Time To Remind: "YIELDS ABOUT TO BREAK HIGHER" Because It Matters To Market Returns

Yields Leaving The Goldilocks' Zone. Talking Dollar And Yields Lower Won’t Work This Time. US Dollar Devaluation As Policy. Bond Duration Shock.

Time To Remind

Below is a »CLUB/EDGE client post from Tuesday, December 12th - with an update!

At the time, many were excited about buying bonds & I said, not so fast. Read why I warned:

YIELDS ABOUT TO BREAK HIGHER

Update to $TLT + #ZN Bond Short,

$USDJPY long, $VIX long... #DXY too

As posted - 10Y2Y Yield Curve DEC 11th:

Updated - 10Y2Y Yield Curve JAN 7th:

Needless to say, I still have a “price target” on this 10Y2Y yield curve before I see any chance of bond bulls getting defended: .45%.

The problem is that as this YC steepens, the 10Y bond will fall faster than the 2Y and that is a big problem for equities IF/WHEN the 10Y yield gets above 4.79 (now 4.69) - a mere 10bp higher.

Yields Leaving The Goldilocks' Zone

The 10-year yield is now up over 100 basis points since the Fed started cutting and I warned premarket September 18th: TIME FOR A YIELD SPIKE.

I then updated clients with the above post December 12th: YIELDS ABOUT TO BREAK HIGHER

It was an historic yield spike by this measure:

In the last 60 years, only one time have 10-year yields risen more in a rate-cutting cycle, in 1981 (brown) when Volcker took the funds down from its world record high of 20%, and the bond market hated it (causing Yardeni to coin the term, "Bond Market Vigilantes") - via Jim Bianco, @biancoresearch

Again, Bianco:

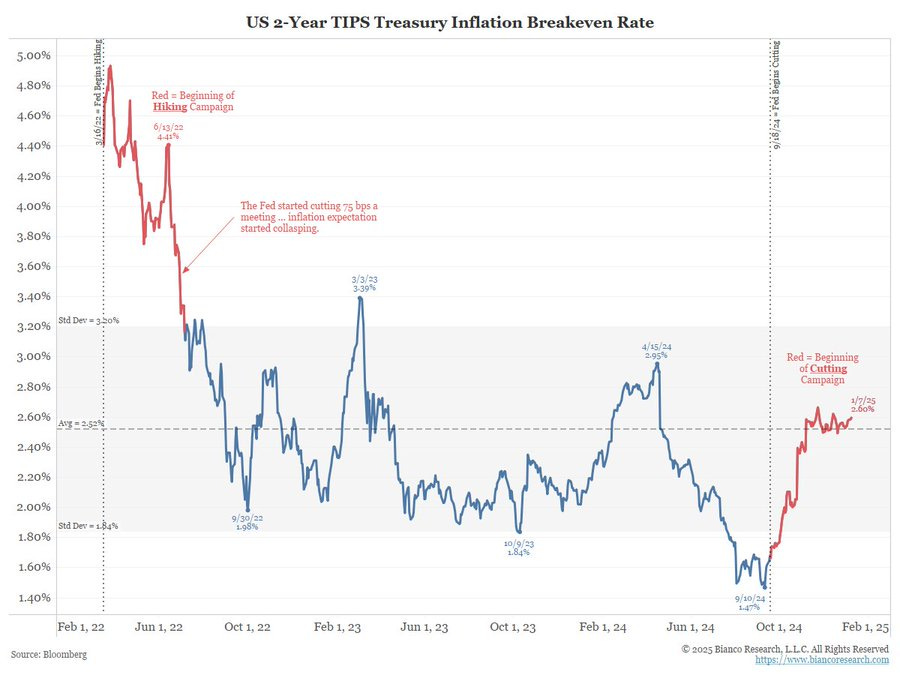

inflation expectations fell when the Fed was hiking in 2022 (left-red). When they started cutting in 2024 (right-red), inflation expectations rose.

If the Fed is not vigilant about inflation (cutting is not vigilant), sell bonds!

Then Monday pre-market I literally wrote to clients to be careful: yields are about to leave the Goldilocks' Zone.

Then Tuesday morning Trump announced:

“INTEREST RATES ARE FAR TOO HIGH"

Ironically, I wrote about the anticipated intervention Monday as well:

Rising dollar and 10Y yield are right at a major risk-off zone. I have mentioned 4.7% on weekly close for the 10Y and DXY above 109.30.

I'm already thinking ahead... should they trigger, to stay boldly bullish equities we would need Policy Intervention.

With Biden soon out, taking Yellen with him, and Powell neutered or neutralized (pick your word choice), we await Trump & Bessent taking over fiscal and monetary policy. Which begs the question:

What form will policy intervention take now that Yellen is leaving & with it her (unpopular but effective) short-duration, liquidity-infusing (not sucking) bond issuance to fund fiscal spending?