Treasury NEEDS Inflation!

CLUB/EDGE client post March 23rd.

My thoughts on the FOMC meeting this week wherein Fed maintained an outlook of THREE rate cuts for 2024 - while expecting higher GDP, INFLATION & RATES - continues to support my non-consensus view (again, from early January):

Treasury NEEDS inflation!

Yellen talks of productivity gains…

That’s akin to letting inflation stay sticky with rates.

Equivalent to if Fed was to raise the inflation target.

Wages would rise with productivity! Consumption too.

The economy would boom!

Stocks would moon!

Like for real not just from nominal govt spending.

And THAT’S how an over-indebted govt INFLATES their debt away.

And this playbook is still playing out, along with the transition to Fiscal Dominance, as Geoffrey has taught us well.

The Fed cannot raise the inflation target because what credibility they have left would be lost.

BUT, they can let inflation stay sticky/rise on purpose.

INSTEAD of raise yields to a higher inflation target.

Craig sums it up well:

"The only logical explanation for the Fed wanting to begin the rate cutting cycle is because the US is in fiscal dominance, the Fed/Govt recognize this, and the Fed needs to bring down interest rates in order to help the government reduce the deficit since lowering interest expense is the only way to bring the deficit down in a dysfunctional DC that cannot raise taxes or cut spending in any other way."

This stealth policy is great for capital - not so much people.

But gold loves loose monetary policy, and is a core holding in this transition from monetary dominance to fiscal dominance.

Gold Update

GLD, technically speaking, remains a conviction long (silver too):

184 wkly close was the level I said it needed to stay above to stay trend long. It did.

190 GLD was breakout which was the trigger March 1st that caused me to write about it and update clients that the Nasdaq crash up rally was delayed. That worked.

193.40 is wkly gap up breakout level that it could retest where I would protect against, using options versus stop out. 194 is the 10W where it likely closes above or I'm wrong.

197.50 I expect to hold before it moves higher.

203.70 wkly is the next level it needs to get/stay above with 1st PT of 209 after that.

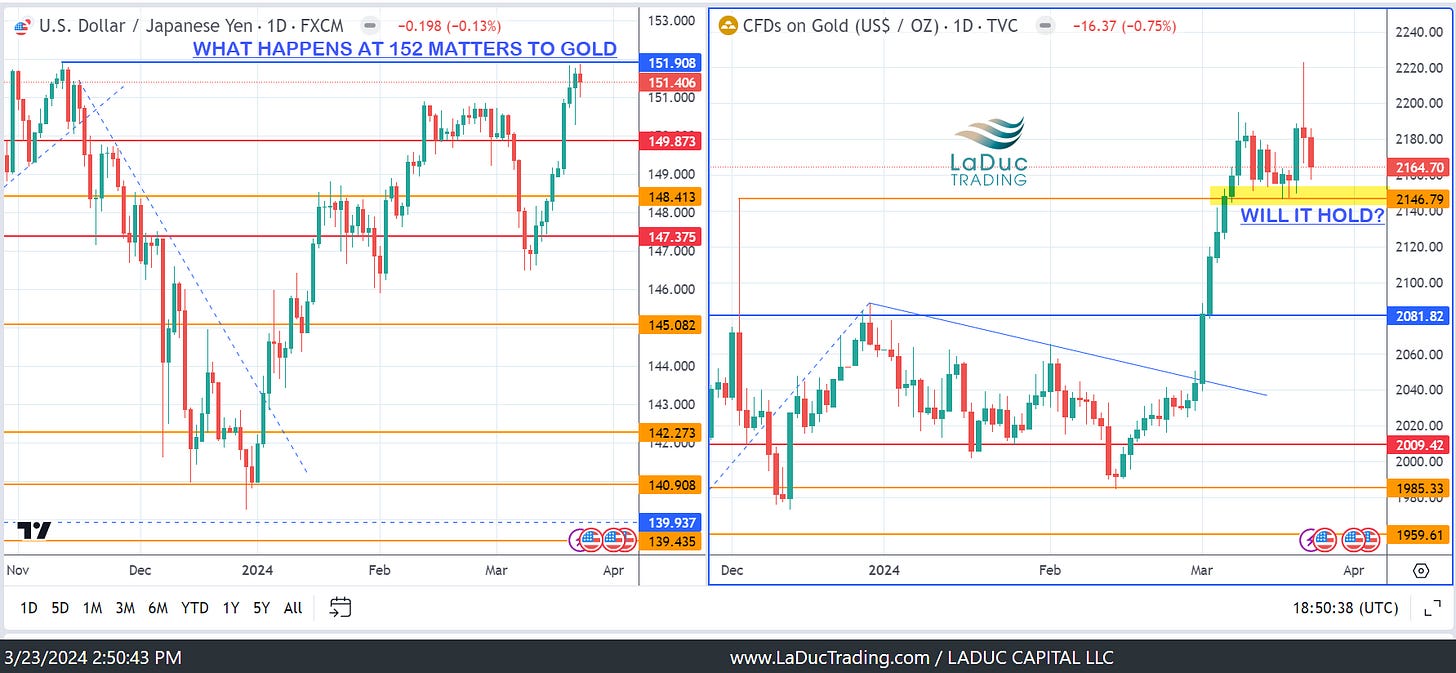

I personally don't see anything wrong with gold digesting here/above 2150 continuous, until we get the next wave of buying.

The monthly bar is lit. The weekly shows digestion post Fed Day, exactly as rate cuts started coming in from SNB, Brazil + Mexico on heels of USDJPY rising up to 152.

Fed board is more hawkish then Powell is dovish.

I think the 2Y10Y yield curve sums up the dilemma Fed members are facing, and how it won't likely resolve until after their next Fed meeting in May. And until they resolve that internal conflict - not likely until summer - I just don't see a lot of reason to expect another gold spike like we got with FOMC day - at least until the next meeting May 1st - or unless triggered by geopolitical events.

The Week Ahead & Hedge Ideas

I was only gone four days over last weekend, but it feels like forever since I last posted! It 'twas a busy week with Fed Day and lots of catch up.

At least I left you with a great trade set up on Pot Stocks!!

And I think the 3 live sessions Wednesday helped clients navigate well.

As I mentioned in my live trading room, I expected a pull back Thursday into Friday, which we got, and have said since March 1st that I expect indices to chop sideways through March as the gold spike told me it would. ;-)

Gold is now going sideways and letting indices try to push higher. It will be a dance.

We could have a macro event risk from Russia/Ukraine as the situation escalates - from the Moscow concert attack to Macron considering sending troops into Ukraine.

Gold is not a short, even if/while USD moves higher. Both can be risk-off trades for geopolitical risk.

Having said that, there are other ways to protect open our Swing & Trend longs - which are both doing really well and I don't want to close on war drumming alone.

Given we are in a light economic data week - other than (potentially bullish) housing data:

New home sales Mon

Case-Shiller home price index Tues

GDP (2nd revision) Thurs

And given market breadth continues to advance with the grind higher in markets...

I am looking at: April 15th $17C in VIX for $.50

AND $440P in QQQ in case PCE or Powell disappoint Friday and end of month produces a sell-off beginning of April.

Otherwise, I can't help but wonder if we push higher into the $5340 SPX price target I gave back in January - before any fireworks occur.

If so, Goldman quant made an observation that looked of interest for this week

SPX 28Mar 5300 calls are ~1% out of the money and cost 10bps. The next Thursday PM straddle is 0.92%, implying one of the lowest weekly moves of the year.

Anyway, is it wrong to add APRIL protection and a chase lotto long?

The main take away is this:

Without a macro driver to interrupt the bullish option flows, or fatigue potential after a monstrous run, I want both cheap upside calls AND protection.

Then I will reassess swings beginning of April into the Q1 earnings season.

Not To Miss Analysis!!

I have done my Intermarket analysis this weekend to share with clients in my live trading room Monday after my market commentary + trade set-ups.

I think you will find my analysis on yields for the next 3-9 months VERY important. Don't miss it!!

Also, I have just published my analysis in support of a "Warm Summer Housing Market Call". Please check it out!!

And given all the excitement from Fed Day Wednesday, here is Our Fed Day Macro-To-Micro Power Hour: The Fed On Pause But Inflation Is Not

Craig does a deep-dive on Fed dot plot, 2Y10Y direction & Fed buying time... while I am wee-bit obsessed on USD & Gold. ;-)