Waiting for AAPL

While everyone is fawning over the afterhours move higher in FB + flat markets, a friendly reminder:

* Breadth is terrible (!) under the surface

* $VIX is bid (>$31)

* Mid-cap tech wreck is not done (see CVNA, TDOC, ARKK...)

* $TSLA is toast (trend-reversal worthy)

* $ACWI (global market tell) is rolling over

* FX volatility is no joke (Euro, Yen, Yuan in a race to the bottom) &

* Nasdaq 100 is sporting a giant reversal top! (as in YUGE!)

BTW, FB wasn't that great either with total revenue YoY up 6.6% but total costs up 31% for same period. And Q2 is expected to be worse.

Yes, the Dow Internet Index ((FDN chart attached) has given back all its gains going back to pre-covid high, but I contend, it has lower to go and will give back all the pandemic gains post $9T in Fed liquidity.

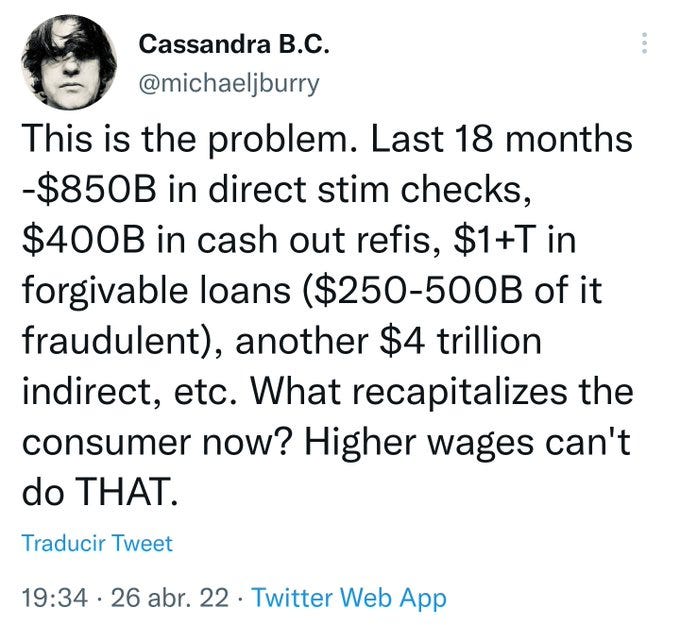

Speaking of liquidity, check out the Michael Burry tweet below asking a solid question about who will recapitalize the consumer now that the stimulus and cash-outs and loan forgiveness benefits have ended.

Bears thinking about.

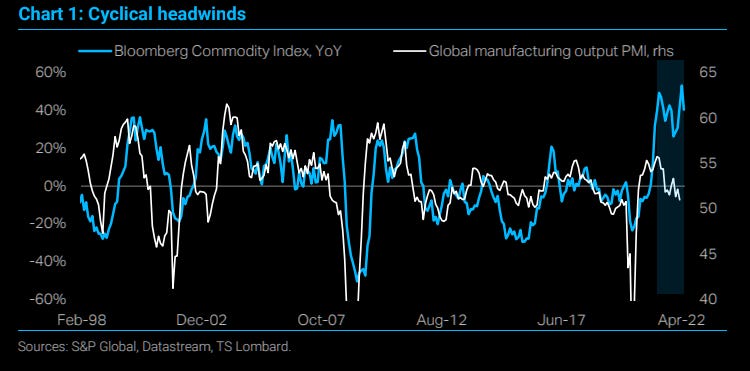

Cyclical Headwinds

I have written here (as has Craig for EDGE clients) about the headwind to commodities with a rising USDCNH (falling CNY). Add to that my obsession warning about the USDJPY spiking higher with yields and oil into May/June - WITH a spiking USD - and I will remind again that FX (currency) and EM (emerging market) volatility can and will seep into US equity volatility - both growth and value plays.

In Liew of Sector Rotation, Volatility Reprices Everything

The above market truism was the basis for why I warned last Wednesday into Friday that our very profitable #trend-ideas plays were about to undergo profit taking.

TS Lombard sums up succinctly the current state of affairs in the reflation/commodity space (great chart too):

"The mix of a slowing industrial cycle with CNY weakness, Fed tightening and fragile investor sentiment raises downside risks."

Having said that, I believe firmly that value is still preferred to bonds/bond proxies/growth/tech plays - as laid out in my #intermarket-tells analysis. Clearly, Nasdaq is down 14% this month so relatively speaking value has done great! BUT global manufacturing PMI is dropping and trends in commodities can very easily come under pressure with expanded China lockdowns causing supply chain contagion. But mostly a higher USDCNH can trigger volatility in the cyclical space which I wrote about and is why I recommended last week, that trend positions should be actively managed. This recent bounce is a great time for adding (more) protection before you need it.

Friendly reminder: Use the 10W close as your guide on whether to close, trail or hedged.

So far, I've warned clients when $VIX would erupt. I still see upward pressure into May/June (as I've warned for months), but now I'm also sizing up specifically where we need to push above - in which case markets will crash OR we simply fade into FOMC before a relief bounce. Either way, you'll hear about it 1st in my trading room!