September 2, 2025 Live Trading Room Market Recap & Trades

Unlocked - so you can see what you're missing & upgrade to PRO!

Gonna try a little something different on you for feedback.

Tuesday’s live trading room video & transcript were fed into ChatGPT to grab highlighted macro-to-micro commentary along with stated price levels, direction, timeframe etc on trade setups for your review.

I gave it these types of prompts:

Highlight what macro matters now and my intermarket analysis.

Include most important charts for bears: "steepener", growth/value ratio rotation, Nvidia head and shoulders pattern with QQQ H&S pattern etc

Review stocks specifically covered: NVDA, QQQ, EBAY, DB, FSLR, ORCL, AAPL, SPX, VIX, BABA, JD, Shanghai Stock Exchange, VXN (Nasdaq Volatility).

Here’s the output (edited) - minus the custom client engagement where I answer macro-to-micro questions across many assets & timeframes.

PLEASE LET ME KNOW WHAT YOU THINK!! As this could help me get these daily room reviews out faster with more consistency ;-)

Macro (what matters now)

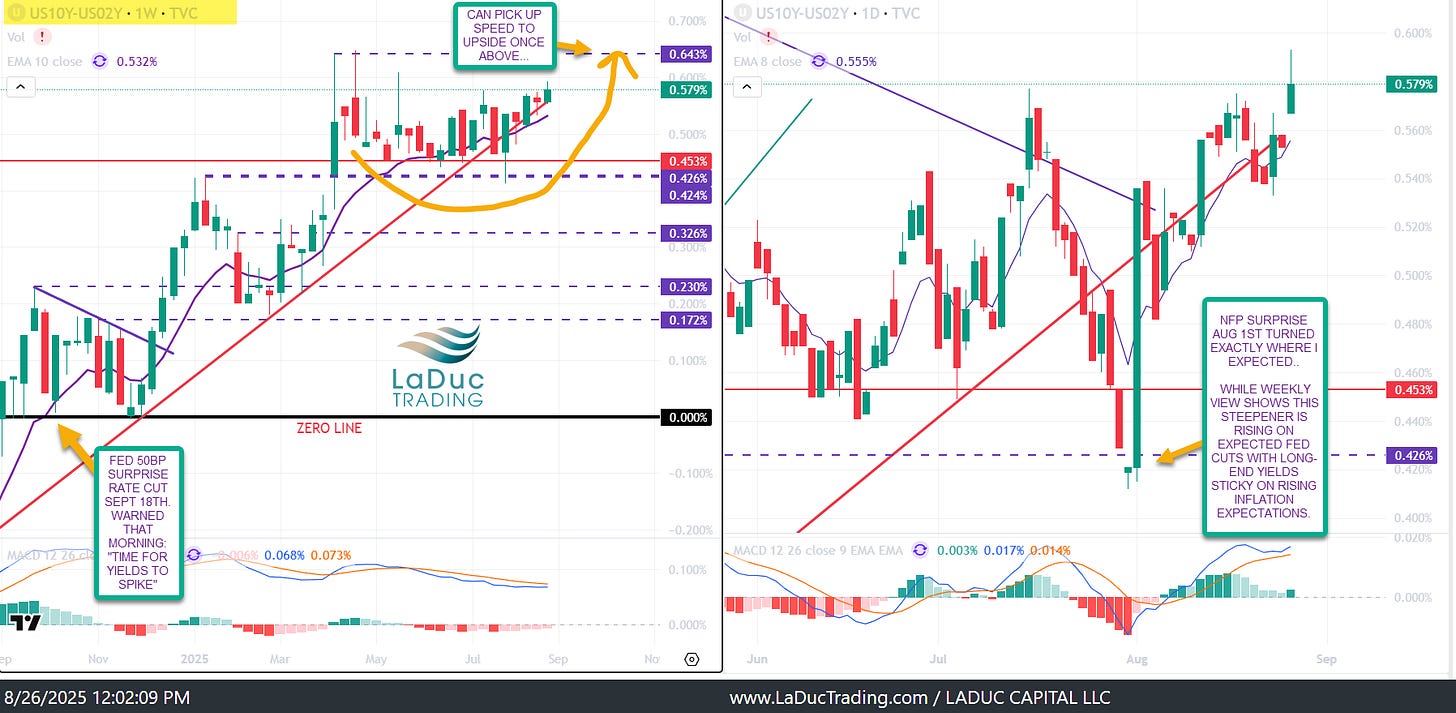

10Y2Y Steepener is ready to launch by ~October: where 2-year yield falling faster than 10-year; a break > 0.64 should cause steepener to pick up speed, coinciding with equity stress.

