Welcome to September!!

CLUB/EDGE client post Tuesday, September 3rd, 2024. Focus on crude oil crashing lower with yields pulling down big tech & semis.

» CLUB/EDGE client post SEPTEMBER 3RD, 3:26 PM ET.

OIL TANKS Forcing Carry Trade Unwind of Semis

Remember how I have written about how oil is a carry trade?

Well, crude is down 5% and I believe it is pulling semis down with it.

I am not surprised oil is falling despite Libya and Houti attacking a Saudi tanker.

Despite war in Middle East about to escalate on Hamas executing hostages over the weekend.

Despite headlines like this pre-market:

Russia signals its official stance on using nuclear weapons is about to change, accusing the West of ‘escalation’ - CNBC

and

US close to agreeing on long-range missiles for Ukraine; delivery to take months - Reuters

You know I am quite bearish oil and yields.

So now all can see how the above "risk premium" in geopolitical matters is still not enough to bid up the price of oil given the the demand destruction that is getting priced in and/or disinflation impulse from recession risk getting pulled forward.

That, and VP Harris is now bullish fracking as she campaigns in Pennsylvania.

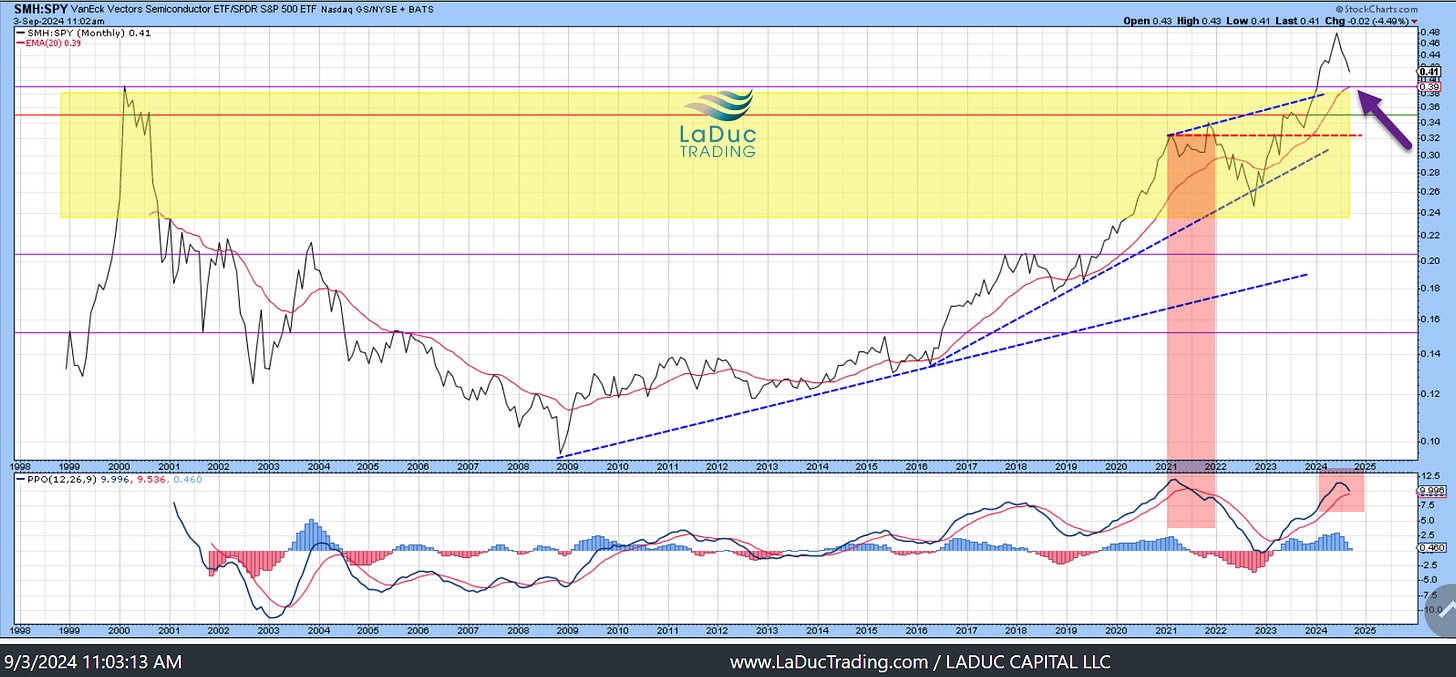

SMH:SPY Update

As posted two weeks ago, and reviewed weekly as part of my sector rotation tells... Semis are falling back down to earth.

This ratio is falling back down after getting very extended from its mean.

https://laductrading.slack.com/docs/T01GN5BH7KP/F07JNHASTGC

I mentioned I saw a retrace from .49 to .39 which is its 20M EMA and prior 2000 high! We are at .41 today.

I will expect a bounce at .39 as I can’t rule out a market advance into OPEX September 20th.

But there is still much to digest on the way there: weakness into Payrolls Friday? VIX crush into FOMC the 18th?

Also, we have an engine that has worked very hard to keep the market stitched together into the elections.

Big Picture, I still see a giant H&S on SMH weekly which only confirms once it gets/stays below $200 (August 5th lows) which would then brings us back (in my opinion) to at least November 1st 2023 levels before the "Fed Pause & Yellen Yahtzee" kicked in.

But for now we are snaking around the 200D for SMH, which is still ascending.

