Trump Returns: US Dollar Is The Big Winner

US dollar, yields and stocks are up yuge! Yen, bonds and precious metals are down yuge!

“Nothing is lost. . .Everything is transformed.” ― Michael Ende

So Now What?

I predicted Trump.

Unpopular Election Prediction - Client Post from Oct 7th:

But I also had my doubts the "machine" would let it happen.

I was wrong about contested election - so far anyway, as Harris refused to speak to supporters last night to concede. [She is slated to speak tonight at 6pm ET unless otherwise noted.]

And Trump has a sentencing scheduled in 20 days. Yeah, remember that detail!

Former Pres. Trump still has a sentencing hearing scheduled for Nov. 26 in his New York criminal case. ABC

Because I expected 'contested’, I kinda thought we had more time before the melt-up.

But it is here.

Markets are euphoric. Like over-the-top happy Trump won - both popular & electoral.

US dollar, yields and stocks are up yuge!

Yen, bonds and precious metals are down yuge!

Due to expectations of tax cuts by Trump - which are being interpreted as stimulating the economy - plus fewer regulations - which are being interpreted as drawing more foreign money abroad to US... we have the conditions for a stronger dollar.

And that is why the strong bid underneath the dollar vs. all the major trading currencies is affecting stocks in a big way.

Note the dollar is up 3% against the peso, 1.7% against the yen and 2.07% against the euro.

I am VERY glad I warned clients about being heavily long gold and silver past two weeks. SLV is down -10% since that call.

But I did not expect equity futures would be flying so soon!

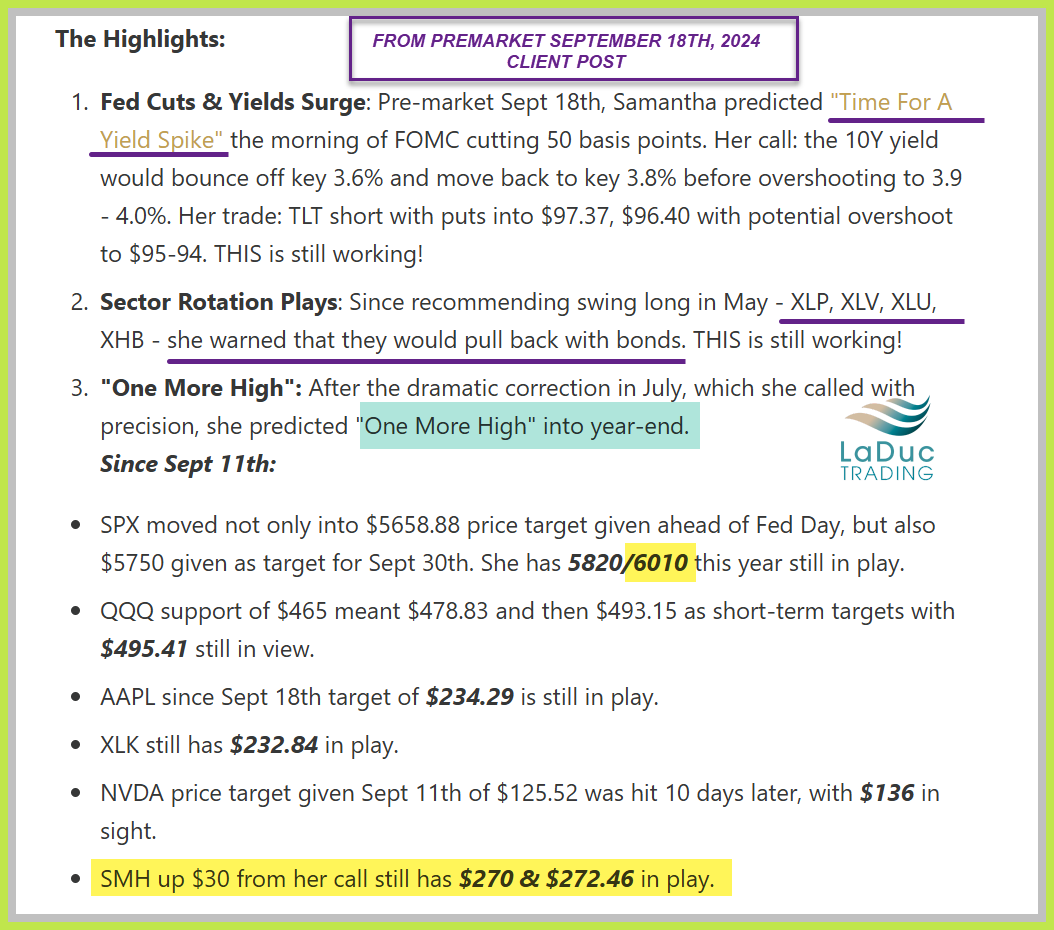

So what's left on my "One More High" from Sept 18th?

$SMH $272.46

$SPX $6010

Fuel For The Fire

And with some folks positioned short and/or underweight stocks, they will now have to chase to catch up.

Then there is Seasonality & Santa & SKEW - all tell me we have a lot of fuel to power higher if jobs don't disappoint.

Me, October 18th:

And that is why with the above scenario of hedges unwinding, I can see a dangerous case for a melt-up. Shocking, I know!

And might I add, harder to trade and time and tell when it will trigger its next big move.

My market read is that it will be trigger-happy, but on the first sign of trouble, it will also reverse violently. Making risk management even more important.

Fast forward, we are here and poised for higher…

Especially if we get the trifecta where we actually need treasury volatility, equity volatility, AND oil volatility to come down for markets to move meaningfully higher.

Dip buyers in bonds will have to wait for the US 10Y yield to retrace back from 4.47% premarket below 4.37% (my line-in-sand) as traders are pricing in a faster pace of growth on the back of any prospective tax cuts even as the Fed prepares to cut rates over the next year. [Trump Tariffs, Deficits & Inflation be damned.]

Macro Event Risk into EOW:

Wed 6pm Harris "concession" speech

Thurs 8:30am Jobless Claims & Productivity

Thurs 2pm FOMC & 2:30pm Powell Presser

Friday Israel-Iran weekend risk?

At some point, Bond Bulls NEED to be defended.

Next opportunity would be Thursday pre-market we have both weekly jobless claims AND productivity gains, followed by FOMC at 2PM. Yes, I am still expecting them to cut 25bp.

Big picture, I patiently wait for this 'dream team' (#RFKJr #RonPaul #ElonMusk #Tulsi2028 #Vince #Shanahan #Vivek) to put a glimmer of hope for actual price discovery in markets.

It's coming...but not likely until 2025.

Prior Posts on The Trump Trade: