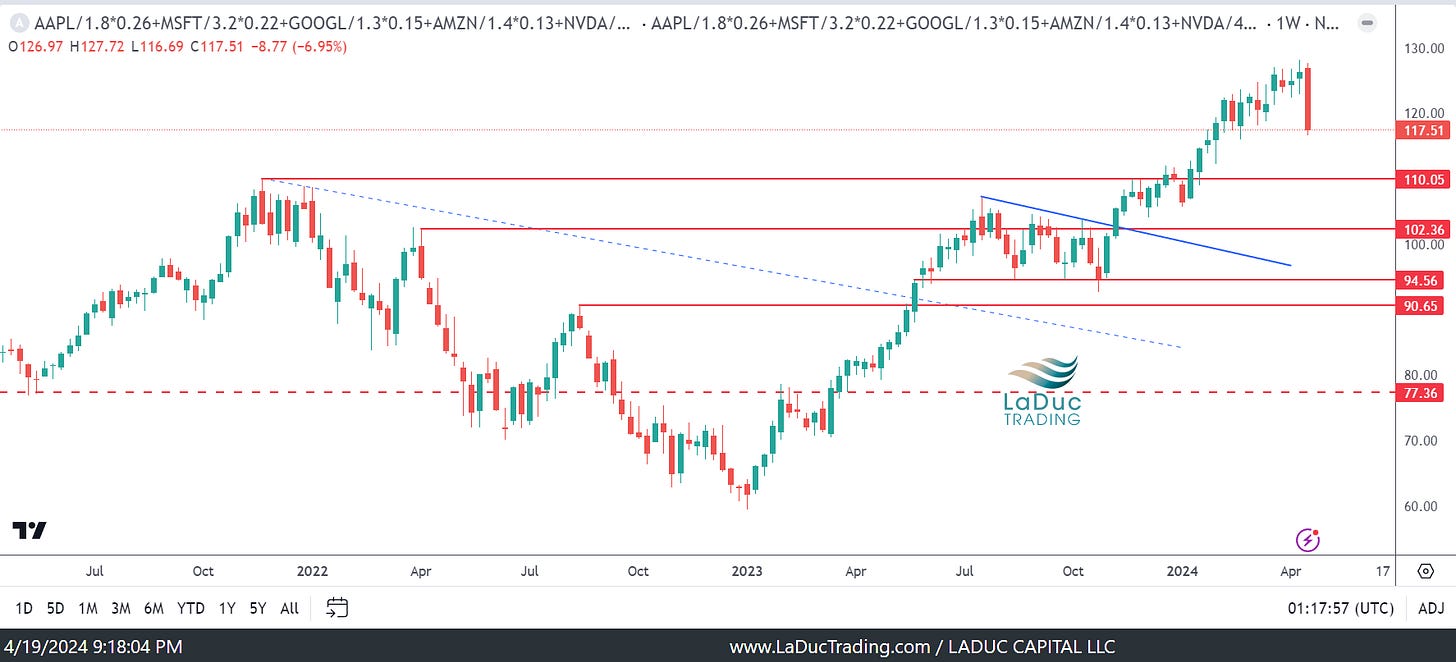

But the big drama this week was the sector sell-off in semiconductors.

NVDA is now down 20% from its March high - 10% of it in one day!

SMCI fell 23% - 40% from its March 13th inclusion in the S&P 500!

Recommended short SMH is down 10% in one week!

Best headline I saw to describe the carnage:

NVIDIA LOSES AN ENTIRE AMD IN MARKET CAP

Thank goodness we were positioned IN ADVANCE for this forced selling.

I mean: Nasdaq had its worst week since October 2022!

Thank goodness I have these funky intermarket tells to warn me when market is at risk of an air pocket.

But we are not out of the air pocket of risk yet!

I literally used that expression on NVDA Friday morning - after warning past few days on a number of semi stocks with the same "air pocket" set up under their 55D.

"We break $823 and there is an air pocket of risk below. NVDA could sell off 7%."

NVDA closed Friday at $762 after falling a total of 10%.

The 4/19 $800P I called out in my live trading room went from $.65 to $37.65.

Caveat: I do NOT recommend lotto’s as a rule!!! I hate scalping, but I love Friday lotto’s on HIGH CONVICTION plays on option expiration dates!

I am primarily a SWING trader, but monthly OpEx days are my exception ;-)))

Remember SMCI down 20% on Feb OpEx? Yeah, THAT!

Same 'trick' I used for NVDA:

Growth-To-Value Ratio Warned

The end of the week saw SPY and QQQ sell off hard on big tech & semi selling of size - all while IWM and DIA managed to stay/end the day in the green.

