URANIUM TREND IS EN FUEGO

It’s So Old It’s New

One year ago I posted an update for CLUB/EDGE clients on the Uranium/Nuclear Theme:

Goldman out once again this week noting the strong demand for the nuclear renaissance:

1. AI data centers drive 165% projected rise in data center power demand by 2030, boosting nuclear interest.

2. China aims to surpass U.S. as top nuclear generator by 2030, targeting 200GW capacity by 2040.

3. Uranium supply chain concentrated: Kazakhstan produces 43% of global uranium ore, Russia/China control 63% enrichment.

4. 31 countries pledged to triple nuclear capacity by 2050, driven by AI demand and clean energy needs.

As long-time clients know, this has been a TREND LONG RECOMMENDATION since November 2020! CCJ is up 9X on a stock basis alone.

Needless to say, everything from this 2023 deep-dive report still applies and then some!

Because AI hadn’t yet caught on, and with it the flurry of Tech Capex and data center buildouts, this was my “boring but profitable” set-it-and-forget it trend long sector trade.

But that was before OpenAI really entered the Chat…

Now, the momentum crowd & thematic traders are in this recursive loop of buying anything in the AI ecosystem, even if nuclear plants take many, many years to come online and the supply of uranium is very, very limited. Earnings Growth is being pulled way, way forward.

Pull up a multi-year chart of any of these Nuclear Stocks that I have sized up for clients over the past five years as Swing/Trend longs. Now zoom out to see there are related names that have also been en fuego - even before the theme of US Government as Venture Capitalist & Whale.

(italicized* denote my client rec’d trend longs):

Small Modular & Micro Reactors

$SMR NuScale*

$OKLO Oklo*

$NNE NANO Nuclear

$RYCEF Rolls Royce

$GEV GE Vernova

Services and Equipment

$LEU Centrus Energy

$CW Curtiss-Wright

$GEV GE Vernova

$BWXT BWX Technologies*

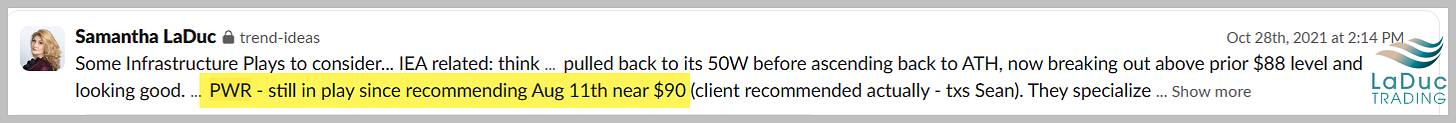

$PWR Quanta Services*

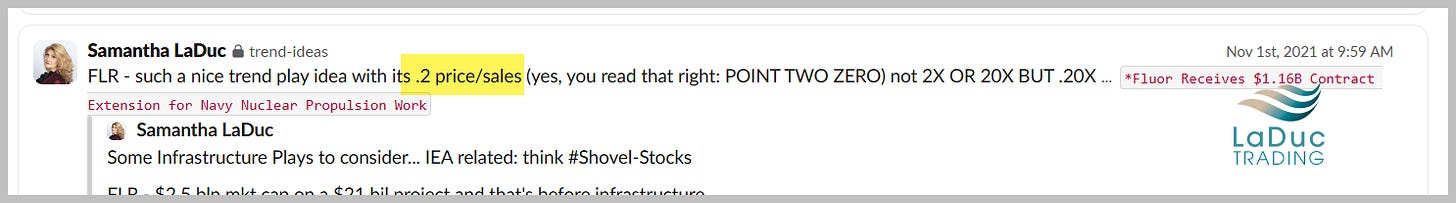

$FLR Fluor*

$MIR Mirion Technologies

$BEPC Brookfield Renewables (CN)

$ATRL AtkinsRealis (CN)

$ARE Aecon (CN)

$SLX Silex Systems (AU)

Nuclear Fuel Technology

$LTBR Lightbridge

Power Producers

$CEG Constellation Energy

$VST Vistra

$TLN Talen Energy

$PEG Public Service Enterprise Group

Nuclear Bitcoin Miners

$WULF Terawulf

$IREN Iris Energy

$CORZ Core Scientific

Uranium Enrichers

$ASPI ASP Isotopes

$LEU Centrus Energy

Uranium Producers

$CCJ Cameco*

$UEC Uranium Energy

$UUUU Energy Fuels*

$BHP BHP Group

$PDN Paladin Energy (AU)

$BOE Boss Energy (AU)

$EFR Energy Fuels (CN)

$EU enCore Energy (CN)

$URE Ur-Energy (CN)

$PEN Peninsula Energy (AU)

$KAP Kazatomprom (KZ)

Developers

$NXE NextGen Energy (CN)

$DML Denison Mines (CN)

$ISO Iso Energy (CN)

$LAM Lamamide Resources (CN)

Uranium+Nuclear ETFs

$NLR VanEck Uranium+Nuclear ETF

$URA Global X Uranium ETF*

$URNM Sprott Uranium Miners ETF*

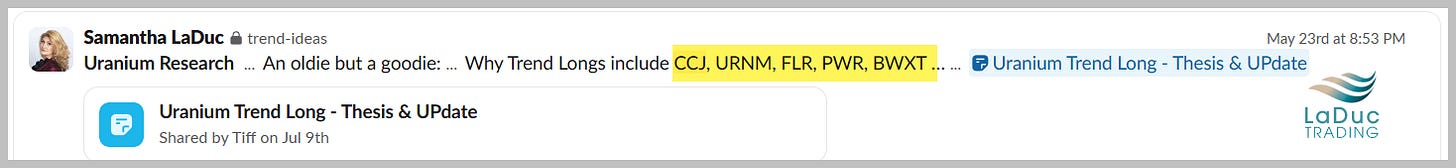

Rec’d Core Trend Longs past few years:

CCJ - URA - FLR - PWR - BWXT

FLR at $20 is only a 2-3X performer - the worst of the bunch. But I couldn’t resist that valuation in 2021!

PWR at $90 was a double when I took it off then got back in on breakout > 213, now $423!

BWXT was a late add, 2024, but it is still a double! Should have also added the two I also rec’d with it: PRIM & MTZ - they also doubled!

CCJ & URA were core adds in NOV 2020, so… lucky or good: 9X & 5X respectively.

As a macro-to-micro analyst, educator and trader I tend to focus on DURABLE THEMES for trend trades, and multi-month rotations for swing trades while running a live trading room each day to better chase momentum moves from market-moving news, macro policy changes and cross-asset volatility.

Uranium and nuclear energy are so old they’re new! And being/staying long and strong has rewarded the patient value investors, while helping to diversify portfolios away from the passive & tech-focused concentration risk- all without sacrificing the alpha.

I love finding these themes for clients. Thank you for being one.

Fantastic long-term tracking of the uranium theme! Your early call on CCJ back in Nov 2020 demonstates real conviction and patience. What strikes me is how the AI data center buildout has accelerated adoption timelines that were already favorable. CEG's position as an established power producer with existing nuclear assets gives them a significant first-mover advantage over companies that need to build from scratch. The supply chain concentration you highlighted (Kazakhstan 43%, Russia/China 63% enrichment) adds another strategic dimension to US nuclear expansion that many overlook.