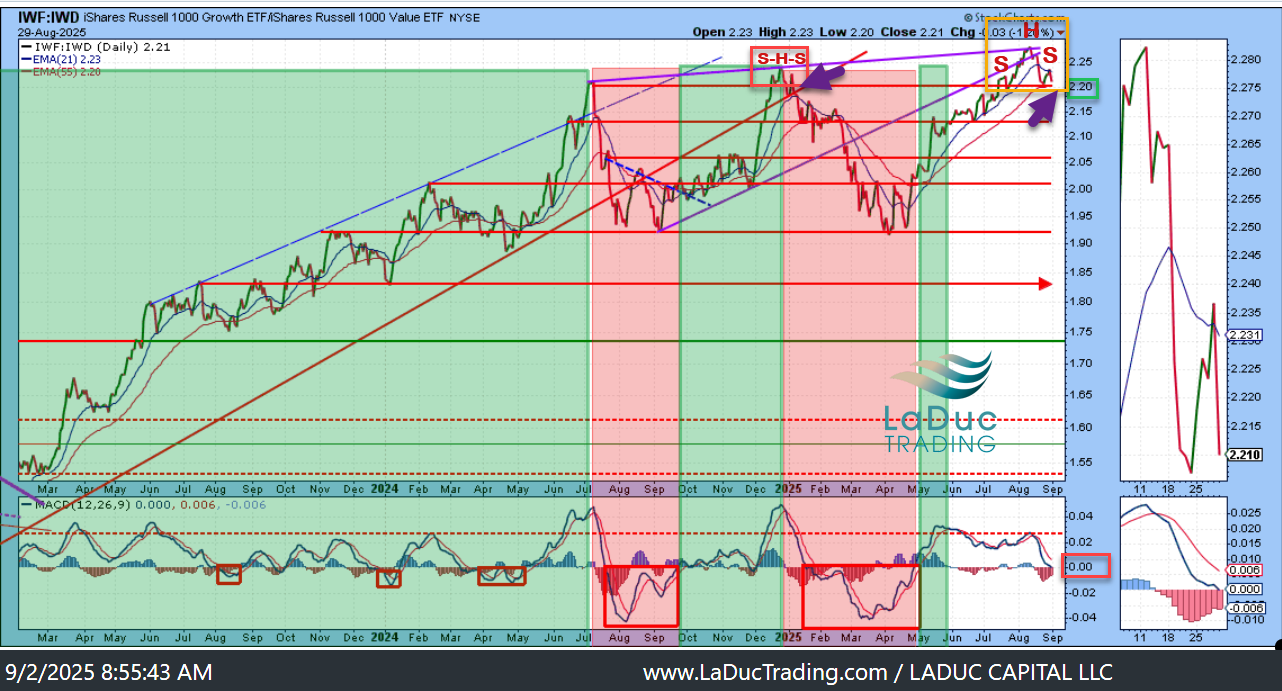

Growth/value rotation risk: Ratio sitting on a 2.20 neckline (wide H&S). Below 2.2 with MACD < 0 = “bigger growth scare.

Credit bond issuance: September issuance is expected to be strong (buyback ammo). Without a macro trigger to interrupt - like potential US Government shutdown ~October 1st - this alone could drive market higher into yearend.

Seasonality & Economic events: I already warned for market weakness post NVDA earnings, into Friday of Labor Day weekend, before NFP Friday and before job growth revisions Sept 9th. Basically, expect chop all the way to CPI and then FOMC meeting Sept 17th. Right up into announcement of Sept corporate bond issuance and then let’s see if US Govt shutdown risk and labor market weakness start to trend - and with it, VIX.

