Market Is Trying

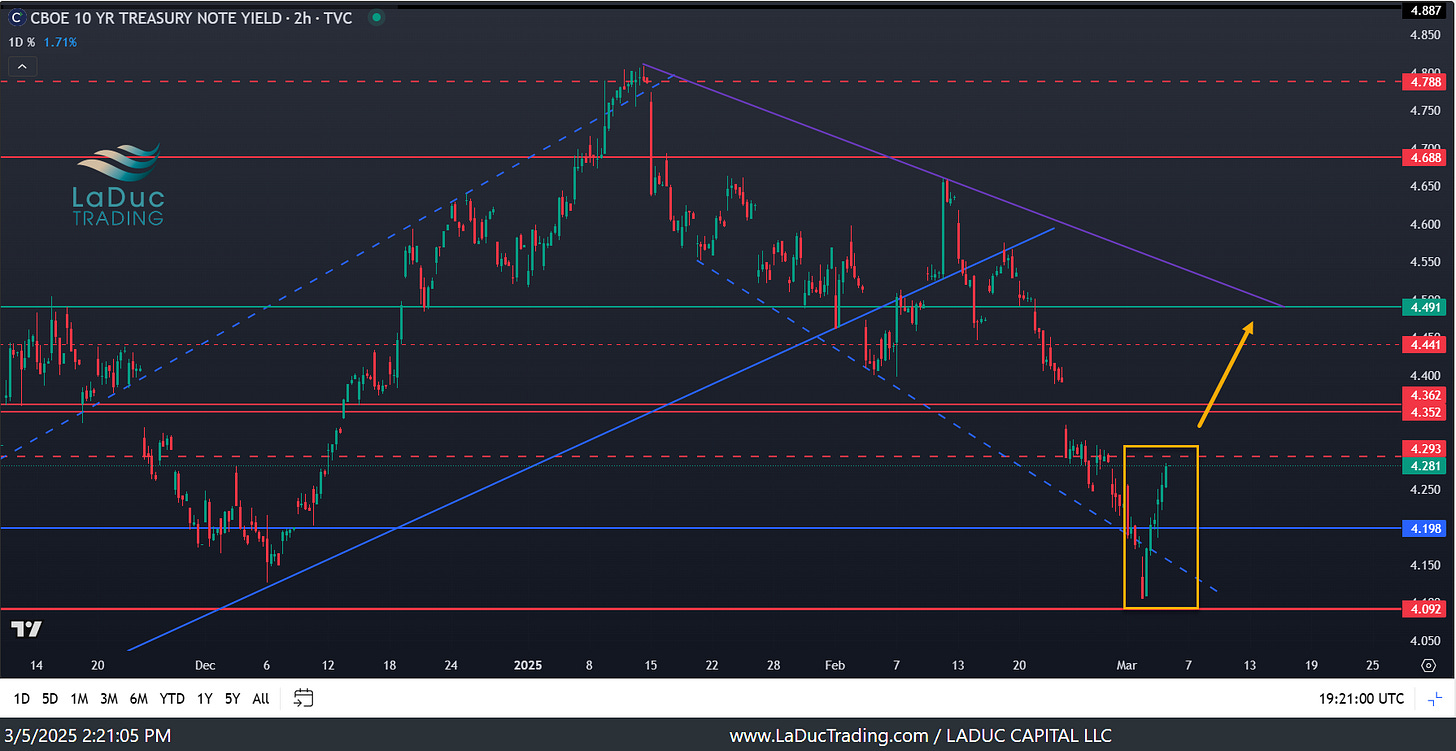

The growth shock is dissipating - for now. The economic data has supported the re-rating on equities. The main reason stocks bounced today was on rising US & EU interest rates - ironically at my expected 4.2% 10Y yield. I also said we needed yields to rise to inflate assets - since we were firmly in a “deflation impulse” with falling yields, equities and oil. Now add dollar.

This intraday bounce today, potentially into Friday, does not remove the risk of government shutdown toward the end next week! But it does encourage those with March 21 hedges to consider rolling them to April. I’m still bearish the market for all the reasons I listed yesterday: Selling Not Done. But I also do not have a precise date on the next volatility surge. I just know that I need a sharp volatility move before recommending clients #BuyTheDip for more than a trade.

Option Flow is Trying

In the same way that I saw and called out the aggressive & large ATM put buying and OTM call selling at the top Wed Feb 19th, I am starting to see hedges closing, calls starting to accumulate, but not a lot of put selling to get really excited about. [Chart h/t Stephen Harlin]

In SPX, the focus seems to be on de-risking rather than taking new large directional bets. Robert Balan

As you know from my intermarket analysis, I need breadth expansion and net buying (not just for them to stop falling), plus a macro trigger to igniter the sentiment unwind from bearish to bullish. We aren’t there yet despite the excitement of too many on one side of the boat:

One thing that would help: rising 10Y yields for those to rotate out of bonds and back into stocks:

I’m not expecting jobless claims to be light or unemployment rate Friday to be heavy. Just the opposite. More confusion to parse, but with Powell speaking Friday morning before the Fed blackout period next week leading into FOMC March 19th, we may have a view into his potential thinking on the impact of rate cuts moving forward. But the bigger wildcard is still the potential of a government shutdown March 14th and if that happens if it would pull forward 50bp cuts March 19th.