Uranium Trend Long - Thesis & Update

Original Post for CLUB/EDGE clients NOV 21, 2023

I am very grateful that I had a long-time client, Richard Sacks, highly recommend Uranium as a Trend trade back in Summer/Fall of 2020. He became a partner (July 2020) to Justin Huhn, founder/money (August 2019) of Uranium Insider, the world’s leading newsletter on the subject of all-things Uranium.

I presented it as a durable macro-investment theme in early December 2020 and related tickers CCJ and URA have been successful TRENDS LONG every since. I have posted occasionally on the trend but otherwise just let it work. I even added URNM as a SWING LONG earlier this year to take advantage of a technical breakout in early August. Since this break-out, many have caught on to the wave that is not going away: Nuclear Power.

In light of this renewed interest in nuclear, and the supply deficit that is uranium globally, I thought it a good time to revisit the space. With assistance from Tiffany, here are recent updates of merit to help further support this macro-to-micro trend that is long uranium stocks.

Uranium Undervalued

Nuclear energy as an energy source has been undervalued for decades, due to historical misconceptions tied to catastrophic events like Chernobyl and Fukushima - one a nuclear facility failure due to mis-management; the other due to a natural disaster (tsunami). Neither a reason to disregard the positive benefits from nuclear power when well managed and safe-guarded. Even die-hard environmentalists are changing their minds about nuclear power.

