Yo-Yo-Yo Market

To cut or not to cut, that is the question the market algos kept asking on Friday - from the 8:30 ET premarket NFP print (HOT) to the 10 ET ISM Services PMI (NOT).

Based on the NFP print, algos reacted to a "strong labor market" as reason for Fed to delay its initial rate cuts, but a "weak ISM Services PMI" had the opposite effect.

Both of those reports, by the way, require MUCH more analysis and context. But I summarize the market reaction before actually pulling back to see what's under the hood.

Main take-aways for now with a deeper dive another day:

ISM service employment plunged but...one-quarter of all new U.S. jobs created in 2023 were US Govt jobs!

Dec jobs report rose on big downward revisions to previous months when in fact the economy shed 1.5 million full-time jobs in a single month. (See thread)

But bad/good economic news didn't matter. For the shortened holiday week, the Nasdaq Composite fell -3.2% - its biggest drop since September. As the 10Y yield tagged my 4.1% price target from 3.8% bounce call - it's biggest weekly advance since October.

Result: we perfectly hit my price targets given here from Tuesday:

Tagged $QQQ $394 and $SPY $465 premarket - exactly.

And my “fade the intraday bounce” call from my live trading room didn’t suck, as we indeed drifted back lower.

All this yo-yo-yo intraday price action was before news in the afternoon that the US is proceeding with plans to file an antitrust case against Apple, and after learning Apple's Supplier, Foxconn, reported -27% Revenue slump in Q4 2023. Didn't matter. We hit my levels and puts were monitized. But the weight of AAPL falling with other "2023 Mag7 winners" getting sold, did help markets break their 9-week winning streak.

Now, let's talk about Gamma.

Summed up well by @MenthorQPro:

One thing to keep in mind, as we move in negative gamma (slightly at the moment), higher volatility will change the gamma profile of options and its delta.

As volatility increases, the gamma curve flattens. In this chart the blue line is the gamma profile in a low IV environment, while the red line is the gamma curve in a high IV environment.

- Low Volatility: The gamma curve should be higher, indicating higher sensitivity of delta to price changes in the underlying asset.

- Medium Volatility: The gamma curve should be lower than in low volatility, showing reduced sensitivity.

- High Volatility: The gamma curve should be the lowest among the three, reflecting the least sensitivity of delta to price changes in the underlying.

See graph of "Adjusted Gamma vs. Option Positioning" and keep it in mind if you care about market structure and your directional option bets.

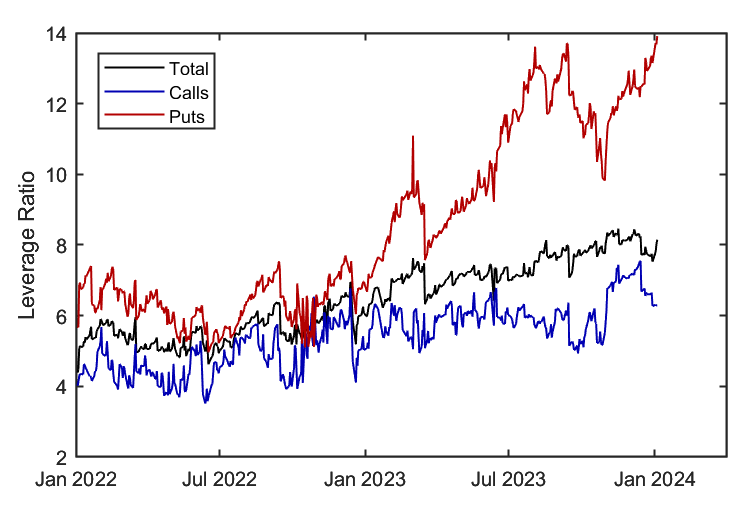

Then, keep the above dynamics in mind as you consider this chart which displays the concentration of leverage of Open Interest in the options market.

It is at a two-year high and a 13.92X leverage.

At first I interpreted this chart as potential fuel for my 1999-esque warning - as most often large puts in OI are sold.

But @Dr_Gingerballs, who compiled this chart, gave his interpretation:

If market goes down 1, people lose 13, which can make market go down much faster.

