TACTICALLY BULLISH & MACRO BEARISH

Short-Covering Confirmed. July Is Time To Be Risk Aware. Budget-Busting Reconciliation Bill. Another Debt Ceiling Drama/Another US Downgrade. Don't Be Surprised...

Short-Covering Confirmed

Past few weeks I said SPX $5750 was the level that would force "short covering". We gapped above Monday May 12th.

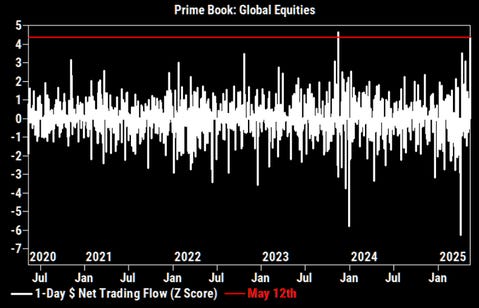

Well, Goldman confirmed global equities had their second largest net buying day in 5 years (3.7 sigma) - MAY 12TH!

And what else did GS say?

Buying was significantly driven by short covers: 1.6 to 1.

Not only that...

[May 12th] "Yesterday's notional short covering in US single stocks collectively was the largest since Mar 7th and ranks in the 99th percentile on a 5-year lookback."

GS

With that a reminder: Tuesday the 13th is when ES reached my target given Wed Apr 23rd for 5928.25 when my liquidity indicator moved back into positive territory.

I also said, once above, my next target higher is 6127.25 ES.

But should 5928 fail, we have two very strong magnets lower: 5687.50 and 5332.25.

Not if, just when.

Short covering in equities is the reason for the season this week on news of 'de-escalation' of tariffs with China, but these can just as easily be reversed as July 8th & August 10th tariff deadlines approach.

Short covering in equities is the reason for the season this week on announced plans that Saudi Arabia/Qatar will invest in the US many multiples of their GDP.

Short covering in equities is the reason for the season this week as TGA & RRP juiced markets as Fed paused QT.

But market NEEDS organic buyers to keep it going past June.