We Still Need A Macro Trigger

February OpEx is over, and often this sets up a 'window of weakness'; but in this market, I see more of the same next few weeks: correcting sideways in time not price - while under the surface, MANY plays still look more bullish than bearish. Our CLUB/EDGE swing longs (multi-week themes) have done nothing wrong yet!

In fact, of the 33 swing positions YTD (open & closed), this portfolio has a cumulative gain of over 173% on a stock basis (option-basis much more).

Optionality around big quarterly OpEx is now my focus. I'm talking March 15th (lesser degree March 28th).

Typically, the bigger the OI, the higher the likelihood we move higher - March 15th is big for SPY/SPX & QQQ.

But that also means, the bigger the fall after we move through a big OpEx and/or should we get a macro trigger to disrupt the bullish option flow & positioning.

What would interrupt the flows and have dealers flip and press gamma short?

Here are top-of-mind Macro triggers that could really matter, eventually:

PBOC yuan devaluation (tough to time; would be a surprise)

BOJ rate hike/normalization (USDJPY above 152 could intonate)

Term Premia spike on longer-duration bonds (confiscating Russian assets would do it)

Oil spike (and one that sticks)

Debt Issuance of more bonds than bills (April 30th is next QRA)

POTUS election year surprise (#RFK odds are growing)

Government Shutdown surprise (March 1st next dance, outside chance)

Unknown Black, Grey, White Swan (definition of unknown unknown)

But it's hard to trade on any of that. Hedge yes, but trade, no.

As of now, I don't see a fat left tail presenting on a surprising CPI, PPI, NFP print alone.

We need a bigger macro trigger for markets to sell off, or more reasons than sticky inflation to cause the market to really price out cuts and price in hikes.

Neither are very viable in my opinion.

My read, now that the Fed pushed back hard on Q1/Q2 cuts:

Fed “can’t” cut because conditions are too loose & inflation is bumping higher.

Fed “can’t” raise because it is a pivotal election year.

Ergo, my bet is they “fold” = watch next 9 months = trapped.

If/When we get a proper macro trigger, then the probability and the magnitude of a stock market decline grows – and we can fill many, if not all, of those SPX gaps on the downside.

But I'm not betting on that just yet. I will watch for "it" - the time when calls get monetized and puts explode in Open Interest.

The Week Ahead - Key Economic Event Risks

Wednesday we have a some market-moving events: FOMC minutes and a 20-year auction to test the bond market. Plus NVDA earnings after hours.

Craig warns in #macro-advisor-craig channel:

Next week we get to here whether or not the Fed has a coordinated message about what they think about the recent inflation dat and the prospect of re-acceleration of inflation and inflation expectations that we have been observing over the last few months.

Governors Waller/Cook/Jefferson/Bowman are all speaking, in addition to getting the Fed minutes on Wednesday (all after NVDA earnings). Yesterday, Bostic (voter) talked about potential upside surprises in inflation returning as rationale for continuing to be patient. Will be interesting to hear if this is the consistent message coming out from them.

Ultimately, for the market to top, we need to remove the rate cutting expectations that remain embedded in the market psyche. After this week's data, the Fed should work to push in that direction and make sure inflation expectations don't become unanchored. If they don't, we will continue to bubble up until they decide to step in.

We should be pricing in a greater risk that the next move is a rate hike, rather than a series of rate cuts. Once that becomes the narrative, equities are done.

Last week, SPY snapped a 5 week winning streak - my "5 bar rule" reigns ;-)! But in reality, SPY has been up 14 of the last 15 weeks, so it's not a surprise we have some weakness into the notoriously weak part of the month (last two weeks of February).

And it's not a surprise we had de-risking Friday into a long 3-Day weekend!

As I have said for several months now: "Market is Overbought But Not Broken"!

There are some divergences of note - as posted last week for clients under #intermarket-tells - but otherwise, the digestion is healthy not scary!

For a more global look for the week ahead, Marc Chandler highlights:

US CPI and PPI saw markets close gap with Fed's Dec dot plot.

Week ahead features flash PMI, which likely underscores divergence after JPN and UK economies contract and Germany warns of contraction in Q1 24.

China returns amid some optimism on consumption.

