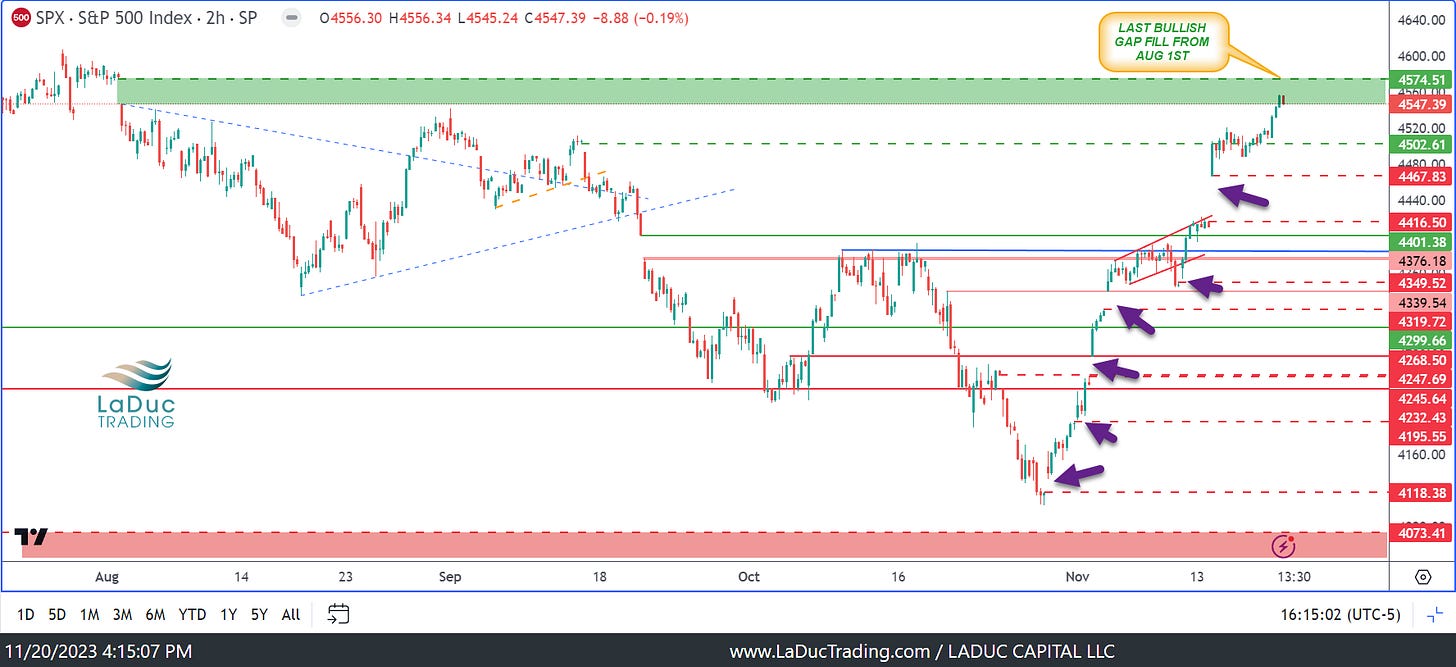

SPX Gap Fill Into Nvidia Earnings

We are running THREE WEEKS STRONG since Monday November 30th when we gapped up and haven't looked back since. All those purple arrows on the chart below represent hourly gaps BELOW, but first, as I've warned, we likely have to go tap the last gap above from August first ABOVE at SPX $4574.51 before we can pullback. Let's just call it $4575. I assume we hit it either just before or after NVDA reports tonight. That has been my SPX roadmap after we got/stayed above $4400, but warned it was possible after the Nov 2nd gap up on "Fed Pause" and "Yellen Yahtze".

After 3 weeks of grinding higher, with last week providing another strong follow through in Russell 2000 names closing +5.3% last week versus QQQ at 2.7%, my Growth-to-Value ratio is starting to roll-over again - but not enough to trigger outright short of MAG7 which have gained 105% vs a mere 19% for SPY this year.

The biggest question for most seasonality traders is how will we fare into year end given 13 of the last 15 trading sessions have been green heading INTO the start of the traditional Santa Rally.

Much will be revealed after NVDA earnings after market close on Tuesday. Calls have been robust and they are THE market darling, but no edge on how they will report or spin the report.

