ALL GAS, NO BRAKES meets ALL CUTS, NO INFLATION

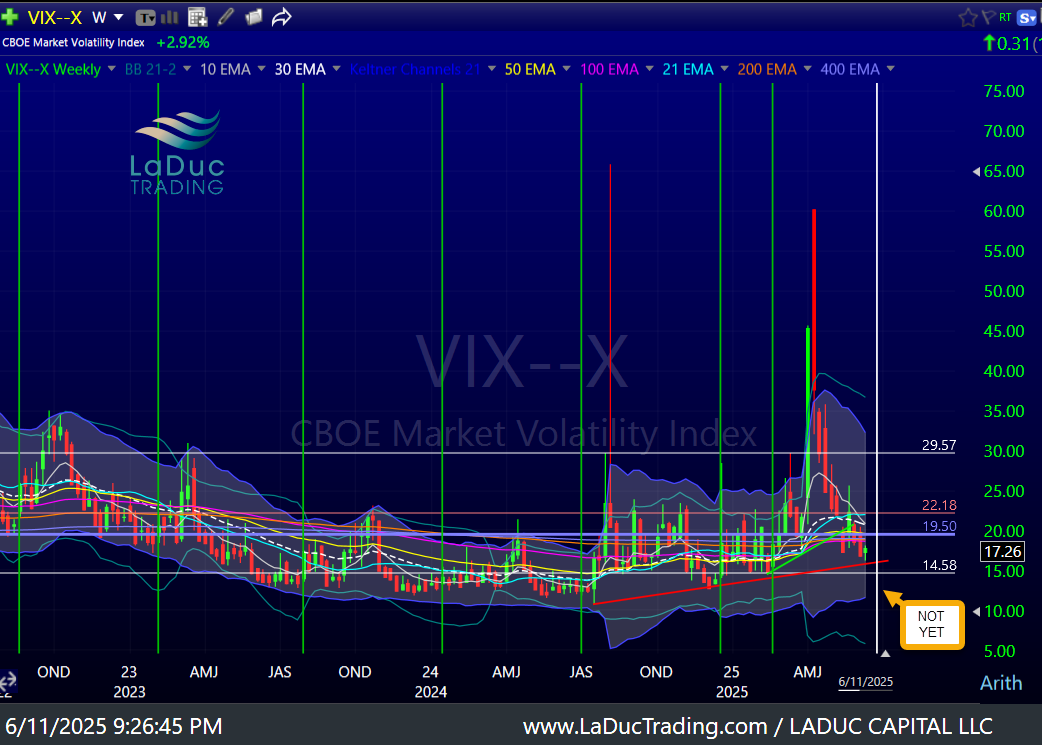

VIX 15.50. Now What?

VIX Expiry is next Wed 7/16 & my 15.50 call from May approaches:

5/19/25 Live Trading Room Market Recap & Trades: "Still Risk Of Blowing Up"

"... a bigger level for VIX to base and move higher with perhaps more gusto that sticks: 15.50."

I even updated clients June 11th: MELT-UP INTO MELT-DOWN

"not yet"

Fast forward to July 9th, and VIX hit 15.76 & I still see no selling under the surface.

But I do see...

✴️Trump bashing Putin & doing a 180 on Ukraine war support.

✴️RUMORS of Xi getting pushed out (soon).

✴️And everyone in DC blasting Powell to resign.

You already know my mantra from beginning of the year: WAR IS NOT PRICED IN. But it’s not easy to time - like an earthquake. And also hard to prepare for.

On Rumors of Xi, I don’t give them much credence, but it bears watching.

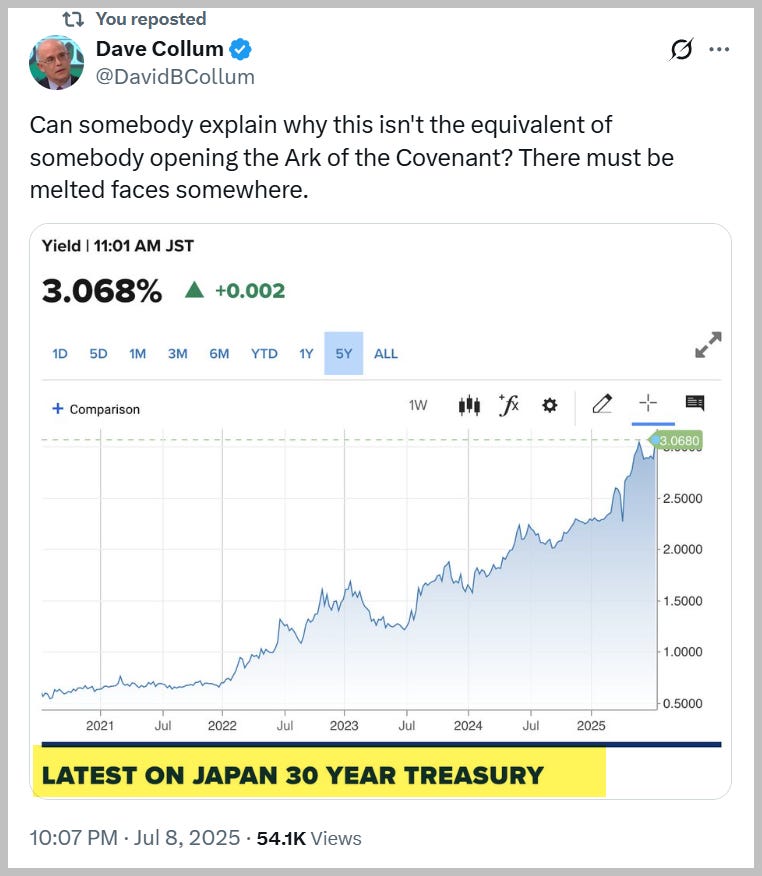

On Powell leaving before his term is up May 2026, I say Vegas Odds are rising. And if Powell leaves/is forced to leave, I would suspect that after a knee-jerk reaction higher in bonds (on anticipated aggressive rate cuts), the bond vigilantes will seize the opportunity to #ShortTheRip - likely in size.

As for the equity reaction...

"USD gets hammered, Gold shines, and the yield curve likely steepens bigly." Client Kirk

Agree, but this macro trend trifecta is in play regardless big picture. Powell’s early departure could speed it up, but more likely my melt-up thesis on equities could trigger.

And here’s why:

In the same way that "All Gas, No Brakes" fiscal is getting priced in, so too would "All Cuts, No Inflation".

And ironically, both themes are huge triggers for future monetary crisis, dollar crash, and yield spike... but initially, market will stupidly rejoice.