My Top 10 Macro Reasons To Remain Bullish:

1. Funds deploying capital, betting on rate cuts that lowers cost of funding.

2. Falling/low inflation amidst wage growth so consumers absorb higher prices + keep spending.

3. Productivity gains as corporate earnings grow to support prices, wages + asset prices.

4. AI as the hot theme du jour (vs internet then), driving the sentiment FOMO.

5. Rising fiscal spending offset by economic growth (Yellen swears by it).

6. Controlled/contained energy costs to temper inflation expectations. (Oil is not allowed to go up.)

7. Dedollarization (yes more local currency exchange outside of USD) to help lower the trade deficit, which leads to govt budget deficit shrinking.

8. Financialized engineering - buybacks, "round tripping" etc - seen as features not bugs.

9. Dispersion Trading + Gamma Squeezes as standard operating procedure to suppress volatility.

10. White House/Treasury/Fed coordinate with Global Central Banks to make sure the market doesn't blow up & take their tax receipts with it!

As I have warned repeatedly since mid-November: Shorting THAT is not fun. It's very 1999-esque!

My #1 Micro Reason To Remain Bullish:

Again, as long as VIX declines or goes sideways, dealers are short stocks, so as they have to buy these back, there is the potential for a bigger squeeze higher in markets.

Added fuel would be if key levels above (likely $5100-5200) trigger and forced shorts (betting against the market) to cover.

That is the recipe for a continued grind higher or even melt-up.

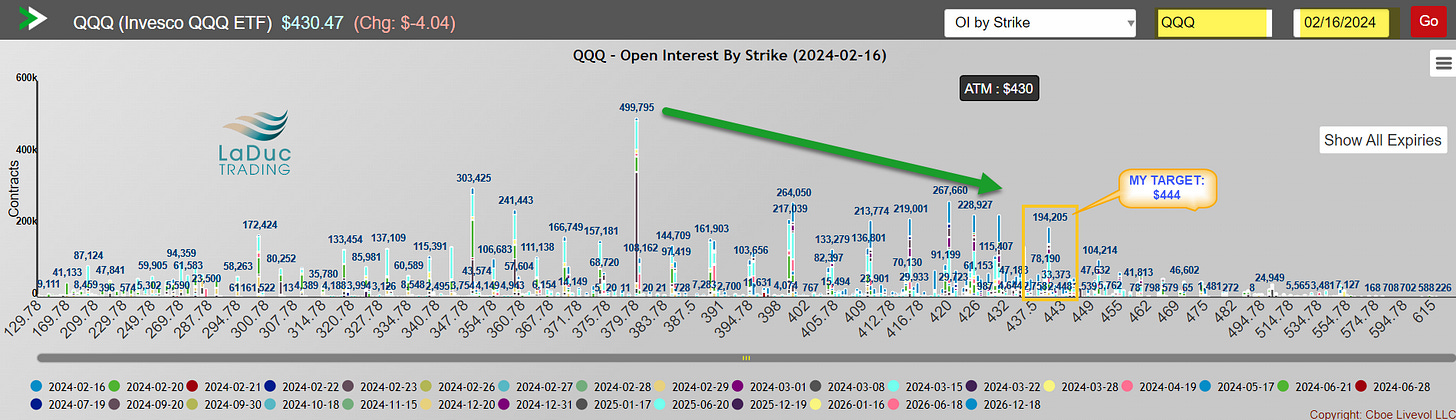

And why I am keeping with my baseline bet as posted in mid-January: SPX to $5340 and QQQ to $444 at least (with $472 overshoot).

With that, I still see the benefit of playing the long-side, owning longer-dated calls, and being very careful into OpEx itself as March 15th calls decay, forcing dealers to sell out their stocks.

Into a large OpEx/quarter end is usually when we will see the strongest rotation or dispersion trading into small caps - and specifically when RTY / Russell 2000 / IWD outperforms - like this past week.

As discussed in both my MarketWatch interview last week and even my Bloomberg interview Friday: This bullish backdrop should help my thesis for outperformance in IWM, IPO, XRT, XBI - as long as vol continues to decline or goes sideways.

CLUB/EDGE clients know my level to protect against: VIX 14.49 - above is market bearish, below is market bullish.

And my mantra: In lieu of sector rotation, there will be volatility.