Intermarket read (quick hits)

Breadth & risk-on tells: % of S&P above 200-DMA still >65% = constructive until it breaks below; crypto (BTC/ETH) holding = liquidity not cracking. Breadth in NYSE still expanding, albeit extended. Net buying still trending higher, albeit choppy of late.

Volatility: Getting closer, but still needs VIX > 19.29 intraday /19.50 weekkly close. VXN is further along so > 23.52 weekly close points to ~30.

Rates: Overall chop in 10Y within 4.1–4.5% still goldilocks; 30-Year UST: becomes trouble if it pushes > 5.2%; below that, it’s noise/chop.

yield curve steepener is bigger trigger to watch, not absolute yield prints.

USDJPY: Over 8 weeks of sideways. Descending 200D. Yen carry trade unwind risk low for now despite multiple BOJ ‘yen interventions’ since February. Needs 145 to trigger US equity risk.

USD & Oil: USD bounce lacks trend reversal properties; still big dollar bear on devaluation, dedollarization, debasement; oil choppy (XLE 86–90 target achieved; likely digestion at 90).

Metals/Miners: Trend-long gold, silver & miners working; Breakout in gold after Trump fired Fed Governor Cook last Monday. Watch for digestion in precious metals after GDX ≈ 67 prior 2011 high (as posted early June); GDXJ “blue sky”catch up trade as discussed past few weeks. BPGDX ~100 → extended but not rolled over yet so looking for macro trigger to cause gold complex to digest/revert to mean.

Stock & index reviews (levels & targets)

NVDA

Key: 172 (neckline/“line in the sand”) gapped below into 169 short price target given last week.

Support: 169 (10-week EMA), 165 (overshoot).

Bounce path: 169 → 173 (gap fill), → 180 if >173 holds.

Breakdown target: ~152 if <172 persists (gap-down follow-through after bounce).

Context: H&S after earnings; China competition as major narrative headwind.

QQQ

Key: 575 (trigger/ short below)

Support: 559 short price target given last week (10-week ≈ 559.54), updated 557 support/risk if weakness extends post-NFP.

Upside: 568.54 daily gap-fill on bounce from 559 before rejection.

Risk tell: VXN > 23.52 → ~30.

SPX / ES

Gamma flip: 6407.

Pivot/defense: 6427; rejection there = lower.

Downside target: 6341 (watch into NFP).

Tape: SPX Put monetization when VIX < 19.5; otherwise falling back below market gets defended.

EBAY

Short from 8/25 from 100 to ~90 (10EMA 88.50) after break at 93.46 / 92.79 led to reversion to 10-week (target hit).

Next: Failed bounces at the 10-week risk a fresh leg lower; reclaim above 93.46 daily close neutralizes short.

Deutsche Bank (DB)

Short from 8/26 on exptended chart pattern, still hasn’t fully mean-reverted.

Magnet: 33.51 (mean). Lose it → deeper channel support.

First Solar (FSLR)

Range thesis: ~220 → ~180 working well. Needs to digest a flattening 200D before it can turn higher with conviction as trend long, recommended at 138.

Structure: Holds > 177–180 for the next up-leg.

Oracle (ORCL)

Recommended in early August as channel play for theta-decay short: 248 to 218.

Key level: <218 weekly close keeps pressure on short to 198.

Apple (AAPL)

Recommended long into 221 then as channel play for income harvesting: 237 to 220

GOOGL anti-trust news triggered AAPL spike into 238. Above is bullish; below is more channel chop.

Event Risk (Sep 9)

BABA

Recommended long since early 2024.

Has been constructive >117, now 126.80; prior high/overhead ~148.

Gap-up digestion expected; CN > US rotation tailwind.

JD

Early/lagging; explosive upside potential; support ~30, unhappy < 29.

Trigger: > 32.80 opens → 36 quickly (squeeze setup), but option tactic needs time (Oct $35 earliest; Jan better)

Shanghai Stock Exchange (SSE Composite)

Weekly/monthly structure very strong; momentum lighter than prior cycles, but trend turning up; better beta often in HK names even as SSE rises.

LOVE IT--