ALL GAS, NO BRAKES meets ALL CUTS, NO INFLATION meets ALL BUYERS, NO SELLERS

As I Was Saying…

The bullish flows continue.

“I study liquidity - in MANY forms - but the key ones I show clients daily in my live trading room are still rising. I know, it shocks me too. But it is what it is.”

This was just from yesterday’s note, where I emphasize, again, the manic buying under the surface. Some from mechanical flows (more on that below), definitely short covering squeezes (oh the bottom fishing plays!), and some just speculative momentum (like bitcoin & ethereum spiking higher after hours as profiled yday!!) It is all very 'bubble'-like, and we haven’t even tagged my VIX 15.50 call from Mid-May yet!

Also highlighted in yday’s market thoughts: bullish Bitcoin & Ethereum charts!

Both are screaming higher afterhours on this FinTwit “news”:

CHINA ALLOWS OWNERSHIP OF BITCOIN & CRYPTO AGAIN

But I can find NO PROOF and NO SOURCE for this news. So careful.

QUICK HOUSEKEEPING NOTE:

My live trading room is closed Friday, so I can focus on PORTFOLIO app testing. Archna & Nel will run the #chase-live-huddle in our LaDucTrading slack member workspace during my normal timeslot (9-11 AM ET ) - in addition to the their all-day market commentary, member Q&A, and live trading. My live trading room moderators Mike & Rithika will join them as my zoom session will be closed. So don’t miss live Friday market analysis from our great team at LaDucTrading!!

More Potential Mechanical Buying

As part of my quant review daily to identify tailwinds/headwinds to the market, I am continuing to find bullish backdrop for higher.

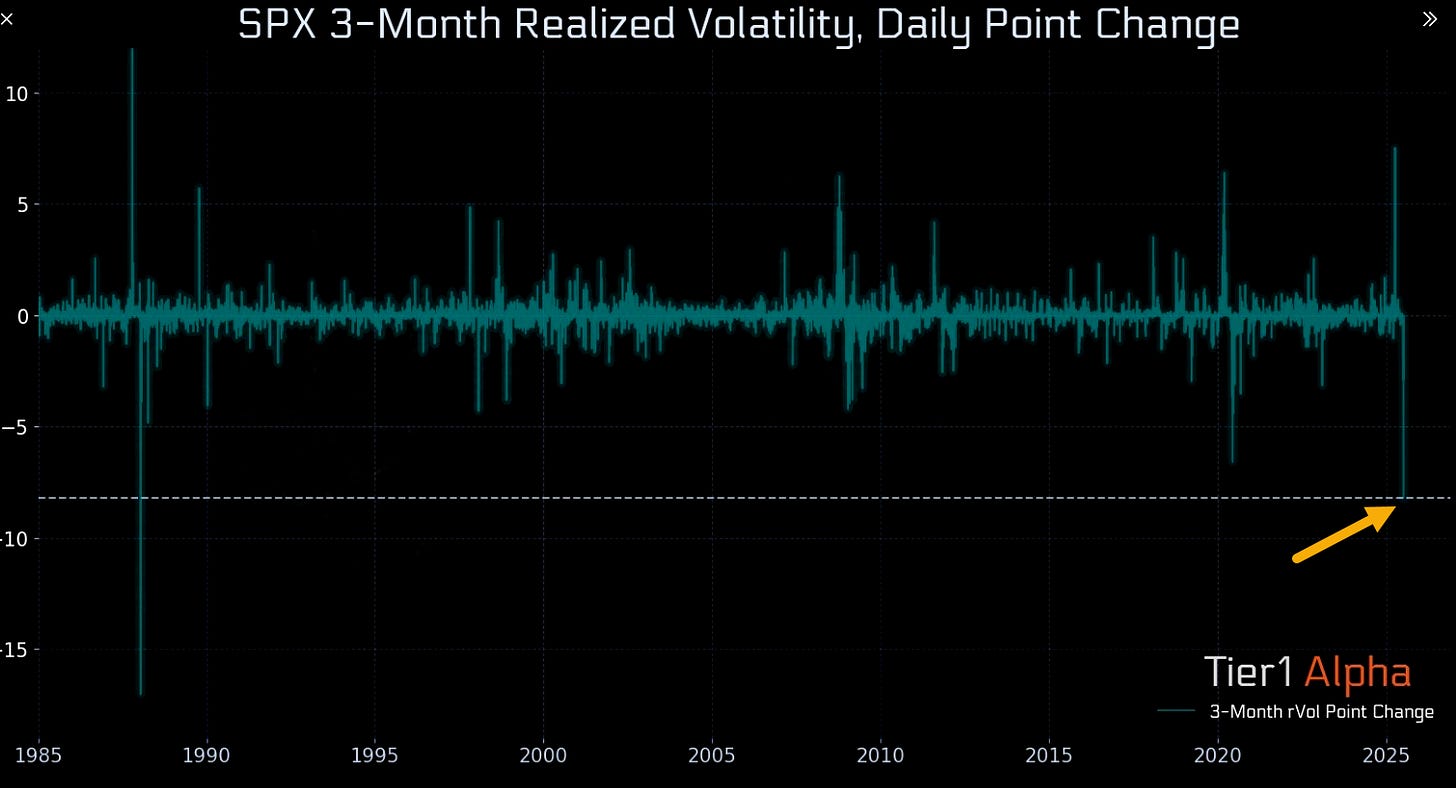

Case in point: SPX 3 month realized volatility just crashed, marking the largest single-day decline since 1987.