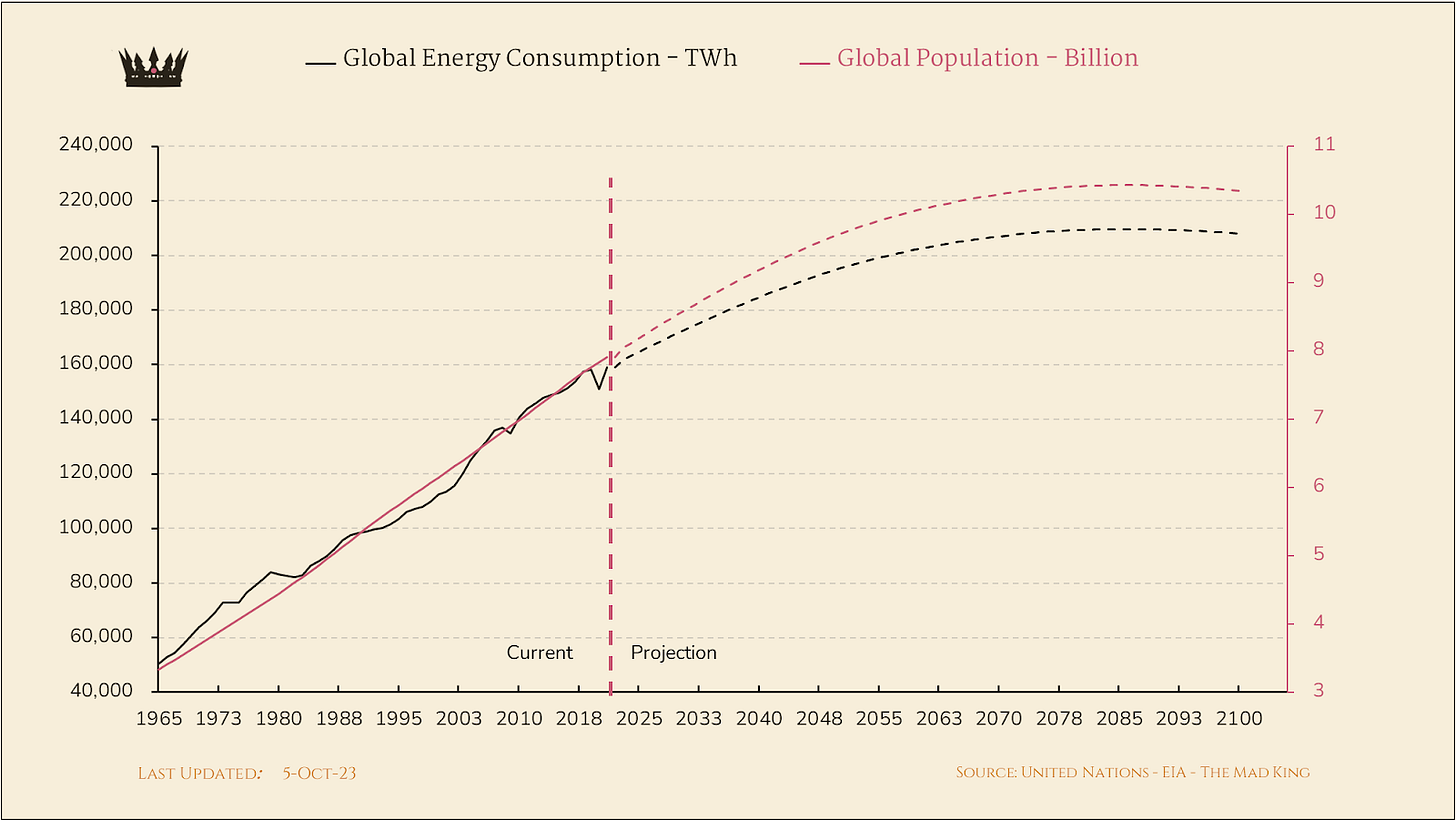

Let’s face it: Fossil fuels are not going away but they are wildly politically polarizing. And while solar and wind energy have been praised, the are not scalable due to unpredictable weather and storage limitations. Nuclear energy is making a resurgence post-EU energy crisis on the invasion of Russia into Ukraine. Now countries are seriously considering using nuclear energy as a safe and viable solution to escalating energy demands, particularly in Asia and Africa.

Let’s just say, nuclear energy is having a rebranding moment. And many uranium traders and macro-themed investors are catching on to the theme that over the next five years or so, the nuclear sector will likely prove itself as a sustainable energy source. As a result, Cameco (CCJ) is bringing production back online. At the same time, Kazatomprom has now taken the lead as the world’s largest uranium producer—and it’s ramping up.

In an interview with Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, he summed up their big bet:

"I think over the long term on a sustainable basis both supply and demand can probably sustain US$120 a pound, and that would be enough to bring on supply over time.

...

"I think that it's entirely plausible to see uranium at US$300 in a spike. Now, that won't be sustainable, but it almost seems likely — you never want to say certain — that you're going to overshoot that US$120. From a demand perspective, utilities are captive buyers that need to get their hands on the fuel."

Uranium Demand

The International Energy Agency estimates that global nuclear capacity needs to double by mid-century from 2020 levels to help the world meet net zero commitments. As a result, US and UK have pledged to triple nuclear power by 2050 at COP28.

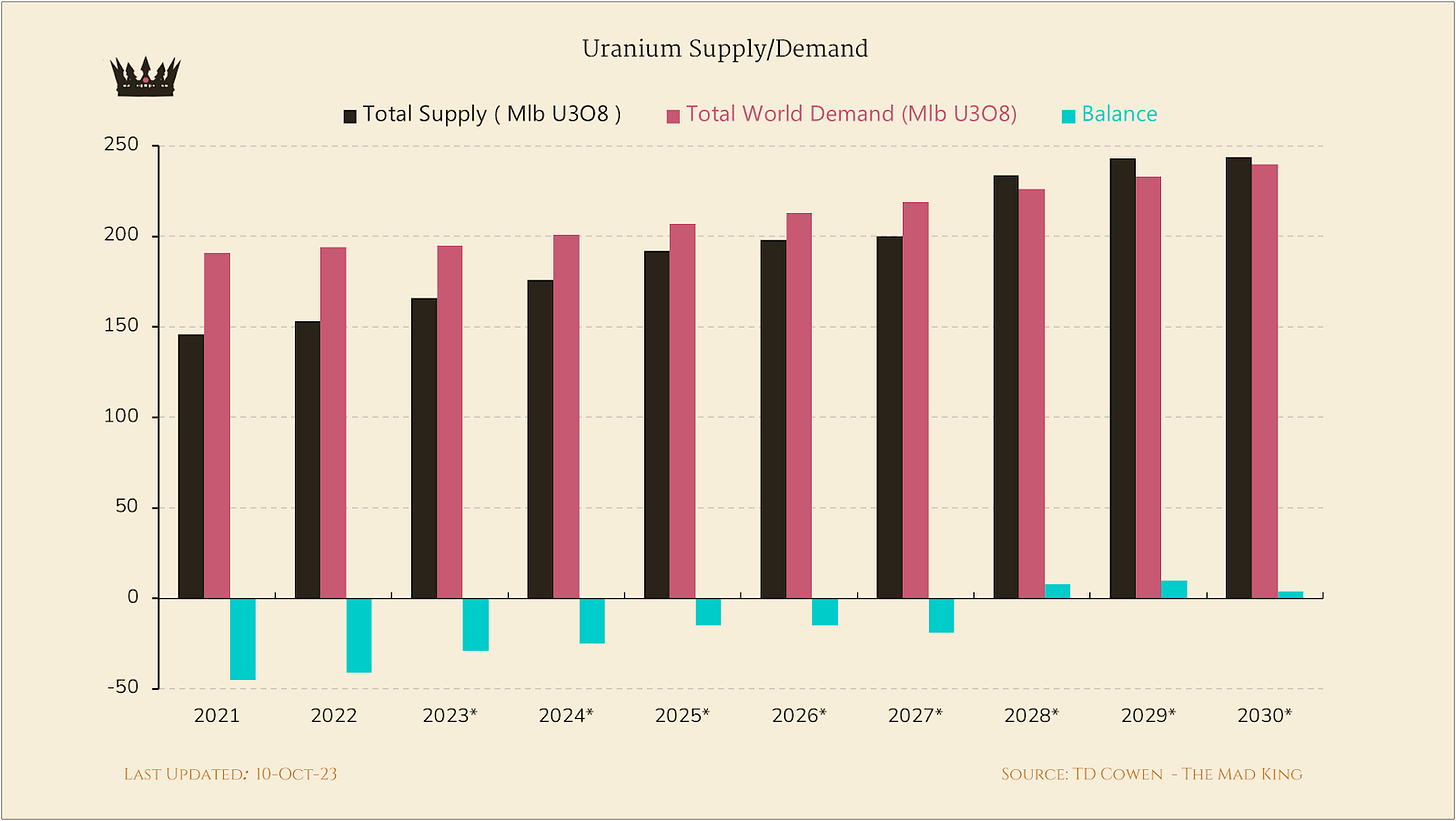

As such, uranium demand is projected to outstrip supply until 2028! With only 74% of demand being met in 2022, this is expected to result in a cumulative gap of 100,000 tonnes over the last decade.

And given the secondary supply, which previously acted as a buffer, has dwindled to cover only about 60% of the current gap, this leads to concerns about uranium availability.

"TheMadKing" recently interviewed Richard and his partner of Uranium Insider newsletter. The following charts are courtesy Richard and Remy (TheMadKing):

Population Growth Drives Energy Demand

Anticipated global population growth, primarily in Asia and Africa, underlines the urgency for meeting expanding energy needs. India has recently surpassed China as the most populous country, emphasizing the need for swift energy solutions. China and India are committed to nuclear energy development, with many new power plants set to join the grid in the next two years. A global nuclear renaissance is taking shape, with numerous countries like Canada, Sweden, Japan, India, France, the UK, and Russia planning significant nuclear energy expansion, resulting in a surge in nuclear reactor construction, the highest since 1992. France has committed to constructing 14 new nuclear power plants, and South Korea is also contemplating building new ones.

But Arthur Hyde, a portfolio manager at Segra Capital said:

“For the supply and demand of this market to balance, we need new assets to come online. If you’re going to insulate the US, Europe and Canada from the global fuel cycle, which is heavily dependent on Russia and China, the best way to do that is to build new mines, new conversion capacity, new enrichment capacity.”

Unlike some commodities, opening new uranium mines is a lengthy and capital-intensive process, often taking a decade or more to become operational. It’s not a quick solution to address this shortage for uranium and have miners boost production. Countries must invest and plan ahead, as significant increases are not expected until 2025.

Nuclear Waste and Storage Issues

It may come as a surprise but nuclear energy waste has distinct advantages over waste from other energy sources. Misconceptions about the hazardous nature and longevity of nuclear waste persists. But truth is, it is compact and traceable. Storage solutions for nuclear waste include on-site pools, dry cask storage, deep geological repositories, recycling, and transmutation. In contrast, fossil fuel energy has harmful side effects and incomplete waste regulation.

