How The Option Market Brought Down SMCI.

And how SMCI option flow was/is NOT like NVDA PLTR or even ARM for that matter. And how I saw that it would easily tag $800.

I love running a live trading room (most days). This morning wasn’t one of them. I had three drinks the night before and I was just not my zippy self. I am a max 2 cocktail kinda gal. But if you have ever experienced an “Irish Funeral” then you will know there are a lot of funny stories and a lot of alcohol.

I had a really good time Thursday night (despite the reason for “celebrating”). But Friday morning I just couldn’t clear the cobwebs by the time I opened my live trading room. Luckily, I can still see stock moves before they happen. Athletes call it ‘muscle memory’. I think it is very much the same thing. My mind just knows how to quietly scan for the action in the market after all these years.

I also know it’s my job: finding best risk/reward set ups for our CLUB/EDGE clients to justify the price of admission.

So it is pretty funny given my mood how I still managed to figure out SMCI early and for it to work perfectly. We are talking a massive parabola breaking and falling 20% on Lotto Friday.

Technically Speaking…

Premarket I talked to clients about this evening star reversal (candle pattern) on the hourly intraday chart, and matter-of-factly stated that a break of $1059 would be the trigger to short. Ok, so that executed and I pointed to the price targets that SMCI would reach if it stayed below that LRE (low risk entry) short of $1059.

I happen to warn that we were having a large February monthly expiration where ~230M in gamma will expire in SPX. I happen to mention how this could introduce short-term volatility as dealers have to sell out their stocks in order to manage the theta decay on calls into a large options expiration.

I said that sentence exactly. You will get to hear it when the SMCI video is uploaded - likely Monday. Sign up our LaDucTrading YouTube Channel!

Anyway, I happen to warn, live, “that IF put/call ratio really picks up on SMCI, then the pressure to sell will increase”.

I also gave price targets should this CHASE (intraday, multi-day) short get legs. I gave $886 - with suggestion it could hit by EOD- which would make for a very profitable Feb OpEx Friday lotto.

Remember, market had JUST opened, so the real option flow hadn’t shown up yet. Anyway, I also strongly suggested that if selling picks up that $886 would only be my 1st target as I clearly saw the magnet of $800 (daily gap fill) with overshoot to $794 (hourly gap fill).

But honestly at the time, I didn’t expect it to tag 800 until next week! And we had only made it to $886 target by time I closed my trading room at 11am.

I remember warning that this pullback might only be temporary, as this SMCI gamma squeeze was straight out of a Softbank 2021 playbook.

Then it occurred to me to see how many were CHASING (intraday, multi-day) verses POSITIONING with later-dated options. Where were the ‘big boys’ sitting - June, Sept? How many of those Jan 2025 leaps were deeply in the money?