Other events this week for market-moving action:

Jobless Claims Wednesday instead of Thursday and FOMC minutes today.

The 20Y Treasury auction on Monday was fine, but the 6 month wasn't.

Macro Musings on FOMC Minutes from #macro-advisor-craig

We get the Fed minutes tomorrow. Reminder that the Fed is in the "buying time" business which means they are looking to sell vol when it gets too high in order to prevent a massive risk asset correction but also look to buy vol when it gets too low in order to make sure they can actually meet their mandate of slaying inflation back to 2% target.Since the meeting, both equity and treasury vol have fallen massively and now sit toward the very lowest levels of the year. Financial conditions have eased massively and the market is looking for 4 cuts next year with a close to 30% chance of a cut in March. This has happened despite core services inflation settling in the 4% range, wage momentum still firm and an economy still looking at 2% gdp growth in the 4q.Suffice to say, the market has significantly front run the Fed's reaction function again in a still sticky inflation environment that isn't falling as rapidly as the market believes. Inflation expectations in survey data also remain rather firm and figure to move higher if the stock market continues its ascent into year end.As a result, I would look for the minutes to read hawkishly tomorrow in order to dampen the animal spirits and remind the market that the Fed will not be quick to cut rates this cycle to address the growth slowdown that is on the way, especially ahead of another PCE print coming next week. Look for the Fed to try to get optionality back from the market and push out once again the timeline until Fed liquidity is coming. I would expect higher front end yields and lower stocks especially cyclicals and small caps as a result.

Our EDGE clients are very lucky to have Craig’s pro-to-pro takes - even when he’s supposed to be on vacation this week!

Asian Currency Turns

USDCNH and USDJPY rolled over on queue! See chart. We've been waiting for this.

Why was I confident they would? I continued to see DXY weakness into $103.38 (50W).

Yen bounce call was the result and it likely follows through after USDJPY rollover digests its current support level of 148. This could be a few weeks of this, but breaking below 148 provides further support to rising Yen and weakness in DXY

.

Trend Long Uranium Update

With assistance from @Tiff, here are recent updates to help further support this macro-to-micro trend that is long uranium stocks.CLUB & EDGE CLIENTS CAN READ ABOUT IT HERE

Chases Were Many

Here were my highest conviction chases Monday:

Day chases: COIN, ENPH, KWEB

Market Direction: SPX 4575

Swings Aplenty

ISRG and ENPH positions are doing very well with JETS.

From the watchlist last week of mid-cap tech plays, all did well: SNPS, CDNS, DKNG, MELI, ZS, CRWD, MDB, PLTR, CRPT, AVGO, DLAC, QCOM, DDOG

Also, as posted/discussed last week:

COMMODITIES are ramping on the falling USD - in a way they may believe USD has peaked, so it is time to position SWING LONG for some plays within the HARD COMMODITIES sector:

ETFs - XME, XLB

COPX - FCX, SCCO

SLX - NUE, MT,

KOL - BTU, HCC, CEIX

BRAZIL - PBR, VALE, EWZ

As a reminder, @Tiff manages this channel with me. Open trades are few but summaries are daily and typically cover my swing-related market thoughts, warnings, sector rotation, repeated stocks of interest, watchlist and positions so clients can pick and choose for themselves from my highest conviction calls.

Looking Ahead:

Market is overbought and we have many gaps to fill below, but we need a macro trigger, volatility and/or net selling. I have no signs of either of size post OpEx other than a very thin week this holiday-shortened trading week, and very real chance for Jobless Claims to continue higher (Wed print 8:30 am) that could introduce a bounce of VIX on $13.38 wkly support.

Given DXY is approaching a solid bounce level of 103.38, that would also time well with some volatility. We would need more than a little to push us from positive to negative gamma, however. And NVDA disappointing OR market reaction to NVDA earnings could do just that.

Housekeeping:

Craig is traveling this week.

Market is closed on Thanksgiving Day holiday Thursday with early market close on Friday (1:00 PM).

Trading room is open - even Friday.

BLACK FRIDAY ALL WEEK

Switch from CLUB or EDGE monthly to ANNUAL plan and get 20% off + 2 free months

Upgrade from CLUB to EDGE monthly or annual and get 20% off

To avail of this member exclusive - you only need to send an email to james@laductrading.com confirming they you want to switch or upgrade and he will take care of it for it!!

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!