Short-Term Rally Targets of High Conviction

CLUB/EDGE client post Thursday, August 22, 2024. Focus on policy intervention to keep US 10Y yield above 3.8%.

» CLUB/EDGE client post AUGUST 22nd, 8:57 AM ET.

Jobless Claims Still Under My 267K Line-In-Sand

My mantra for many months..

“My bet: This crowded trade in VIX and Notes/Bond shorts will amplify market shocks as "growth fears" transition into recession fears when:

1. 10Y US yield stays below 3.8%

2. Crude oil crashes + stays below $70.

3. Jobless claims get/stay above 267K”

And this morning...

They are really working hard to keep the US 10Y yield above 3.8%!

USA Initial Jobless Claims 232K Vs 232K Est.; 228K Prior

Now we just need BOJ to punt tonight (talk back the .25 bp rate hike) with Powell Friday (normative not accommodative cut), and we run into $NVDA earnings Wednesday.

With that, here is a reminder of my PTs given to clients from my live trading room and #trading-room-notes:

$QQQ $495.41

$SPX $5658.88

$AAPL $234.29

$XLK $232.84

Then let's see.

These are my short-term rally targets of high conviction given to clients.

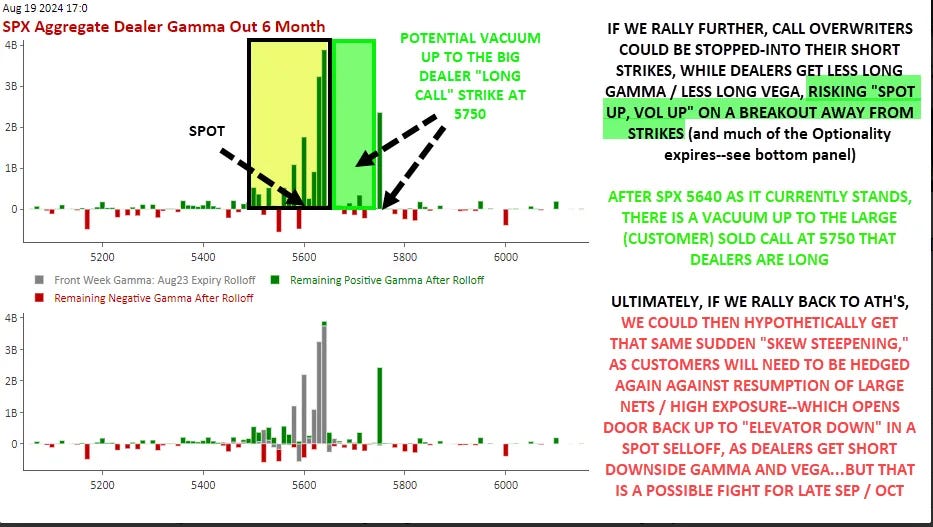

If they close above on daily, then we are at risk of a short-duration melt-up (option-fueled), as per McElligott of Nomura.

Market is getting more unstable not less, big picture.

But I also believe *they* will do what is necessary until Nov 5th to keep markets levitated... IF oil & yields + jobs don't crash lower.

With that, an obvious price extension for this rally when/if the above gaps are filled would be ....$5750 - which is the JPM Collar that expires September 30th.