BAAHAAHAAA

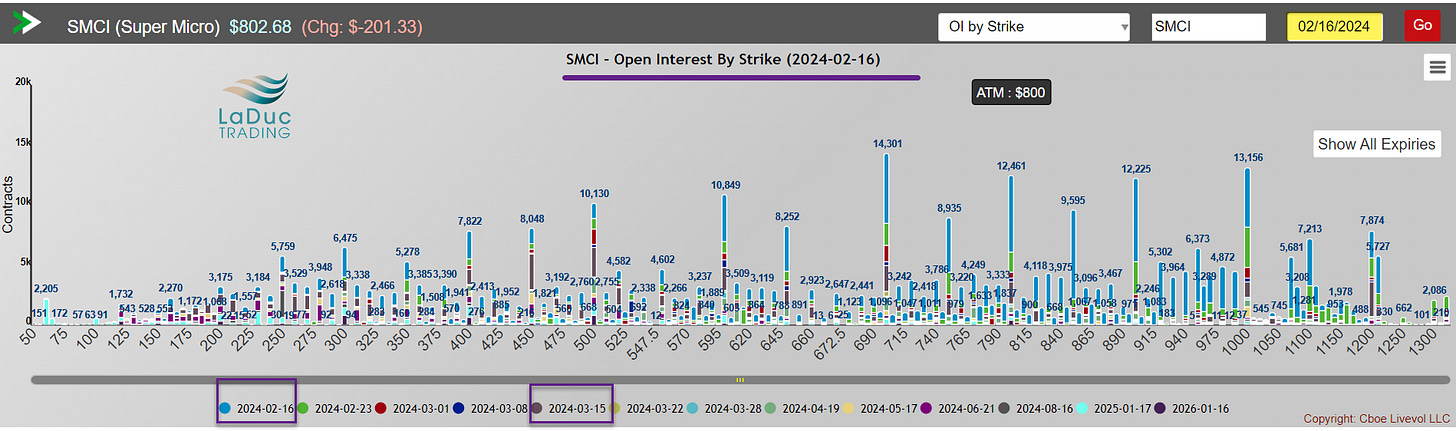

Check out the Open Interest. On first glance, I see a good amount of contracts. Then I move my tired eyes to the left and notice THE TOP TEN STRIKES OF ALL OPTION EXPIRIES WILL COME OFF THE BOARD FEBRUARY 16, 2024.

I laugh out loud in my room: “That’s today!”

I took a screenshot of the option volume coming into SMCI at 10:30 am ET - after it tagged my 1st PT of $886. IT WAS ALL 0DTE with more and more buying of puts and selling of calls hitting the tape. I said if it continues we would see $800.

LOL - look at this option flow EOD compared to 10:30 AM.

Need I say more?

But I will.

SMCI, a CHINESE-linked server/networking systems company in the supposed sweet spot of #AI excitement, is run up to $1078 on Feb 16th from $280 the 1st of the year - a 285% cumulative gain - on a gamma squeeze.

There are NO longer-dated option positioning of size. The next largest stack of option contracts reside at March expiry, but it is small in comparison to Feb expiry. Doesn’t mean the gamma squeezers - large and small - can’t glom onto March and bid this up again, and they might, but for now, they have exhausted the gamma squeeze as dealers had to sell out their stocks in order to manage the theta decay on calls into a large options expiration.

From the above screenshot of ALL SMCI contracts across all expirations, you can see that most is short duration (specifically 02.16) and that means most all of the options for SMCI came off the board - TODAY.

That makes SMCI the poster child of “0DTE”.

Is NVDA at Risk of ‘Being Played’ like SMCI? Or PLTR or ARM?

I have very strong opinions about NVDA as being the Player not the Played, but this is not the place for that discussion. Suffice it to say, NVDA is not in a gamma squeeze.

NVDA has a lot of option contracts that expire between now and March 15th (brown), which is usual around a big headliner announcing earnings.

But June positioning is also bid (purple):

And January 2025 leaps are massive and massively in the money:

PLTR also has a lot of further-dated option sponsorship - a recommended long for CLUB/EDGE clients since since May 9th from $8.81. ARM has very large Jan 2026 leaps - and only 10% of its float trading (a Softbank bed-time story for another time).

Point is: not every AI company is in a gamma squeeze. But SMCI is a poster child of excessive call buying forcing a gamma squeeze that unwinds reflexively - all during a speculative wave of AI euphoria.

AI may be real, but the SMCI buying was not.

Hope it helps.

Postscript: I Forgot A Few Things!

Apologies if you read this via email as I had uploaded a duplicate chart (not the juicy OI one that gave me the AHA moment), and forgot to edit “Chinese-linked” with the Bloomberg article.

Also, I remembered after hitting send, how I forgot to share what I will be watching moving forward.

I spent the time to write this post up on SMCI because it is an excellent example of how to spot a true gamma squeeze AND when to safely short.

I didn’t even mention one way I track a stock that gets the gamma squeeze treatment: the near-dated option strikes have an IV that spikes above 200 suddenly and climbs from there.

Gamestop (GME) was above 1000 IV and selling calls all the way up was dangerous. SMCI didn’t get THAT bad, but I haven’t looked back at the IV path past 2 months.

Also, Put/Call ratio flipped Friday. Translation, there were many more puts getting bought than calls and I then I looked at the orders for the big calls - they were clearly being sold.

Given Big OpEx and dealer positioning, it was a perfect storm for a $0.20 open price for a $800 option to fly to $20.00 in a New York minute. And that’s why I love running a live trading room!

Really good info supporting the thesis how 0DTE can flip the market down badly here soon

Very insightful. Thank you!