Will April Showers Bring May Flowers?

Nasdaq lost -13.2% in April to register its worst month since 2008, with the 10-Year yield rising at the fastest pace in more than a decade and first quarter GDP falling -1.4%. The S&P 500 and Dow lost -8.8% and -4,9 % and experienced the weakest month in two years, taking out both their February and March 2022 lows as I predicted.

Kick-off to May started as expected: we sold off into end of April, then briefly rallied Monday through Wednesday into the FOMC announcement:

The Federal Reserve announced on May 4, 2022 that it would start to reduce its holdings of Treasury securities and mortgage-backed securities (MBS) beginning on June 1, 2022. Their plan is to sell off $30 billion of Treasuries and $17.5 billion of MBS every month from June through August. Then in September they plan to ramp up to double those amounts every month.

Now that FOMC is behind us, and we know Fed has 'met market expectations' for a .50 bp rate hike, with June as official announcement for the kick-off to its tapering of bond purchases, what might the next few weeks look like as we trade into monthly options expiration May 20th?

According to MarketEar, we should expect a $4-5bn buyback bid every day for the next 5 weeks:

The buyback window is reopening and after $1.2 trillion of authorisations in 2021 and $160bn from Apple and Google alone last week…we will see $4 to 5bn that will be bought each and every day between now and mid-June according to GS trading desk. With earnings and Fed behind us the buy back bid matters again...

But market-moving economic news likely matters more. Case in point: the day after FOMC, we got the hot labor cost data which turned the market on a dime. SPY dropped 3.6% from its high - luckily we caught it in my trading room, but even I was surprised it continued south for a 3-sigma intraday move. The destruction was hardest felt in megacap tech - the generals so to speak, as all the other tech soldiers have been taken out on stretchers already.

As I've mentioned/written about before, bonds hate higher wages/higher wage labor costs. Obviously, market does too. As warned, the TLT dam at $117 ($138 in ZB) broke, and with it the intraday flash crash was triggered.

Despite the FOMC announcement Wednesday, the 10-year Treasury yields moved up Thursday in the sell-off to end the day at 3.04%. My price target was 3.025. Fed also announced they wouldn't raise .75bp at a future meeting, and yet, there was no change to where markets see the Fed Funds ending the year - so the risk-off attitude continues as market fears Fed is "too little too late", allowing inflation to grow more entrenched.

My opinion on Inflation hasn't changed. Inflation was structural in 2020. It’s rate of change increase in 2021 signifies it’s now firmly entrenched.

We have a CPI print coming up this week and US CPI and PPI are set to soften.

It would be the first decline in headline CPI since last August. Core CPI will also likely ease as well. Recall that after the March report, many economists suggested that could be the high-water mark. - Producer prices, both the headline and core, are also expected to have softened a little. In April 2021, they had increased by 1.0%.

A few points either way won’t matter I believe. Big Picture: We are victims to imported inflation from deglobalization + war + global energy crisis. Fed can’t fix it. They can only crush demand.

As a result, I contend the bid in US yields, oil and dollar continues.In fact, we have reason to fear they trigger aggressively this week should Japan's March data out this week show further treasury selling.

Suffice it to say, here is my cheat-sheet for further yield spikes:

Yen Devaluation by BOJ to support JPY Bonds = Stronger USD...

Foreign Governments sell Treasuries to get Dollars (Japan, China etc) causing Treasury Illiquidity and weakness so...

Spiking Higher US Yields = Higher Oil.

It may not be a perfect or a perfectly lead-lag formula, but it's a good baseline to track the macro backdrop that impact our micro stock picking and direction. And given tech is a long duration bond proxy, it begs the question...

Has Tech Bottomed Yet?

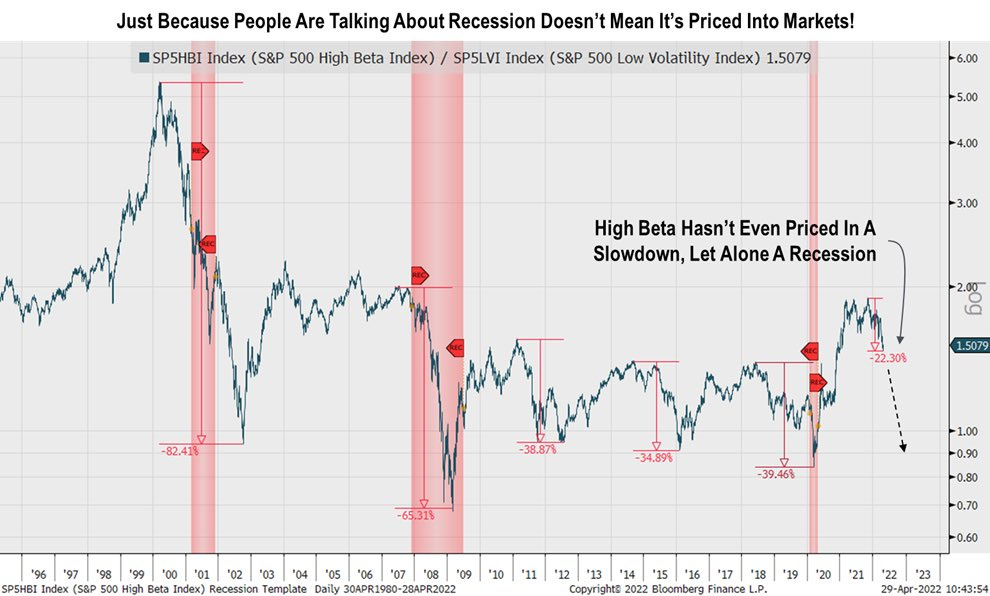

Five months ago I updated this chart of high beta relative to low volatility SPHB:SPVL - as further proof of my Growth-to-Value rotation call. My hope was this warning would help clients position with more confidence for the Nasdaq short.

Alternatives To Tech was just one client post December 20, 2021 where I warned tech was really not safe - just before I went on StockChartTV with my 2022 Prediction for Nasdaq underperformance, $3800 SPX call and with it Growth-to-Value rotation to continue. So far, I haven't seen a reason to change from this thesis.

Let's update that stacked chart - then versus now - and ask the question: Is it safe yet to buy tech?

Dec 20, 2021:

SPHB:SPLV chart is one of my #intermarket-tells that still shows how the high beta sector continues to underperform as LOW VOLATILITY plays continue to outperform. Granted, this is on a swing and trend basis, but my point is this: RELATIVE TO SPY (see my #intermarket-tells chart below), sectors such as MTUM, IBB, PNQI, SOCL + IPO are still in protracted downtrends since peaking in late Jan/Fed.

Michael Kantro illustrates graphically why this trend can continue much farther (great historical chart):

Stocks haven’t priced in a slowdown, let alone a recession. High beta relative performance (vs low Vol) is down 22%, not nearly as much as the last 3 soft landings (-35%+) last decade or even remotely close to the pain seen in prior recessions.

As a reminder, we just officially set on a path of rate hikes and Fed balance sheet run off - both of which is bad for growth/high beta and beneficial for low volatility value plays.

As Douglas Orr highlights in his chart of Nasdaq PE ratios:

$NASDAQ remains 10% above ave, + 20% above post Taper lows in 2016 + 18! And EPS downgrades are coming thru due to hard comps/surge lockdown sales + margins

Many disagree: Retail is still buying heavily these tech stocks on sale; ARKK inflows are picking up, and corporations are in the meat of buyback season. But I contend, TSLA, Bonds + Crypto are still in big bubbles and the breaking of which will make it very dangerous to hold tech.

It will also mean that it is harder to find low volatility stocks when Fed tightening, FX currency devaluations, and spiking oil, yields and USD all trigger market volatility to reprice everything.

To sum it up simply: Caution is still the play. Big Money knows QE = bullish and QT = bearish, so by definition in my book, tech is still a SOLD-TO-YOU market on every pop.

Final Thought:

Given the intraday crash Thursday, I have been asked if that was "the" flash crash I warned about?. No, it is not.

We could have a solid bounce into options expiration - although the weekly closes from Friday make that less likely - I will let you know based on how we do Monday. But the wicked dangerous part is not done.

Again, we danced up the mountain in 2020 + 2021. We are dancing down the mountain in 2022 + 2023. Be careful not to trip.