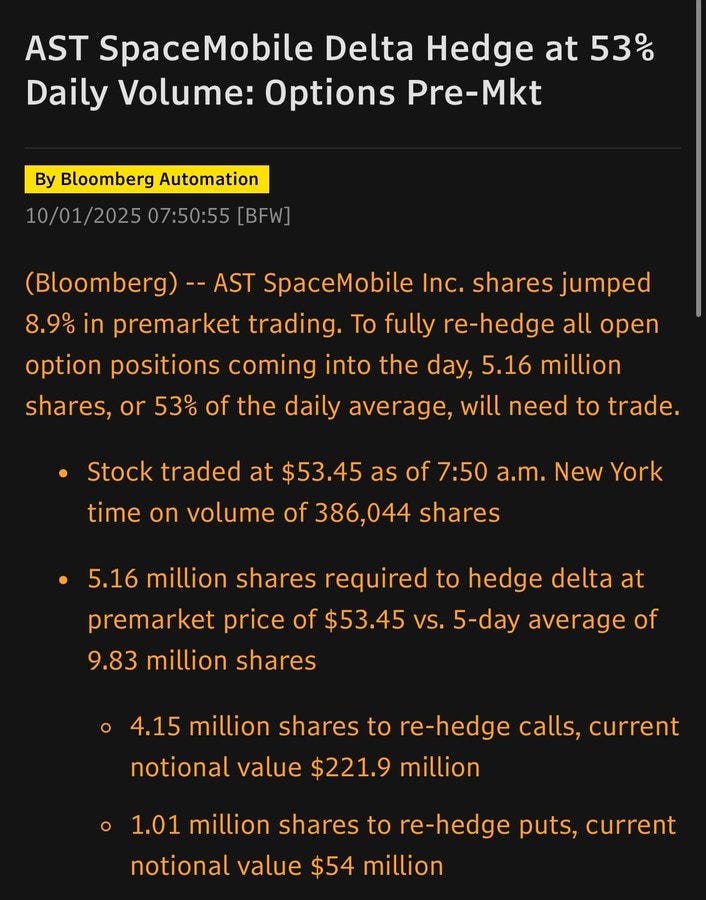

TREND LONG ASTS - Option Update +60,000%! Good Enough?

This Is Why I Love Options

The JAN ‘26 financed call spread +30,000%

The JAN ‘27 bull risk reversal +60,000%

THANK YOU SPACE MOB 🤣😍😘

When I recommended ASTS as my “sock-drawer” trade in February 2025 for the next 1-2 yrs, it was not my usual pick!! But I did the due diligence work to recommend it to clients, along with some flexible option tactics that employed leaps - both JAN 26 & JAN 27. At the time, the top leap strike was a $50 call. Now, it’s $90! AND they have added JAN 28!

Everyone has their own style of trading/timeframe & risk management/options experience, but when I have a high conviction pick I like ADDING TIME and financing the option position. It takes margin and skill to defend, but I find it the best bang-for-the-buck and the current ASTS returns prove that out.

ASTS is up 200% YTD. That’s a pretty strong run to hold through. Let’s face it, most won’t hold but take profits early and often. Nothing wrong with that - especially as this approach works great for shorter-duration trades or when a thesis is negated.

But in the case of ASTS, all the same reasons for me recommending early & often have remained - even after a 100% run in June!