Regarding carbon footprints, nuclear (elemental energy in the chart below) is one of the cleanest and most efficient ways to create energy. With over 90% of its energy remaining even after five years in a reactor, spent nuclear fuel can be recycled to make new fuel and byproducts.

While the United States does not currently recycle spent nuclear fuel, other countries like France do. Additionally, advanced reactor designs are in development that could potentially consume or run on spent nuclear fuel in the future, offering a promising solution for recycling and utilizing this valuable resource.

Uranium Investment Vehicles

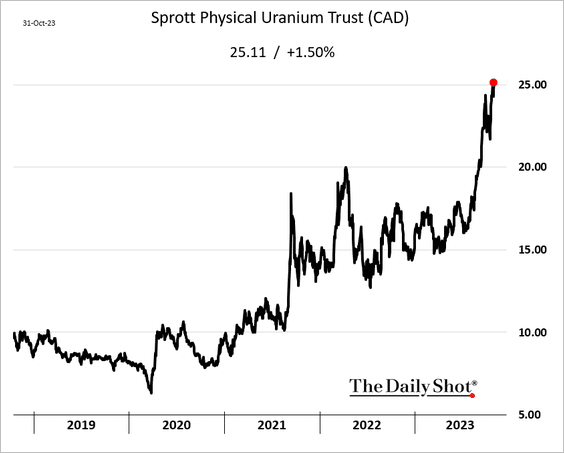

It’s ironic how Uranium has caught the attention of Hedge Funds now that uranium prices have already soared 125% since the end of 2020 - when I literally recommended long.

Hedge funds and D.I.Y. investors are mainly focused on uranium miners. As such, that is why I added CCJ, URA and URNM as proxies to play the #channel long uranium theme.

Here are the recommended plays used by Uranium Insider as focus on their core holdings:

URNM - Spot

EU - enCore Energy

NXE - NexGen Energy

DNN - Denison Mines

URA - ETF

Investment Risks

Long-term macro trends support long-term investment themes. Nuclear is not going away as a viable and sustainable source of cost-effective and safe energy. It will have obstacles to scale and there can be set-backs of size, but overall, the supply deficit that is uranium against the back drop of growing global energy needs helps to support this bull case for uranium and uranium investments for the long haul.

Just keep these risks in mind:

Hybrid Solutions: Small modular reactors (SMRs) are advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit, which is about one-third of the generating capacity of traditional nuclear power reactors. Given these are not expected to really roll out until the 2030s, it is too early to tell their impact on uranium demand.

Infrastructure and Supply Chain Risks: Uranium mining and supply chain infrastructure may face challenges, including aging facilities and limited processing capabilities. The entire nuclear fuel cycle also can take years and supply chains can span across multiple countries where geopolitical disruptions can impact prices and availability.

Public Perception: Negative public perception of nuclear energy can influence investment decisions, as it may deter funding and support from governments and investors. For example, Germany wound down its nuclear program in 2011 in reaction to public outcry over Fukishima. They have since pivoted back to nuclear, but only after the crisis caused by the Russian-Ukraine War.

Environmental and Regulatory Risks: Environmental concerns and stricter regulations regarding nuclear energy and uranium mining can affect the industry. Changes in environmental policies or regulations can impact production costs and profitability. These are the unknown unknows the industry still faces.

And as with every macro-themed long-term investment I present, each client must determine your risk vs reward, timeframe and position size. I simply thought it was time to renew this strong sector theme for clients and why I am staying the course long-term.

__________________________________________________________________________________________

In the list of equities under "Uranium Investment Vehicles", URNM is not spot. SRUUF or U.UN is the Sprott Physical Uranium Trust (SPUT), and is the vehicle that most closely tracks the spot uranium price. URNM is another ETF, but an actual pure uranium play vs URA, the latter having quite a bit of non-uranium stuff in the mix. The volume on URA is considerably larger though.

Here is the link to the original article published in October '23.

https://themadking.com/article/call-me-elemental/