Stairs Down, Elevator Up

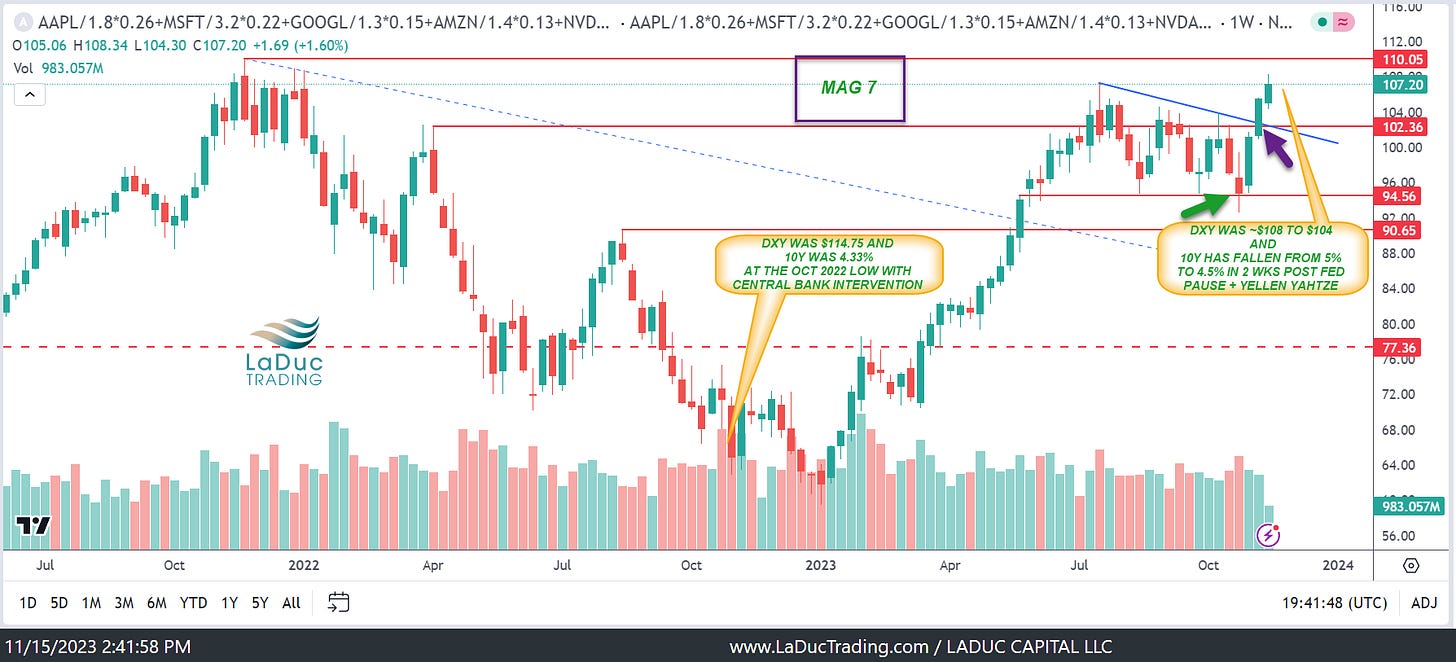

Check out the Before and After for MAG7 charts below.

From “Bounce Hard or Trounce Hard” warning Oct 27th, to now: Breaking Out Loud!

Oct 25th I posted the BULLISH CASE: Note #1 and #6 in particular as both occurred Nov 1st!

In order to stay bullish, the following at a baseline need to take place:

Macro: Assumed and Real Global CB Liquidity/(read: Intervention) must continue.

Derivatives: Positive Gamma = VIX suppression. In between the Govt Interventions, all you really need to know is how options drive market direction and right now we are below a critical line: SPX 4353.

Fundamental: Wage Inflation increases purchasing power; steady demand delays recession. Do not confuse this with REAL “growth” as PMI and GDI stay flat. In a nutshell, companies will pass on higher prices and keep people employed until they can’t.

Technical: Big Picture, SPX needs stays >$4000 min, $3800 max THIS YEAR.

Intermarket: We already destroyed these levels posted months ago: "Bulls can run IF 10Y < 4.1%, DXY < $106, WTIC < $95"

Sentiment: Fed Pause is bare essential to support a levitating market. Hikes are not equity/bond bullish, and cuts remove the confidence needed to get the game in play.

My best bet is that this panic buying in Mag7 serves as a ‘fake breakout, fast failure’ before year-end, but for now, it is in play BIG as a result of the strong pullback in US dollar and yields.

Hard to swing short safely until it turns.

It could be easier AFTER we net through NVDA earnings 11.21 and Black Friday/Cyber Monday.

In the meantime, we have lots of chases in the space

On the recent oil spill...

I know, I know. I closed my XLE short too early (and I knew it and said so as soon as I did). Judging from those in my trading room, you rightfully ignored me. Kudos.

So what happened? Well, as Bob #bobs-oil-and-gas would say: "No Interest!"

Check out his chart from Nov 10th: he really nailed this move

Other reasons of note as Jack Kemp of Reuters sums up:

"Closely tracking the gradual stabilisation and then accumulation of inventories, the three-month calendar spread has collapsed from a severe backwardation in late September close to level in mid-November.

The spread’s weakness implies traders anticipate inventories at Cushing and elsewhere will accumulate even more in the weeks ahead."

Trading Room Updates:

My recent New Swing Long of ISRG is doing great. I regret closing WSM and INTC (and XLE) but all were for gains so there's that.Closed a few Trends today in the energy patch after warning they NEEDED to be protected.

Also closed WMT flat after they disappointed and warned of 'deflation'. Geeze, maybe it's just that AMZN continues to eat there lunch leaving less of it to enjoy.

Anyway, I do not trust that big expansion candle pointing to future selling.

I added a new one Trend today after already taking it for a nice spin this summer as swing long.

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!