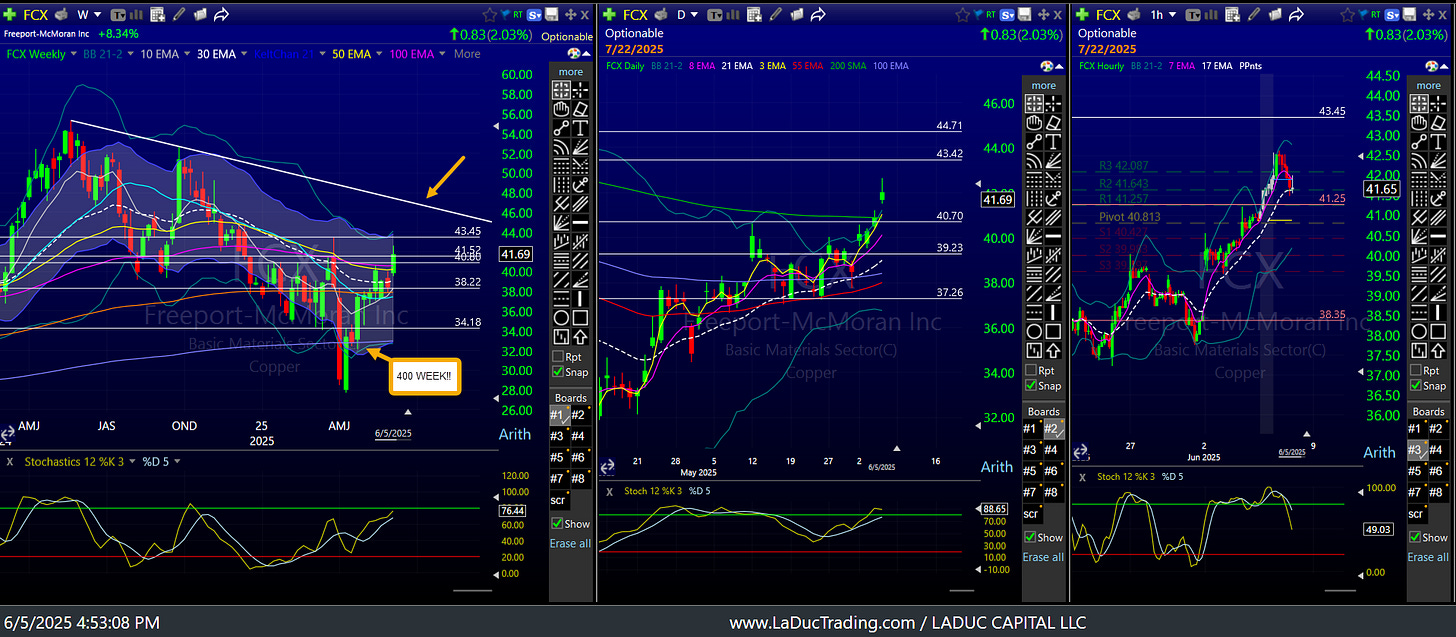

Copper Gets A God Candle

What is up with Trump levying 50% on copper imports?

Trump is making EVERYTHING that uses copper more expensive for US manufactures and consumers. 🙄

Trump’s Copper Tariff Threats Are Already Raising Factory Costs

But it is very good for my rec’d $FCX continuation swing long with $COPX & $XME for clients posted May 23rd! 💃

6/4 & 6/5/25 Live Trading Room Market Recap & Trades

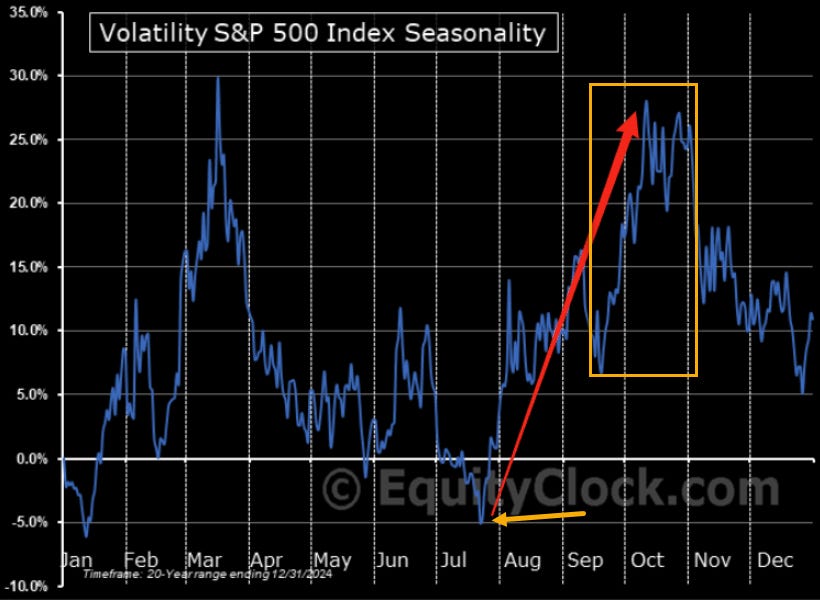

Liquidity Rising Into VIX Seasonality

I study liquidity - in MANY forms - but the key ones I show clients daily in my live trading room are still rising. I know, it shocks me too. But it is what it is.

Having said that, we are not without macro event risks - and I’m not even talking about the Full Moon tomorrow.

Japanese Elections are 7/20 - one year after I warned about the yen carry trade unwind July 19, 2024. Maybe it’s nothing, but I will be stalking USDJPY very closely as the 30Y JGB yield starts to “melt faces”.

Also, don’t be complacent. We are approaching the seasonally low point for VIX.

Not since “Liberation Day” April 2nd has VIX had a 15-handle.

“the July and August VX contracts are at new lows with the rest of the curve not too far behind. As far as the VIX futures term structure is concerned, all is right in the world.

Noteworthy is the $VVIX divergence. It is nearly 10 points above its low of ~85 from back in May.

VVIX's 10-day correlation to VIX and the VX futures is plunging, nearing levels that put me on the defensive. VVIX could certainly catch down to VIX and VX futures, but I'm now on the lookout for other signs that VOLs are bottoming (for now).

Even if VOLs do blow off a little steam, the current overall health of the market and VIX complex should keep a lid on any selling.” @vixedsignals

I agree in large part, although I did make comment this morning to clients live that this is exactly when to expect LARGE VIX activity enter the options market - those pressing short while betting on melt-up as well as large hedges for Sept/Oct now that hedges are cheap.

Then I saw this tonight: LOL

1 million $VIX options traded today. Odd to see that during a relatively calm session in which VOLs got crushed. Usually a day like today would be 1/3 that volume. @vixedsignals