September 4, 2025 Live Trading Room Market Recap & Trades

Unlocked - so you can see what you're missing & upgrade to PRO!

PART 1: Premarket Review / Rant — Focus on S&P 500 Fair Value

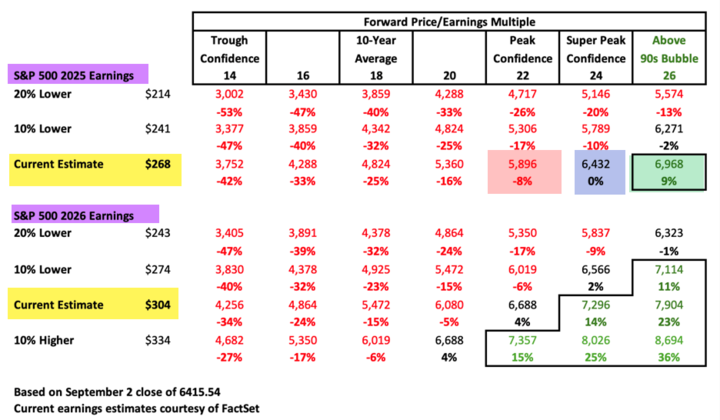

Fair Value / Historical Context:

S&P expectations of 4% Q2 growth were smashed: printed 11% and is big part of reason why SPX ramped / and is at high multiples.

PE ratios range from 14 to 26: 14 at 2020 low; 24 at 1999 highs. Average forward multiple over last 10yrs at 18X.

Current consensus 2025/2026 earnings estimates are $268/304 per share. Grid shows lower/higher estimates and corresponding S&P 'fair value' used by macro/fundamental analysts to determine if market is over/under/fairly valued.

SPX at 6500 trades above long-term fair value (24X) vs historical (18X). Compared to the 2000 bubble, current multiples are stretched! But... supported by liquidity, mega-cap AI narratives, loose fiscal and monetary easing, also fiscal dominance and falling value in US dollar.

But the index is also overvalued by 16 percent using the 2025 estimate of $268/share. That's $5400 area.

DataTrek estimates: The S&P is right around its fair value (within 4 – 5 percent) just now if the index earns either the expected $304/share or 10 percent more in 2026. If the S&P only shows 2 percent earnings growth next year ($268/share this year, $274/share next year), fair value is 15 percent BELOW today’s close.

Earning Risk = Volatility Risk: if liquidity wobbles or employment market shocks, valuations will suffer and equities will be de-risked.

PART 2: Macro Matters & Intermarket Review

Market Chop:

Expecting chop into the Sept 17 FOMC. Seasonal Sep/Oct weakness challenged if corporate bond issuance delights.

Thursday calling for green close - just like I did Tues & Wed; red close on Friday.

Liquidity:

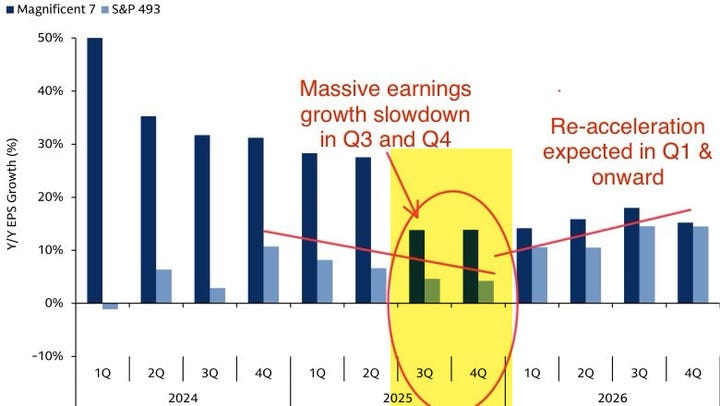

No deterioration in liquidity yet: Fed liquidity > concerns around RRP drains (“bearporn”); corp buybacks until 9/14, passive flows to eventually slow on job losses, Q2 earnings beating handily keeps equities bid until Q3/4 disappointment.

CTA flows ~100% long and now reducing into selling ($70B). Dealers’ positioning adds to chop risk. Follow Jason's channel for daily updates: volland-dealer-positioning

Internal indicators also holding up under surface - with my rate differential indicating weakness for Friday.

Labor Market:

Expecting labor market weakness: NFP Friday & Job Revisions Sept 9th, but that is to be offset by rising rate cut odds. Short-term bullish but not long-term. It will pull recession risk forward as warned repeatedly and often.

Also why market chops: Weak revisions could accelerate growth scare → rate cut hopes but CPI risk (expected hotter) will complicate Fed decision.

