Bonds Bid (for now); Oil & Markets Are Not

CLUB/EDGE client post. Focus on Liquidity, Bond Volatility & Bank Stress.

» CLUB/EDGE client post Tuesday June 4th, 6:51 PM.

Short-and-Sweet

Today is June 4th.

SPX 3-month ATM puts cost less than 2%, which is historically cheap.

That's the market thought for today.

Longer Version ;-)

"It's Just A Glitch" was the running mantra on twitter for not one but three market disruptions in the past week.

Last Thursday, there was no live pricing for the S&P 500 for more than an hour. Just before SAAS stocks & AI Tech swooned.

Monday, NYSE claimed a “technical issue” that caused trading halts in about 40 NYSE-listed stocks. Same time as T+1 settlement policy went into affect.

I forget the 3rd issue, but I do remember telling clients past few days that the market did not present great set ups either way, and to tread lightly.

Now, to be fair, the market is neither long nor short for me with conviction at these levels as we chop below SPX $5340 and above $5200 - likely into FOMC and CPI next Wednesday, OPEX on the 21st and QRA June 30th. I continue to see more calls sold then bought on aggregate and puts already bought for protection (not sold) - both keeping us very rangebound.

Bonds Bid (for now); Oil & Markets Are Not

This morning I reviewed my Intermarket Analysis charts from last week. The video review is posted under intermarket-tells:

Intermarket Analysis Week Ending May 31, 2024: Bonds Bid (for Now); Oil & Market is Not

I would also like to highlight two macro themes that are working:

Oil Short

The oil short talked about for WEEKS has finally woken up! WTIC - 5.5%.

Reasons noted repeatedly: structural demand weakness.

CLUB/EDGE members can see all the charts - technical and fundamental - in #bobs-oil-and-gas channel.

Suffice it to say: this theme has been in play for weeks for WTIC, RBOB, ULSD... XLE, VLO, etc

With one notable exception - posted under #swing-ideas: ENERGY PIPELINE plays long.

