A CURRENCY IS ONLY AS GOOD AS THE ASSETS IT BACKS

And Cutting Rates Under Fiscal Dominance Is More Inflationary Than Not

I offered up some charts on USD in yesterday's post to highlight the short-term bounce potential against the long-term trounce projection.

I bring this up again as DB is out saying the dollar needs to weaken 30-35% to correct Net International Investment Position (NIIP) and Current Account imbalances.

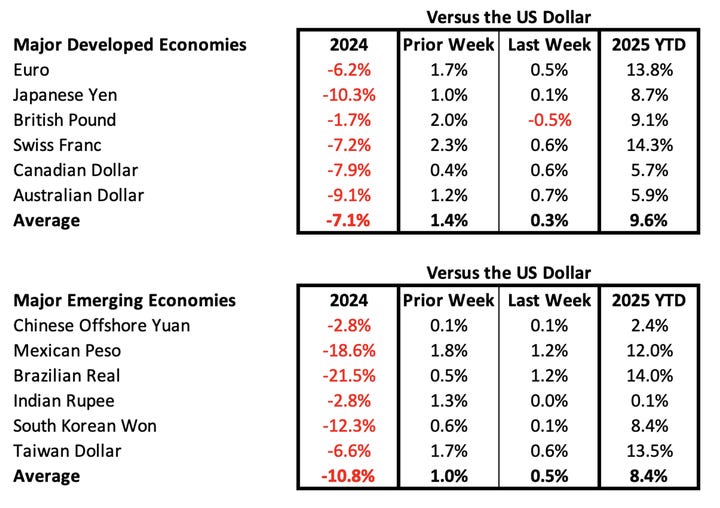

H/t chart from @DatatrekMB on value of dollar relative to peers.

Because the US runs a trade deficit of size with foreign trading partners, financed by debt, foreign liabilities greatly exceed foreign assets held.

Changes in asset prices (like stocks and real estate) and exchange rates can significantly impact NIIP, but the largest affect to NIIP comes from currency valuation.

I'm not sure that when Trump talks of balancing our trade deficit through tariffs he is trying to drive the value of the US dollar lower in an attempt to reduce risk ahead of an economic downturn, especially if interest rates rise; but either way, as Geoffrey and I have discussed and posted for many months, Trump's plan of devaluing the dollar is a feature, not a bug, of his plain to maintain US exceptionalism through isolationism.