SPX $5200 & Bonds Are Back

CLUB/EDGE client post May 9th: Focus on Bond Bounce & Bullish Equity Flows

» CLUB/EDGE client post Thursday May 9th 5:30 PM

April 30th, I was interviewed by Brent at @SpotGamma for PNL for A Cause, offering up my macro views, touching upon some of my sector rotation calls as well as my "bounce call" to SPX $5200 with QQQ to $445.

"We are half way there in this reflexive bounce"

For SPX, $5264.85 was the all-time-high on March 27th before correcting lower into $4953.56, but we have made it back to the hourly gap fill of $5197.81 I've been harping about.

Nasdaq still has some catching up up to do, as it needs to push above $442 to make it to gap fill at $445.34 before having a chance to get back to $449.34 ATH.

Point is, my bounce call is still in play.

And so are bonds.

Check out recent headlines on the same theme:

SOFR Options Wager Targets Aggressive Path of Fed Easing by 2026

Dovish Options Bet Targets Rate Cut Priced Into July Fed Meeting

Traders Weigh Next Move After Short Bond Wagers Scrapped

Treasury Option Trade Targets 10-Year Yield Drop to 4% by June

Stocks, Bonds Gain After $25 Billion Treasury Sale

@parrmenidies made a really good point of late:

Three years ago, there was very little yield cushion for investors considering buying Treasuries, or any US high grade fixed income.

In May, 2021 investors would begin losing money on a total-return basis if the 2-year yield rose just 6 bps.

With the selloff in yields, investors considering purchasing the 2-year now have 170 bps of room.

In large part, it is lower INFLATION EXPECTATIONS that are helping to support bonds and raising chance of rate cuts.

That is why, next week - between Tuesday morning PPT at 8:30 am/Powell 10:00 am, and the 8:30 am release of the latest CPI print - we will have what qualifies as the biggest macro-event risk this month. If the print is hot, Fed cuts get dialed back. If not, they get pulled forward. It is binary and will affect stocks and bonds accordingly.

Goldman even puts out a cheat-sheet for those who want to position for the volatility or hedge.

In the meantime, earnings expectations keep rising! And market continues to chop higher in expectation of lower yield and strong economic growth.

Bullish Flows Building

Corporate Buybacks:

According to a recent article at Money.com:

More than $383 billion in authorized share repurchases have been announced over the past 13 weeks, marking a 30% year-over-year increase and the most since July 2018.

Part of that was AAPL at a record $110B as well as GOOG at $70B authorized buyback.

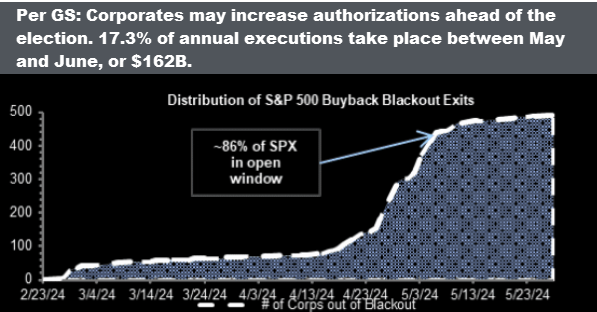

Per GS:

Corporates may increase authorizations ahead of the election. 17.3% of annual executions take place between May and June, or $162B.

Long story short, 86% of SPX companies are now in the open window to buy back stock. This is a tailwind for those equities that will have purchases.

Quants:

Via TheMarketEar: ‘The vol control crowd has puked equities, but if we continue to tread water, they will be big buyers.’

McElligott writes. "...daily 50bps SPX changes over the next 1w would be +$23.3B of buying…and daily 50bps changes over the next 1m would be +$58.4B of buying"

And why is implied vol staying so low?

@countdraghula sums up well:

Market gets the message loud and clear - the fed isn't letting bond vol come back like in '22/'23 by retaining tight control over rate expectations.

Traditional business cycle vol is non existent.

Low risk for vol sellers (even if volatility risk premium is pretty tight now)

CTAs:

On equities:

"We estimate >$80bn of outflows in the last month across equity ETFs and systematic strategies. Whilst that doesn’t mean a full positioning washout has taken place, it suggested to us an entry point for tactical bullish trades.

In the case of a continued rally in equities this week, we expect to start seeing CTA inflows. Our model suggests that if equities were to rally back through YTD, we could see >$15bn buying of US equities from CTAs."

On bonds:

CTAs are running an estimated $324bn short bond position. The potential bond buy could be huge. Per GS, Rubner.

@options_insights summarizes best:

"When the Bond CTAs have upside convexity, owning bonds is doubly attractive as you earn carry from the bond yield."

Which kind of brings me full circle to: BONDS ARE BACK!!

And with financial conditions supporting earnings, and earnings expectations ratcheting higher...

As US dollar and yields soften...

And Oil with Volatility are range-bound or falling....

At the same time: Dealers are long gamma; Corporate buyback window opens; and CTAs are buying stocks and especially bonds...

It's hard to be bearish stocks or bonds!

At least until we see what CPI brings Wednesday!! ;-)

PNL For A Purpose!

Brent & Team at @SpotGamma went 12 hrs straight!

Interviewing 25 macro-focused guests talking their books!

You get to pick the price of your ticket!!

Show some support. Show some love. Donate now.