Now, as I wrote Friday morning, I am not expecting that we are likely for any "Big Unwind" until we get a Big Macro trigger to shock Vol sellers into their big unwind. I don't see any, yet.

But that doesn't mean we aren't on edge.

Macro Interpretations & Event Risks

Speaking of which, EDGE clients have been well-served as Craig added puts 12.27 expecting this grim start to the year.

Here he analyzes the recent macro environment in light of recent economic data:

The services economy has been the strength for the US so this December reading is very concerning, and suggesting a serious loss of economic momentum to end the year, with very sizable drops in employment and new orders. However, prices paid remains quite elevated as inflation remains sticky. We saw wage data this morning re-accelerate in December as well, back above 4%, and we know Fed govt employment is up 5.2% this year, COLA adjustments are +3.2% and tax brackets/standard deduction increases of 4-5% will support consumer spending as well. All of this positive momentum on consumer balance sheets can make it more difficult for the Fed to believe we are rapidly approaching the 2% target. This will mean they are going to be slow to add accommodation.

So we have evidence of a stagflationary environment setting in where the Fed's reaction function will remain slower than the market wants/needs to keep moving higher. If we aren't going to get much in the way of multiple expansion from here on falling rates (since too much accommodation is likely already priced in), then we need to have earnings growth momentum pick up the slack. Early evidence on the earnings trajectory doesn't look that great as we have seen some pretty crappy results in December (FDX, NKE, ORCL) and to start this year (MBLY, WBA).

Double digit earnings growth is expected in 2024 but that assumption seems very aggressive in light of this deterioration in the services economy (note manufacturing has been in recession in the US for over a year).

So if we can't really expect to get much from earnings growth surprising to the upside here, and we aren't likely to see assistance from multiple expansion that comes from lower rates, what exactly is the rationale behind plowing into risk assets, particularly equities in here?

The last argument would be flows which we know are typically supportive to start the year and there is a lot of ITM single stock calls for January opex which may keep us pinned however, we have lost the stock buyback support for now as we are in blackout and we know that systematic flows are very long after the rally we saw in Nov/Dec (both CTAs and vol control). So we don't really have the support from flows either in the coming weeks.

So what we have here really is no multiple expansion, limited potential for positive earnings surprise and flows that can start to go the other way, exacerbated by dealers currently in negative gamma position and realized volatility starting to move higher which can act as a "throttle" on further selling (h/t @t1alpha).

I have to admit: The equity outlook here is grim. Caution is warranted.

Government Shutdown Worries, Again

Yes, I know it's not a real worry given historical precedence, but it can create market angst just the same.

White House budget director Shalanda Young said Friday she is not optimistic about reaching a deal to avoid a partial government shutdown later this month.

Congress returns to Washington next week to tackle Jan. 19 and Feb. 2 deadlines for settling government spending through September, amid Republican demands to reduce fiscal 2024 discretionary spending below caps agreed in June.....Reuters

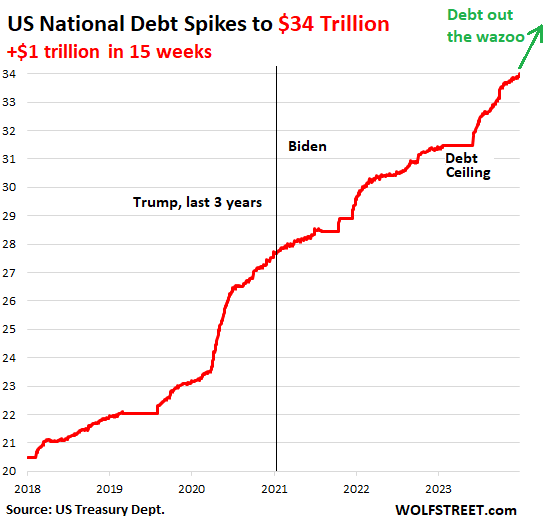

So here is a cold hard fact that bears repeating: US Govt Debt Is Exploding!

»$1 Trillion was added debt in just 15 WKS!

Interest payments threatening to eat up half the tax receipts may be the only disciplinary force left to deal with Congress

@wolfofwolfst

Chart is of our US National Debt "out the wazoo":

So why might it matter this showdown?

In the seven months since the debt ceiling was lifted, the national debt spiked by $2.5 trillion.

