A BOUNCE IS NOT A RALLY

PPI. CPI. Earnings. Tariffs and US Dollar, Oil and Yields. Almost Done Selling? Q4 2024 Earnings Season Meets Macro. When Trouble Starts.

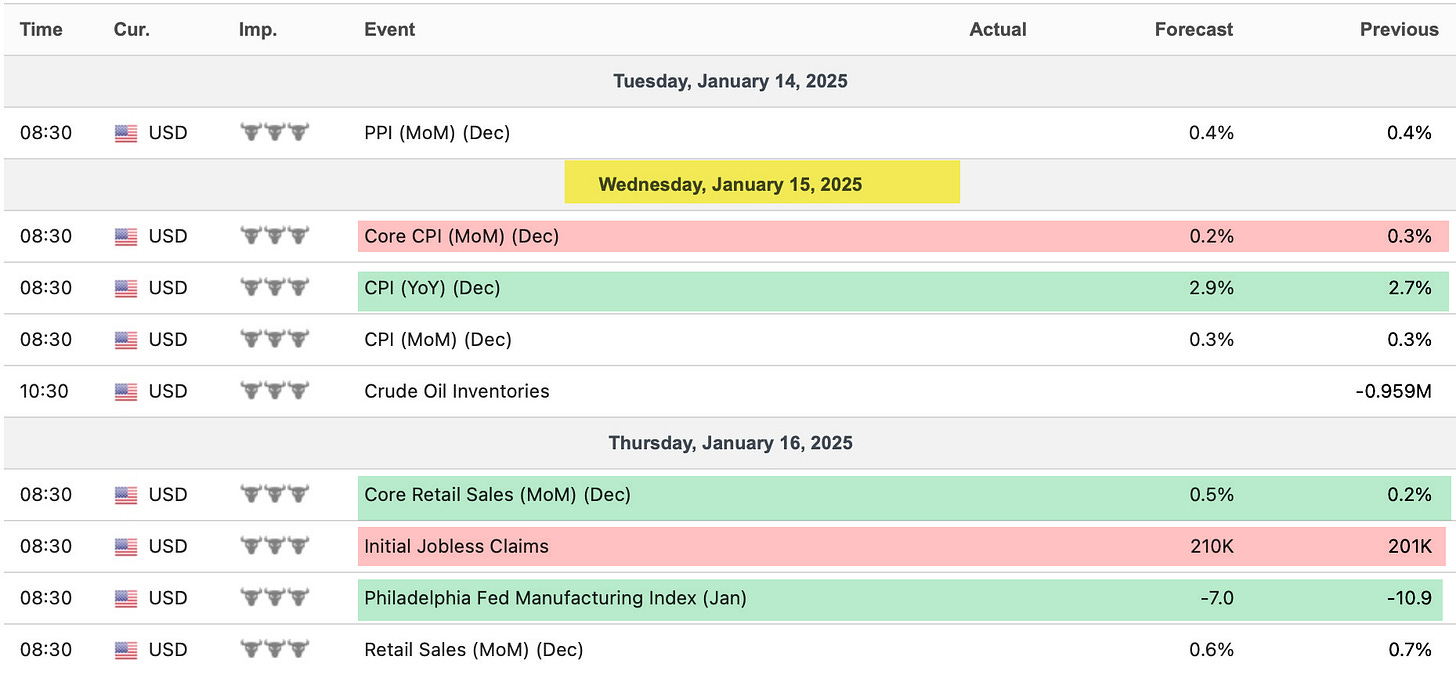

PPI Today. CPI & Earnings Kick Off Tomorrow

Sluggish PPI on one month view is silly to determine trend. So it drops .4 to .2 & market sees Fed cuts? Silly.

It doesn't even contain shelter costs!

Bigger picture, core PPI bottomed in mid 2023 so little progress on inflation since.

Here's a detailed look if you're into that:

PPI Inflation Accelerates to +3.3%, Driven by “Core Services,” +4.0%, both the Worst Readings in Nearly 2 Years

CPI matters more, but I'm not expecting a big change.

Although a .2% increase is expected, any upside surprise would push Treasury yields even higher, putting more pressure on stocks.

We have bank earnings this week that should give us a look at their business as well as consumer from which we can extrapolate tells on strength of economy.

But big picture, Q4 earnings are expected to be good, and the bar was lowered to make sure of it.

It's Q2 I'm much more interested in - given strength of dollar, yields and oil of late.

Earnings will start to really absorb my attention, so it will be very hard to study the onslaught of earnings and write detailed market thoughts.

So please remember to review my trading-room-notes that I post daily with the key price levels, themes and trade set-ups.