US Trade War With China Is Not Priced In

Summary of Points:

Update on my market direction call that is still working.

I review why productivity and wage inflation matters to bond returns.

I summarize Fed Day Wed and why Powell won't help Trump or markets.

Lastly, I analyze the real risk to market returns from the continued US trade war with China.

When I next see big volatility return.

VIX To 20 Still Working

Since I called out April 22nd (Tuesday morning) that Realized Vol would start to fall into Options Expiration - VIX expiry next Wed & monthly options next Fri the 16th - VIX has fallen 33% and SPX has risen nearly 10% with QQQ up 13%.

That was my directional bet: VVIX & VIX softening would be supportive for markets and support a bullish bias. That worked, and...

VIX HASN'T TAGGED MY 20 PRICE TARGET YET, AND YES, I STILL EXPECT IT WILL BY NEXT WEEK OPEX.

Even this past Monday May 5th, I posted:

Referring to the bullish option backdrop and mechanical buying estimated to continue to support markets along with the macro headlines (read: Trump/Bessent hell-bent on propping up markets).Hans of options-mentor-hans and I also spoke to this bullish bias in our Macro-to-Micro Options Power Hour - last Wed (Clarity in Chaos) and again just yesterday in our Powell Punt Or Pander special!

(Wage) Inflation Is The Enemy of Bonds

I have a running mantra that (Wage) Deflation Ended With Covid.

It was this thesis in Oct 2021 that helped me double-down on my bond short for clients - after calling in Aug 2020 that "Bonds Are Done Going Up".

[see chart of 30Y bond below - forgive the old logo]

This chart of the 30 year treasury bond shows price has stayed in an ascending channel the past 40 years. It’s forming a trend-reversal pattern known as a Head & Shoulders. Once this channel breaks we will know INFLATION is more than transitory or sticky. It will be clear inflation is systemic because bonds will begin their descent. At that point, the rate of change in that bond break will matter – to volatility and to market returns. Bonds, after all, are just equities without circuit breakers. The ‘market tell’ will be when bonds sell off with stocks in the midst of rising energy and commodity prices. This could be very destabilizing to markets and economies worldwide as the risk-parity trade is unwound in favor of cash.

I remember how many attacked and/or dismissed my call: "as the risk-parity trade is unwound in favor of cash."

Fast forward and bonds are still sucking wind - but mostly for all the reasons that Geoffrey has detailed under Fiscal Dominance.

As my twitter handle reads on my profile: "Often Right For The Wrong Reasons". ;-)

Anyway, the reason I bring this up again is because PRODUCTIVITY & HOURLY COMPENSATION matter to bond returns.

And today we got a look at falling productivity against rising wage costs.

Unit labor costs in the nonfarm business sector increased 5.7 percent in the first quarter of 2025, reflecting a 4.8-percent increase in hourly compensation and a 0.8-percent decrease in productivity. Unit labor costs increased 1.3 percent over the last four quarters. BLS

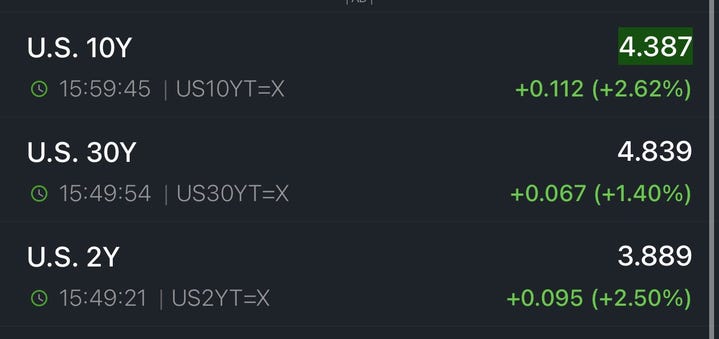

My point, yield rose sharply on the release.

Unit labor cost 5.7% in Q1

Compensation +4.8%

Productivity fell -.8%

Another good reason bonds stay bid...

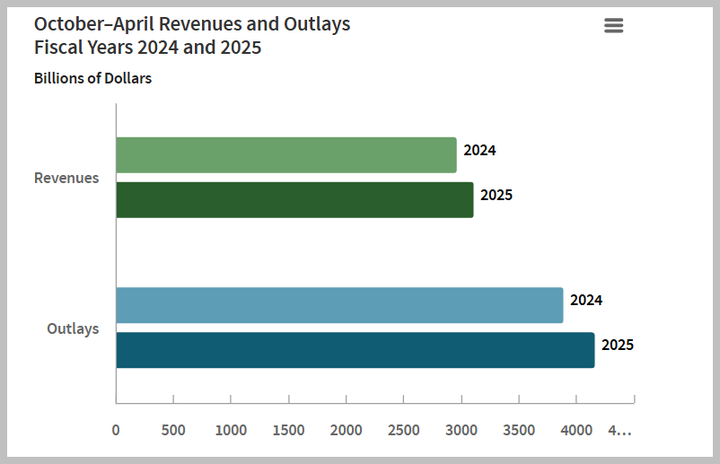

The federal budget deficit totaled $1.1 trillion in the first seven months of fiscal year 2025, CBO estimates. That amount is $196 billion more than the deficit recorded during the same period last fiscal year. CBO