'Turnaround Tuesday' - That Worked!

CLUB/EDGE client Post Tuesday April 23rd; SPX target of $5131

» CLUB/EDGE client post Tuesday April 23rd 8:53 PM

The S&P 500 broke a six-day losing streak on Monday. It wasn't a 'perfect gap down' on Monday morning like I had hoped, which would then reverse strongly, triggering put hedge monetization and short covering, but it was effective!

The mini gap up allowed the move to fade early part of Monday, fill those mini gaps I pointed out, and then set up for Turnaround Tuesday.

I mentioned "Turnaround Tuesday" in my live trading room Monday as my high probability bet, after reviewing my #intermarket-tells for clients Monday live. I also said VIX just needs to get/stay below 17.77 on the hourly. That was a great tell for market strength. Lastly, I warned Friday that gold & silver were about to have a big move - likely lower - which would set up tech to bounce.

The result: The overbought nature of precious metals & commodities combined with the oversold nature of the move lower last few week in semis and Mag7 set us up for a strong bounce with QQQ: $423 and NVDA $823 as 1st price targets. Further, as SPX worked its way higher into 5050 today I said this level would ignite dealers to go long gamma after being short.

I also warned, however, that I was not really excited about the long game until SPX could get/stay above 5080. We hit a high of 5076 so markets have more work to do.

I also mentioned that TSLA would report after market close Tuesday and my bent was bullish AFTER falling 40% YTD. I have no edge with earnings, but I tend to prefer bounces in oversold names, so it made sense to expect a relief bounce in Tesla, especially after overshooting my $146.41 daily gap fill price target as highlighted under #swing-ideas! Rithika had the same level form her Elliot Wave analysis. She has since closed her profitable swing short from $170.

After TSLA Tuesday, we have mega cap tech earnings from GOOGL, MSFT & META - right before PCE data on Friday.

Todays weak US PMI services and manufacturing print at 9:45 AM, but strong prices paid, pushed the USD & 10Y yield lower helping to support the bid in equities.

But we need more of that and positive earnings sentiment, if we are to really push higher into SPX target of $5131.

Keep in mind over the next two weeks, we have 2/3'rds of the S&P 500 reporting their earnings and outlooks - right before FOMC May 1st and Yellen's QRA April 30th.

My focus will be on individual names - both TREND & SWING positions but also for post-earnings chases. I will not be posting general market thoughts as much during earnings. It's a lot to track results and market reaction and position/hedge/chase. I'll be back to the focus of macro as we approach end of month.

Multiple Contraction Worries

Nvidia suffered its biggest downdraft since 2020. In fact, NVDA pulled back 20% before bouncing this week, but the real suspense will be how they do given the onslaught of competitors that have entered to eat away at its nearly 90% market share.

"Now Amazon.com, Google, Meta Platforms, AMD, and Intel have big ambitions in AI chips." Barrons

My baseline bet is to continue to expect the very overvalued names to pullback post earnings, and oversold to pop.

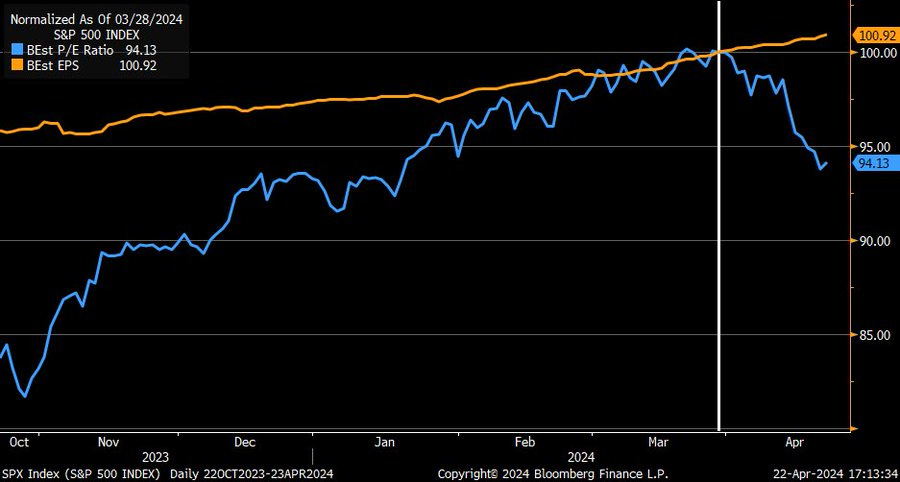

Case in point: the recent pullback has been largely from previous high-fliers that had been bid up in a 'multiple expansion' chase. Now, the reverse is happening:

“So far, S&P 500’s selloff since late March has been all multiple contraction (forward P/E, blue) as forward EPS (orange) have moved higher.”

@LizAnnSonders

Flow & Positioning Still Signaling Sell

Multiple models suggest the price-insensitive quants/CTAs have not finished selling.

CTAs have sold about 30B in S&P 500 and will remain sellers in all scenarios (up or down) over the next 5 days. GS

The combo of CTAs selling and dealers entering short gamma and stock buyback blackout and Fed cuts getting priced out... have all combined to push markets into sell-mode.

CTA crowd has not finished selling...

Further downside in equities will be met with more selling from CTAs. CTA equity length sits in the 90th %ile, with $26bn of forecasted equity supply next week on a flat tape" (GS trading desk)

JPM's Kaplan weighs in:

"Flow risks are two-way as CTAs could re-lever if markets recover the short-term signals that were crossed over the past couple of weeks, but they have considerably more room to sell on a further decline. Nearby downside signals on major US indices that could cause CTAs to de-lever further sit between ~4700-4950 on the S&P 500, ~16400-17500 on the Nasdaq". Downside fragility remains the main "concern".

Gamma Levels are closer:

JPM writes: "...post-expiry dealers likely remain short gamma (put imbalance) below ~5100, turn flat gamma near 5150, and would likely turn significantly long gamma (call imbalance) above ~5200". Here or lower dealers magnify moves both ways as they need to sell low/buy high and above 5200 they become sellers of deltas.

Short-The-Rip Worked

I know many of you have covered the majority of your shorts into this week, until a better direction is determined. Hopefully some of these positions provided you alpha during the pullback:

QQQ short 3/25 at $445 with multiple price target into $425.70 with 413.58 overshoot. All hit.

SPY short 4/8 at $519 with multiple PTs into 497.37. All hit.

XLK short 4/15 $204 with multiple PTs into $192. All hit.

SMH short 4/15 $218 with multiple PTs into $196.51 (one left) ;-)

This is my SWING portfolio for clients with #swing-trade-notifications as representation of my market views. Obviously, I set up a lot more stock-specific plays for clients live in my trading room and posted in CHASE & SWING channels in slack.

I also posted a detailed INTERMARKET REVIEW Monday to demonstrate the nature of this correction, the potential relief bounce, and how the market is now both short-term oversold AND broken.

Without a major pullback in dollar and yields, given stagflation backdrop and geopolitical risks, market will require a stellar set of numbers from the market's leading companies to return the indexes to their March highs.

Personally, I think we will come close to market highs but won't retest them. Bold statement, I know. But that is what I see now: Complacency has ended but trust hasn't returned.