In that time...

FITCH DOWNGRADES: August 1st

The Fitch downgrade occurred same day we gapped down on massive QRA issuance by Yellen.

Fitch noted that US general government debt, including state and local government debt, was at an estimated 112.9% of GDP this year, which is more than 2.5x higher than the 39.3% of GDP median for AAA-rated sovereigns and 44.7% of GDP for AA-rated sovereigns.

MOODY'S CHANGES OUTLOOK TO NEGATIVE: November 10th

"Given the increasingly polarized political dynamic of US policymaking in recent years, including congressional brinkmanship around the debt limit, it is questionable whether US legislative and executive branches will undertake the pronounced shift in policy that will be required to address rising fiscal pressures," Moody's via Reuters article.

The timing of the Moody's revision timed with bullish market quant flows post Yellen kicking the can on QRA issuance Nov 1st with Fed pause. Much equity and bond pain was averted as a result.

Just Friday, Moody's reminded they weren't done warning:

MOST NORTH AMERICAN SECTOR OUTLOOKS ARE DETERIORATING ON A SLOWING ECONOMY.

With the government needing to issue ever more debt to cover the shortfall of revenues relative to spending, and real economy slowing, why wouldn't Moody's join in with a full downgrade around the time of the showdown? It's an outlier, but worth considering.

More to my point: if any of these macro triggers occur, markets will sell off into next QRA March 31st, where Yellen could once again, issue more Tbills (liquidity) than bonds and talk about less QT.

As @FedGuy12 estimates:

“QT is going to be tapered - much like it was in 2019.

This would extend the QT run way.

Reserves levels are still very high, and it looks like several participant are ok with rate cuts amidst QT.”

That's a good segway to revisit my thesis on March fed rate cuts.

Fed Cuts in March

I have presented my take to clients since mid-November, even teased on twitter Nov 28th, so I will say it again: Fed is gonna cut in March but the market doesn't know it yet.

Since my call, FOMC announced a pause in Dec and a Dot Plot 'pulled forward' of 3-4 cuts in 2024 (from 0-2) versus FFR of 5-6.

And every macro wonk on the planet has hotly debated the likelihood and market algos have moved markets violently intraday based on economic data headlines that add/subtract future fed cuts. It's crazy busy and noisy out there, but I will stay focused on the motivations of why Fed would cut:

As posted:

I saw in my intermarket and technical read early Nov that the 10Y would make a 'fake breakout, fast failure" at 4.9% and reverse hard, falling fall back to 4%. I needed a narrative to go with my chart read, for at the time, no one was discussing cuts - not even me.

"USD Has Likely Peaked" was my macro-to-micro position in both long post form and interview Nov 9th.

I couldn't help but wonder should the 10Y stay at/above 5%, the wave of corps refinancing in 2025 would turn into a wave of defaults. I believed that Fed was going to cut to make it more manageable for banks to recover with CRE needing more time to repair/reposition, and of course, for struggling (read: unprofitable) companies not to die under the weight of spiking funding costs.

Bill Ackman has given his assessment on March cuts:

“There’s a risk of a hard landing if Fed doesn’t cut rates pretty soon.”

Stephen Miran, of @ManhattanInst

"Currently I'm more concerned about upside inflation risk than I am about downside labor market risk (from these levels & prices), in part because I think the Fed is determined to cut based on realized lower PCE inflation in the last two quarters, regardless of cutting means for the outlook."

Dominque Dwor-Frecaut of MacroHive on Bloomberg where she explained she expects 50bp cut in March:

as "Fed is hedging return to pre-pandemic underperformance in inflation".

She wrote me with her summary and key chart of core PCE 6month change

"The Fed is v focused on core PCE. The 6 month average to November at 1.9% is below the Fed 2% target. Because of falling energy prices December could print even lower. Since the Fed is not convinced the US has moved to a higher inflation regime, a March cut makes sense"

This view aligns with mine that Fed needs inflation, and that with lower oil prices, a surge in foreign-born workers to pick up the labor slack, and strong growth from govt spending, US has experienced a nice year-plus-long wave of disinflation.

MY VIEW: Deflation is now the risk if they don't cut!

Wow! You just launched your substack. Love it.