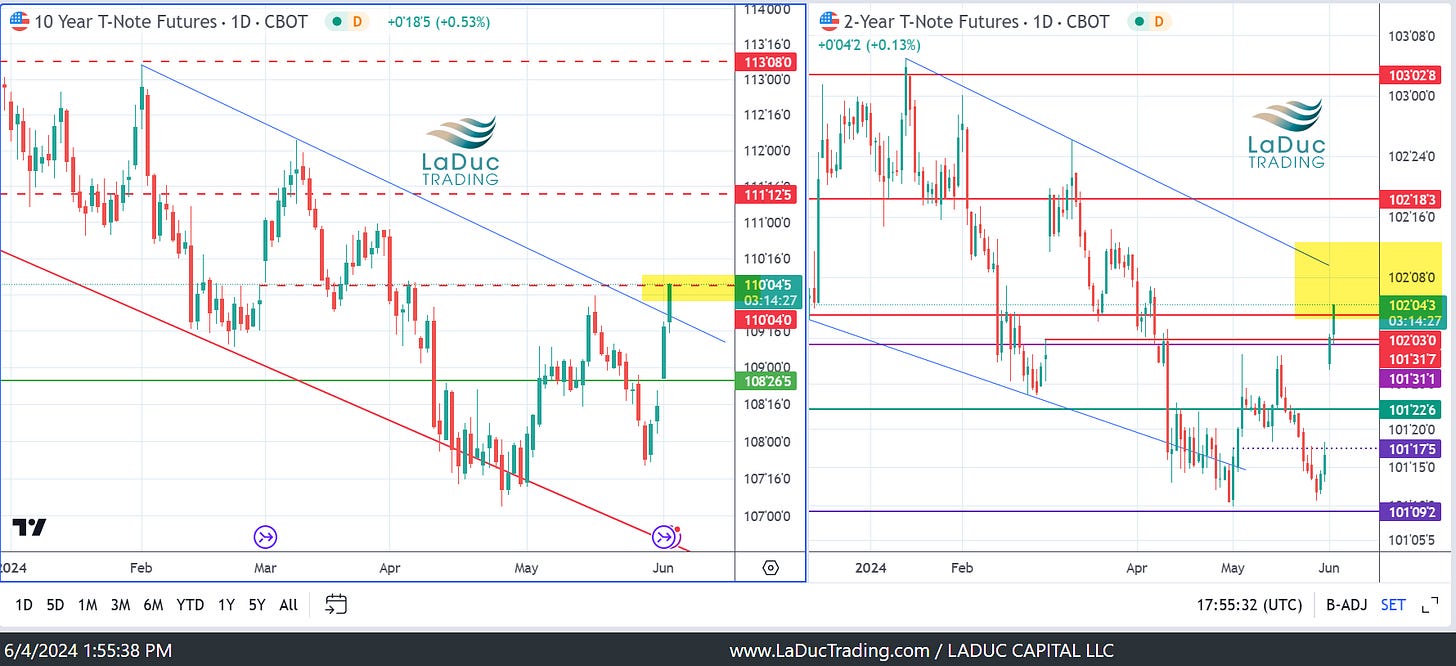

Bond Long

The bond long talked about for weeks didn't happen smoothly, but it did happen.

June has started off with a bang for bonds - see chart below.

Yields falling into key key key 4.33% on 10Y with TLT bid into/above 200D was my baseline bet.

Now, what they do from here really matters.

I still see 10Y yield falling into 4.2% and MOVE volatility weakening into summer.

I still see 10Y/2Y yield curve inversion to -.60%.

With that, it's a good time to review my May 7th client post: What If Yields Crash Down Not Up?

Liquidity, Bond Volatility & Bank Stress

Michael Howell of @CrossBorderCapital sums up well my thinking about a supply/demand balance in equities lasting a little longer:

"Global liquidity is gaining momentum. The driving factor is the collateral multiplier which has risen as bond market volatility has fallen."

With that, my current thesis remains: this disinflation impulse (ex: slowing factory activity) and incremental growth slowdown (ex: revised lower GDP) serves as nice backdrop for bond bid as equities chop and commodities drop.

We now turn to Nonfarm payrolls on Friday for the next bond market-moving news before we get to see how many rate cuts the Fed expects for 2024 when they present their SEP next Wednesday. Currently, market is pricing in a nearly 62% chance of the Fed cutting rates in September after ISM data was released Monday.

Banks would appreciate a rate cut no doubt as FDIC Quarterly release showed a worrisome trend continuing in Q1 2024.

US Banks Face $517B Loss.

This is up from Q4 2023 of $478B.We are fortunate that @Geoffrey Fouvry loves a good FDIC report and already alerted clients weeks ago that we have bank/economic weakness the market can't see yet.

FDIC Highlights By Geoffrey:

Ok, FDIC numbers are out.

-0.3 QoQ in Loans Shrinking in nominal terms

up 1.7% YoY (Much lower than the official inflation and likely the inflation is higher)

Charge off in Credit cards ramping up to 4.7%. 55bps in just one quarter.

Above 5% historically we are in recession.

CRE going south.

And last time I showed that bankruptcies are going up.

So we really are not doing well here.

Not catastrophic but really mediocre

Stagflation is now, what's next.

Banking sector would need some lower rates to alleviate the funding pressures and the falling net interest margins.

But the Fed is constrained because the US gov keeps on creating inflation with a large primary deficit.

We are in crowd out

Big Picture, banks aren't severely stressed, but the pressure is building. Again, Geoffrey:

What we have a classic end of Banking cycle, with cost of funding pressures. NIMs shrinking, charge off at 4.7% in credit cards (historically at 5% it's recession), with a 55bps increase in the quarter. We have increasing business bankruptcies, negative growth in loans...

With all of the above, I like cheap XLF + SPY ATM puts 3 months out against select stocks swing long (ex: infrastructure-related, precious + industrial mining, defensive stocks/ETFs…) - all the while waiting for a stronger rotation theme - or correction - to emerge.

Housekeeping

Website - front, middle and back - are 100% rebuilt and tweaking will be done by EOW.

Including Portfolios - which I can then focus on populating rather than bug-fixing.

I am over Covid/sickness - thank you for your patience with froggy voice & foggy brain.

James - your membership director - goes on vacation June 12th for a week. He's earned it!!

Rithika & Namita will join me in posting of CHASE trades shortly. You're welcome

Nelson & Archna run a daily chase-live-huddle every day/afternoon. CLUB/EDGE members are welcome to join!

Craig & I did a webinar last Thursday, publicly: End Of May: Go Away Or Stay? / Macro-To-Micro Power Hour

This Thursday I have back-to-back EDGE Roundup Webinars with Craig & Geoffrey - will post for EDGE members Friday.

I wish you all a great trading week!!