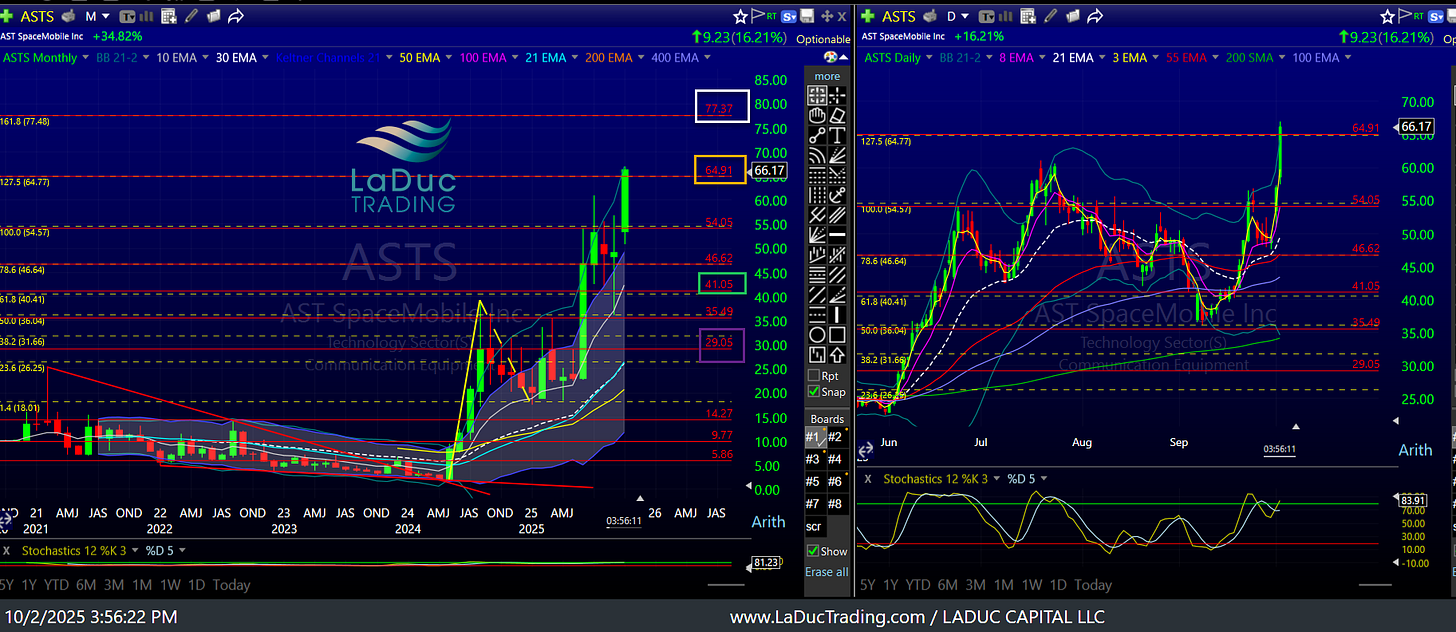

Clients can attest I helped them navigate the pullback from $60 to 36 and then Sept 12th said it would get defended. It turned out to be a great call as $36 held and ran hard into 54.55 chase/swing long target in just a few days.

Then after some end-of-month digestion, it is running again from $48 to 67 in ONE WEEK!

Clearly, the momo crowd has taken hold. It is no longer an under-the-radar spec play. It is now a ‘found’ stock with persistent shorts, helping to make it very extended and pushing its valuation into a ‘space bubble’. Ironically, I posted back in February that I expected AST to grow into it this pricing level $55-75 over time (1-2 yrs).

Now that we are here, I’m digging in with the following update:

Original Thesis

At the bottom of this post, I have included a copy of the original client research report. Here is an AI VIDEO that captured the essence of it this summer.

(Note, the image is AI; none of the research is AI.)

Despite being a high-risk play in a potentially recessionary environment, she believes ASTS could be a ten-bagger due to its high-margin model, global expansion opportunities, and growing strategic relevance.

I was referring to the stock: $25 to $250. And over a longer period of time. I had no idea at the time there was a designated “ASTS SPACE MOB”. Yes, it is a cult but a very fundamentally sophisticated one. Every so often I check in to see if they are still bullish. They only grow more so.

Time To Update

Good news & a hot sector: UFO

🚀 $ASTS +15.42% today & surging after Bell Canada tapped AST SpaceMobile for direct-to-cell service (launch 2026). Bluebird 6 satellite prepped & launch cadence intact (45–60 sats in orbit by ’26).

$RKLB +9% & $PL +8% riding the hot space wave.

ASTS Shorts likely helping fuel this week’s surge: ~50m shares of short interest has yet to cover…

Oh, and an early analyst on the scene, Barclay (as profiled back in Feb to LaDucTrading clients), is out upgrading their Buy Rating with a $60 target (as stock hits $67 Oct 2nd):

Note the insider selling. Maybe it’s nothing, but be aware anyway.

At $65, ASTS is either turning into another parabola with a $77 next price target based on my monthly 161.8 Fib level, or will base/consolidate here (127.5 Fib level) next few weeks.

Either way, just know that ASTS HAS DONE NOTHING WRONG but it is a CULT STOCK.

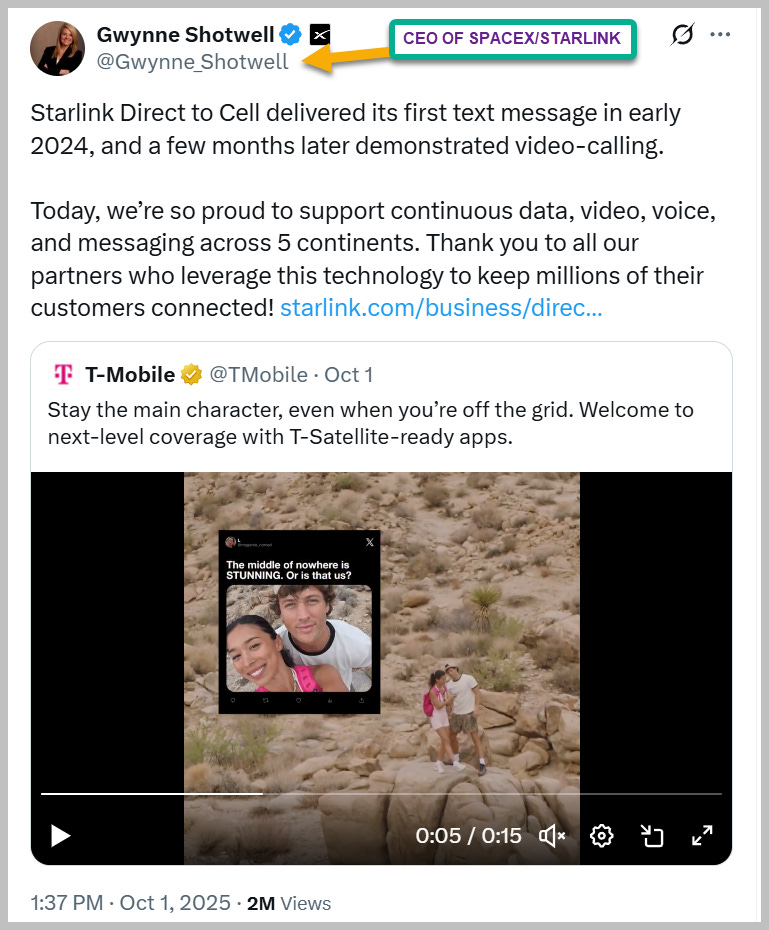

And it does have entrenched competition with SpaceX/StarLink.

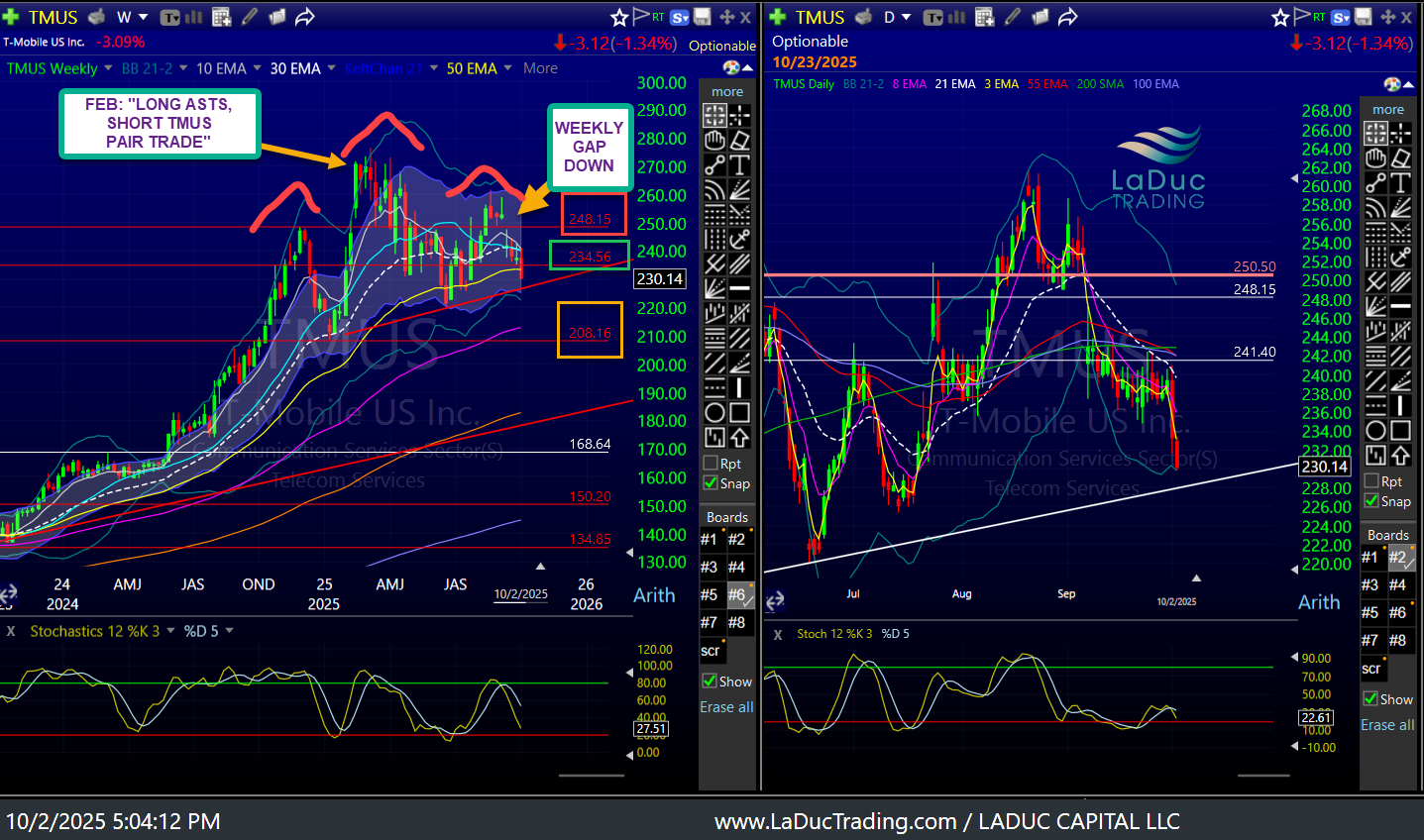

THE PAIR TRADE: LONG ASTS / SHORT TMUS

Feb 2025 when I rec’d ASTS Trend Long, I also gave a cheeky pair trade:

Long Anti-Musk ASTS / Short Musk TMUS

I did not know Musk would fall out of favor with Trump & DOGE would be disbanded. I did not know the “Golden Dome” announcement this summer from the Trump admin would fuel the ASTS June rally. Today in fact, Bloomberg interviewed AST President to reaffirm their government applications in support of DOD.

In Feb, I was simply referring to ASTS as competition to the announced StarLink/T-Mobile partnership. Lucky or Good, I top ticked that TMUS short ;-) And the pair trade has actually really worked GREAT!

In fact, I’m really curious… TMUS is still looking like a big short in progress with a giant Monthly/Weekly Head & Shoulder’s trend reversal pattern.

Something Else To Think About:

Market timing is my job - markets, sectors & stocks. I am not siloed to macro OR fundamental OR technical analysis. I combine them all. I also cover narrative/story stocks as well as boring but profitable value plays. I love cross-asset intermarket analysis overlaid with quant option structures. I have a team of ten contributors and thousands of clients with whom I collaborate to better help them position, profit and protect. I run a live trading room from macro-to-micro analysis, custom client engagement and set up trades across Chase, Swing & Trend timeframes. If you think that might help support your trading & investing goals, join us! I will look forward to working with you.

ORIGINAL CLIENT POST

ASTS as a "New Trend Long"

Congrats on those returns! The way you managed through the June pullback to $36 and then the bounce shows really good risk managment. The financing of long dated calls makes a lot of sense when you have that level of conviction in the underlying thesis. The ASTS Space Mob is definitely real and getting bigger, which helps provide some upward pressure even during consolidations. The pair trade with TMUS short is also clever, especially with the way T-Mobile is looking technially. Thanks for sharing the whole journey, lots to learn here about defendng positions through volatility.