This means it will take weeks to months to form a proper trend-reversal of conviction.

For now, it would be reasonable to assume another 3-4 weeks of SMH overshooting its 200D - both to the downside and upside - before it flattens out and starts to roll-over in earnest.

It may be too early to discuss upside price targets, but here's the irony...

SMH has a DAILY GAP FILL at $270.54 that likely gets filled before a serious trend-reversal gets priced in.

Hourly gap fills for key semi/tech charts have also likely to tag before a serious trend-reversal gets priced in.

NVDA has 125.52

XLK has 232.84

QQQ has 495.41

IN THE MEANTIME... crude is crashing lower pulling down big tech & semis.

NDX100 just filled the lower PT given after Aug 22nd bearish engulfing on daily pointed to: Wednesday Aug 14th DAILY gap, AND afterhours NVDA earnings dump, of 465.11. I still see 463.63 HRly gap to fill on way to 100D at 460.58. Break there brings 454.37 Aug 12th DAILY gap.

SMH just filled the lower PT given after Aug 22nd bearish engulfing on daily pointed to Aug 12th HOURLY gap of 227.17 and today's open was below key 239.14 wkly support. A break of 226.49 brings 200D back in view near 214.

NVDA opened below KEY MONTHLY support of 115.82 to fall back into 110.10 HRLY + 111.07 DAILY gap fills. Continued weakness brings 106.47 WKLY support at risk to revisiting 97.40 MO support.

SPY 553.28 is 21D. Below that we can see 544.96 but ONLY if we get/stay < 555 which is strong wkly support.

SPX 5554.25 is wkly support so break of this and we can see 5463.22 daily gap fill.

AAPL just filled its Aug 14th 222.35 Hrly gap fill.

BUT HERE'S THE RUB:

The Advance/Decline for neither NYSE nor NDX is weak. Neither is cumulative breadth or volume!!

This smack of dealer hedging. I mentioned that in the room but I'm even more convinced.

NYSE breadth is actually expanding even if IWM is down 2.65%, QQQ down 2.4%, SPX down 1.62% - as of 2PM ET.

VIX was pricing in NO risk into OpEx. Then $9M in VIX 22X30 CS got bought Friday and here we are... dealers are hedging.

More than that: OIL FALLING - bringing Brent & Crude back to lows of year - smacks of CARRY TRADE UNWIND.

Yes, a carry trade unwind out of VIP SEMI longs as Oil - used as a collateral hedge - wipes away all gains for 2024.

Normally, I would be quite alarmed at a 'CARRY TRADE UNWIND', and yet, my prior bet still holds: Sept 20th OpEx likely sees higher.

I am on watch for this pulldown in first part of the week of Sept to being a bear trap.

Why?

Because I think it is early to put on the BIG TREND REVERSAL PLAY.

Talk to me in late OCTOBER ;-)))

For now it feels very much like the A-Team market makers came off the beach and said to the B-Team,

"Thanks for keeping the market from breaking apart in August. Now it's time to lighten up into NFP + FOMC."

Just before they bid it back up into to tag SPX 5658.88 my hourly gap fill price targets.

UNLESS my three legs of the table get kicked out:

WHEN THE 10 YEAR GETS/STAYS BELOW 3.8%…

AND CRUDE GETS/STAYS BELOW $70…

AND JOBLESS CLAIMS GET/STAY ABOVE 267K…

Right now, we only have crude threatening a $70 flush, but remember, it needs to get/stay below to confirm.

Trading Room Summary - September 3rd

Oil is falling as USD bounces off 100.50 and 10Y yields off 3.8% last week; intraday both dollar and Yields chop sideways.

Ueda pushing that he is still expecting to hike 25bp this year is negative risk assets in US. I sincerely doubt they follow through, but by sticking to this threat, NDX continues to see selling.

SPY + QQQ falling into hrly gap fills from Thursday: 467.40 + 556 respectively set up "bearish below", until it can get back above.

GOOGL, AMZN, MSFT, TSLA are all hugging their 200D after breaking their trends (10/21W roll-overs). Ok scalps but not great swings.

AAPL, NFLX, NVDA, META are still in their bullish trends (no 10/21W cross-overs) and with all a good distance above their 200D - even though NVDA is selling off nearly -9% today.

NVDA chase short with SMH have reached their intraday hourly gap fill PTs given early.

SMCI has support on 428 for now; a wee push into 499 area before rejection into 357 wouldn't surprise me!

PYPL, PLTR, EBAY swing long rec'd are still holding well.

T + VZ show impressive strength for over-indebted value plays.

XLV, XLP, XLU, XLRE are the strongest continuation sector rotation trends I have rec'd since March,

XME, URNM, COPX, SLX, XES are broken trends that continue to show the disinflation impulse I've warned will continue with falling yields.

SLV, GDX, GLD are even pulling back, and they have been more resilient thank most!

COIN, MSTR & Bitcoin proxies short continue to be great swing rec'd faves.

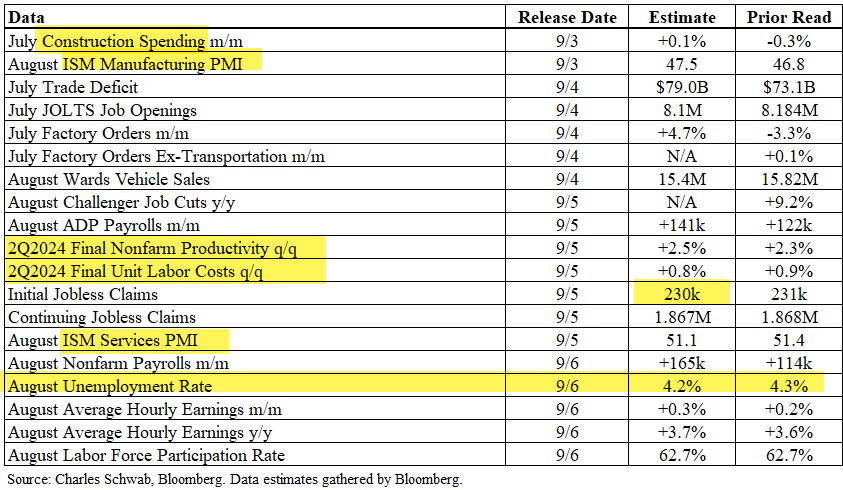

As mentioned this morning, we have a lot of economic data to get through.

The US ISM Manufacturing print this morning was disappointed, and further pressured the rotation from growth to value.

Craig sums up well:

The rotation into defensives continues (XLU/XLP/XLV/XLRE) as cyclicals get chopped from the rotation trade on back of further deterioration in the economic data in the US after another crappy US ISM manufacturing report which showed a very sizable drop in the new order to inventory ratio while prices paid remain quite elevated. Slowing growth with prices still too damn high.

But eventually the alpha unwind becomes a beta face plant when folks start to pull money out of equities as an asset class as they realize the Fed cutting cycle isn't going to be able to address the slowdown in any particularly rapid way.

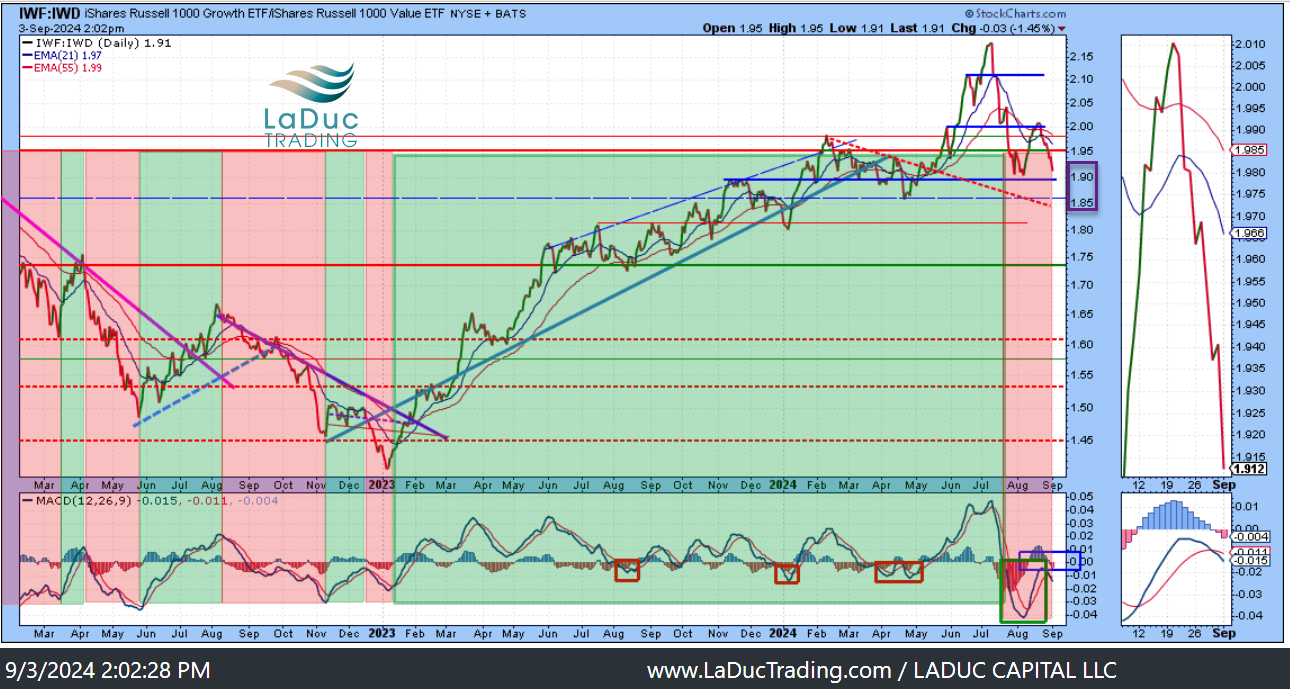

This rotation is also as evidenced by my IWF:IWD roll-over as warned last week.

The biggest bond mover this week should be productivity reports on Thursday with non-farm payrolls Friday.

I expect the 4.3% unemployment report to soften to 4.2% which could be the bottom in this sell-off this week.