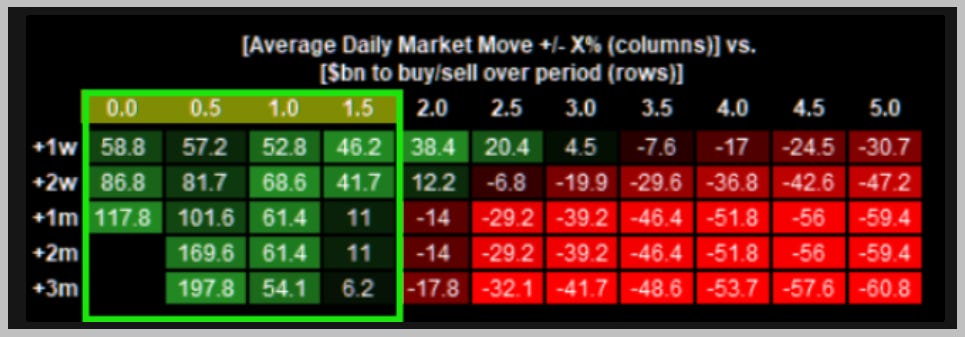

That will likely trigger Volatility Controlled Funds to buy as realized volatility is “oversold”.

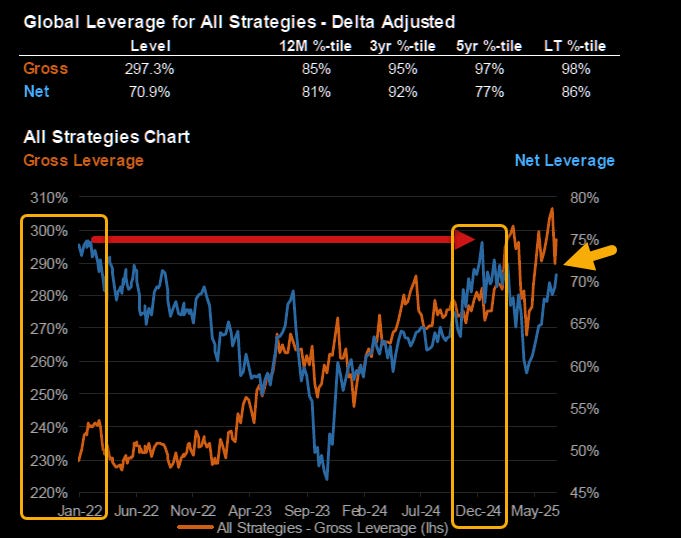

As for the fuel left in the tank from the overall hedge fund folks, GS + JPM say they are not yet max net leveraged:

The caution to that comes from Nomura’s McElligott:

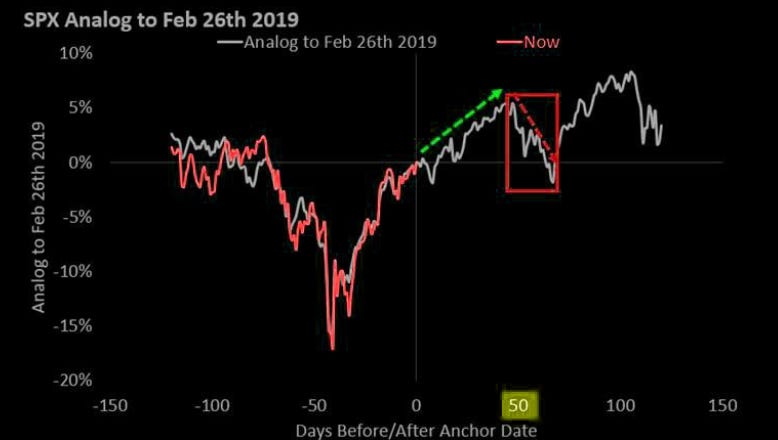

“...we head into July Op-Ex overlapping with the Earnings “Buyback Blackout” window and this fresh Systematic positioning rebuild, which could then act your primary de-risking flow into a Spot selloff / Vol squeeze".

Something like this, maybe?

Obviously, I need to see selling under the surface first, and I haven’t. BUT I WILL LET YOU KNOW WHEN I DO! Until then, we are making records…

There have been 52 consecutive trading days the S&P 500 has closed above its 20-day moving average — just shy of the 53-day streak seen in early 2024 — and one of the most persistent trend runs of the past 25 years.

Grant Hawkridge via @SubuTrade

Vegas Odds for Capital Gains Tax Cut?

If there is a trigger for a manic melt-up, THIS IS IT.