Energy, Utilities, Financials, Real Estate, Health Care and Staples did well.

Many were surprised with the strength in value names. I was not because I have this ratio I track every day and throughout the day that shows me the strength/weakness of growth plays.

As clients know, I expected it would roll over (red arrow), and that would be further support for pressing short tech, semis & even bitcoin proxies - all as laid out under #swing-ideas channel & Portfolio & covered daily in my live trading room.

Much of Friday's damage was caused by a selloff in the Magnificent 7.

The Magnificent 7 combined value posted their worst-ever weekly market cap loss: $934 billion.

Here is the MAG 7 ratio on a weekly timeframe I show clients daily that demonstrates how 11 weeks of gains were erased on one week - most of it in one day!

SPX filled 3 more hourly gaps to the downside Friday (yellow highlight). Impressive!

Now, when we finally get a bounce, and one that is sustained, at least we have a level to fill on the upside now: 5130.94 SPX (green shaded).

We have two upside hourly gap fills for QQQ: 423 and 445.47 (green shaded).

At some point: THESE WILL FILL. It's not "IF" but "WHEN".

With that, keep in mind: 4 of the Mag-7 report earnings this coming week (TSLA, META, MSFT, GOOG).

The week after, we get AMZN and AAPL. Then a month later NVDA on May 22nd.

AMD and SMCI on April 30th.

Bounce Then Trounce

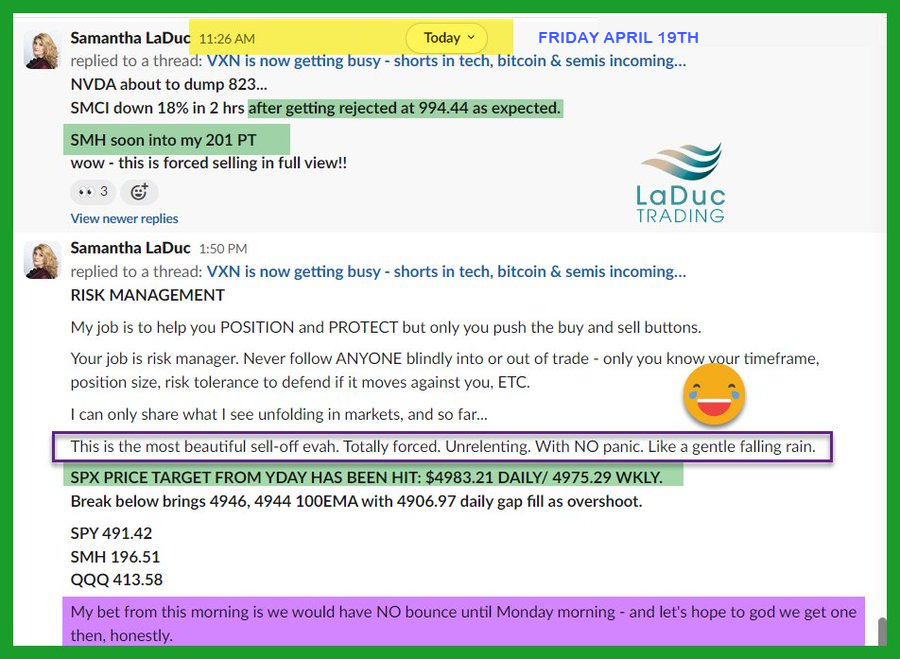

Premarket Friday I posted to clients my thinking:

My gut thinks we have a sucker’s rally Monday that will make people think this is the dip to be bought.

Then we can short from higher levels.

As the selling continued, I posted after lunch:

"This is the most beautiful sell-off evah.

Totally forced. Unrelenting. With NO panic.

Like a gentle falling rain."

A wee bit of Samantha humor.

I followed up with:

My bet from this morning is we would have NO bounce until Monday morning - and let's hope to god we get one then, honestly.

As you can see from the chart I posted premarket highlighting that only 8% of companies in SPY are above their 20D:

I also added:

Doesn't mean we are done-done going down-down - big picture. But I can see potential for a bounce coming soon.

Just keep in mind, CTAs have just started selling, earnings have disappointed and companies are in blackout buyback period. Lots of reasons to stay short big picture.

The good news: Complacency ended.

The bad news: All the reasons I have warned "Market is Overbought AND Broken" still exist!

The only difference now: "Market is Short-term Oversold And Really Broken"

WEEKEND LISTENING

Craig is very concerned about markets next few weeks. He offers up SO MUCH ALPHA in our recent Macro-to-Micro Power Hour Thursday!! Don't miss it!

And please do consider upgrading to MacroAdvisor EDGE with direct access to Craig, Geoffrey and me! Bespoke trades & Personal engagement.