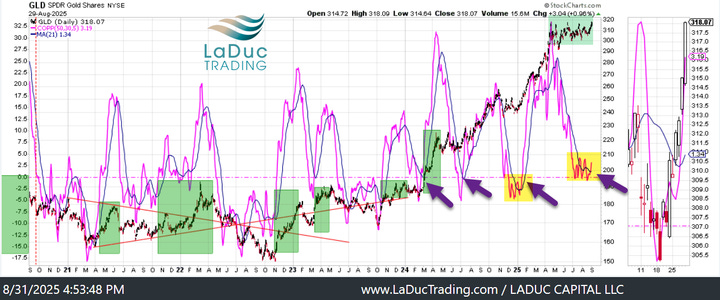

Gold Run (Parabolic Trend Now):

Gold and miners remain the leadership trade, but parabolic behavior = risk of digesting behavior for last-in-first-out traders.

GDX: Pushing toward 67 (2011 ATH zone). This was my price target from June 3rd client post - 3 months ago.

Junior Miners have the most to run (NGD, EQX, CDE, HL, IAG, EGO, SAND): Breakouts above critical long-term 66 MONTHLY support for GDXJ is key.

Warning: at GDX 67, watch for trap-long/liquidation if parabola fails.

Coppock Curve (Gold): Extended >0 consolidations → parabolic thrusts.

Market Bounce (Day 3):

Markets stabilizing with QQQ gap fills, and MAG7 strength intact.

Bias: Green close today. “Day 3 bounce” supported by option flows, net buying under surface, and breadth not breaking.

Friday red close.

MAG7 Ratio:

Still holding Dec highs, no deterioration. Strong expansion candle in latest session. Until reversal, tech leadership intact.

Calendar Risks / Catalysts:

Sept 5: NFP.

Sept 9: BLS revisions + Apple event (key shake-and-bake date).

Sept 11: CPI

Sept 17: FOMC.

Sept 19: Options expiration

Last Sept: Corporate bond issuance.

Oct 1: Gov’t shutdown risk.

PART 3: Stocks & Assets Covered (with Levels)Indexes & Vol

SPY: Green bias today.

QQQ: above 574.44 is bullish; bearish below

VIX: 15.50 - 17.50 ping pong

Metals & Miners

GDX: Watch 67–68 as parabola risk zone.

FCX: Key >46 bullish; looks good to 49 as swing PT.

Healthcare / Biotech

Hospitals (HCA, THC): Strong continuation.

BSX: Gorgeous trend. Above 107 wkly close = breakout after all of 2025 consolidation & repeated attempts.

AZN: LT uptrend intact since 2017; breakout >87.68; support >78.

XBI/IBB: Momentum >91 / 139.

ISRG: bullish bounce > 449

China ADRs: News of China tapping down on speculative trading causing weakness.

BABA: still gorgeous monthly chart. Not worried as long as closes > 120 wkly.

JD: Next “BABA.” Needs >32.80 → 35. Must hold >29.

BIDU: finally pushing > 90.45 wkly close; up $10 this week; 101.69 wkly resistance to expect dighestion; gorgeous monthly scoop pattern/trend reversal.

KWEB, FXI, EEM: Still trending well long above 10W EMA

Crypto

BTC: Stable near 110k.

ETH: Cooling after breakout.

SOL: Needs >186. Likely attracts the BTC & ETH buyers next.

Other Themes

SAP / EWG / DB (Germany): Still expecting trend breakdown/reversion to mean.

WYNN, LYS, MLCO (Casinos): Rec'd long 8/21-8/29 when I warned I expected last Fri to 'be it' for this run. They pulled back PERFECTLY on cue.

Client Requests:

HIMS: Great bounce off 200D Tues into 55D PT with 52.72 PT. Lots of overhang there so tough to get through.

C (Citibank): not safe swing short until breaks 90.

PART 4: Charts of Interest

DataTrek S&P Fair Value Grid - know what you own.

Gold: Coppock Curve as posted last month that it was consolidating & preparing for its next breakout move higher.

BONUS: MSTR: May be added to SPY (unusual option activity) - found after closed live trading room

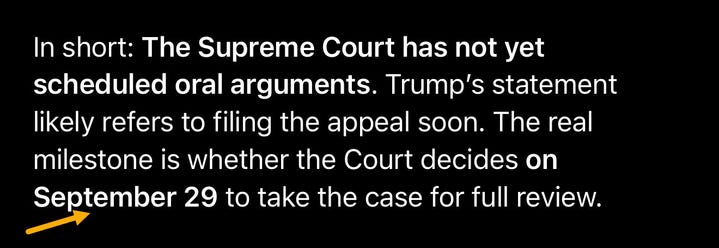

Tariff Appeal Case: Supreme Court decides whether to take case Sept 29th

Expected Q3/4 Earnings Growth Slowdown: MAG 7 vs SPX493

"Thursday calling for green close - just like I did Tues & Wed; red close on Friday."

-4 for 4! And my personal fav new feature. haha. Can we see if we can get a streak going? I promise not to be mad if it's ever wrong because that in itself will still be valuable/informative/tradeable ;)

Amazing summary. Thank you very much for giving us your substack tier some A.I. tech updates as well!