WAIT FOR IT... WAIT FOR IT... NOW!!

I did warn clients that it was time ... Tues morning! ... with FIVE key charts as support market would sell-off a bit.

Why? I practive the art of "wait for it... wait for it... wait for it... NOW, I SAID NOW!!!"

I’m very patient. I’m very persistent. And my job is market timing to keep my clients safe AND on the right side of the trade.

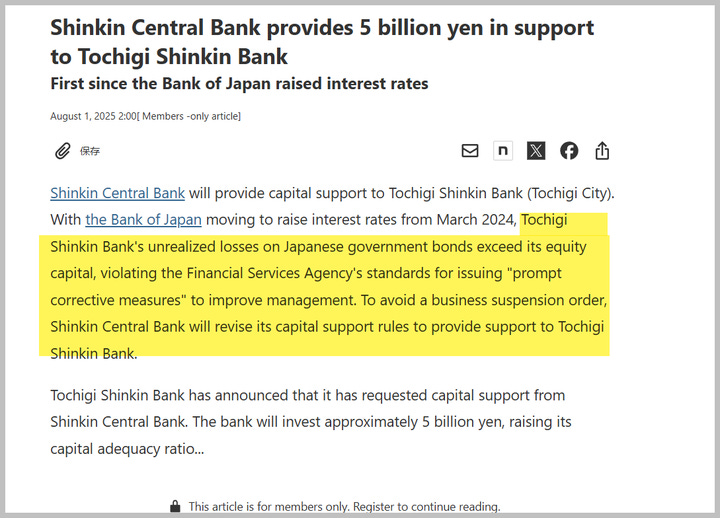

I also offered up one deep dive on BOJ intervention . That timing didn't suck.

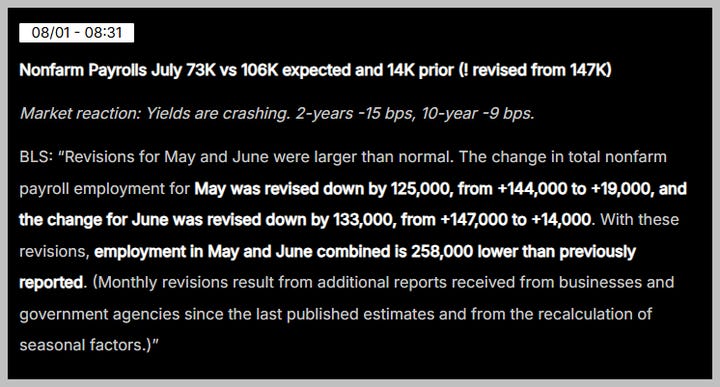

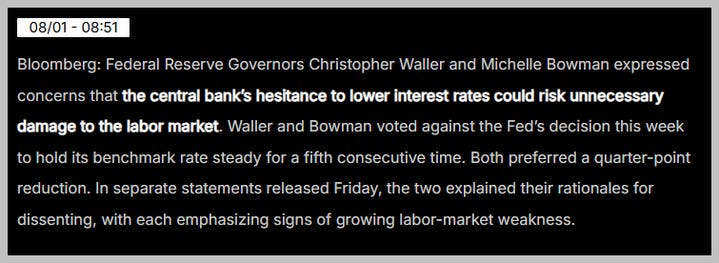

Also, I posted Wed to be careful of NFP comes in WEAK and for Waller & Bowman to come in strong.

I warned OPTIONS coming off the board EOM would also trigger volatility.

Now, the situation has changed for the first time since 6/20: market is trading in a negative gamma regime again: 6305 was the flip.

Negative gamma imbalance: Dealers sell weakness, and buy strength in order to fulfill their delta-hedging mandates, which can lead to sharp self-amplifying intraday moves (down AND up).

And that is what we got. Hope you READ what I wrote and/or listened in my trading room live. I warned with precision.

I had FIVE key charts that intonated weakness: