PART 1: Premarket Review +/or Rant

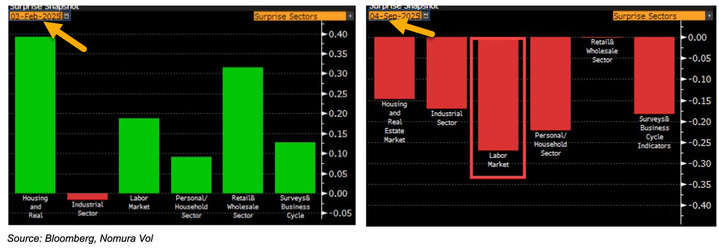

Let’s focus on CPI rising with Jobless Claims. Also let’s not ignore the BS meter: ORCL "RPO" promises plus AI Stock Concentration Risk growing to eventually become unwieldy at same time economic data under the surface is deteriorating as per McElligott at Nomura.

PART 2: Macro Matters & Intermarket Review -

My growth rotation call still in play with broad-based advances today helping to give the AI ecosystem stocks that moved strongly Wed a break to digest so value plays (RSP) catch up. Strong banks for example. But also falling US dollar and yields pulling VIX lower, SPX higher into my "HELL-BENT ON SPX 6666" target. Again, no breadth destruction or selling under the surface so market is strong ahead of FOMC.

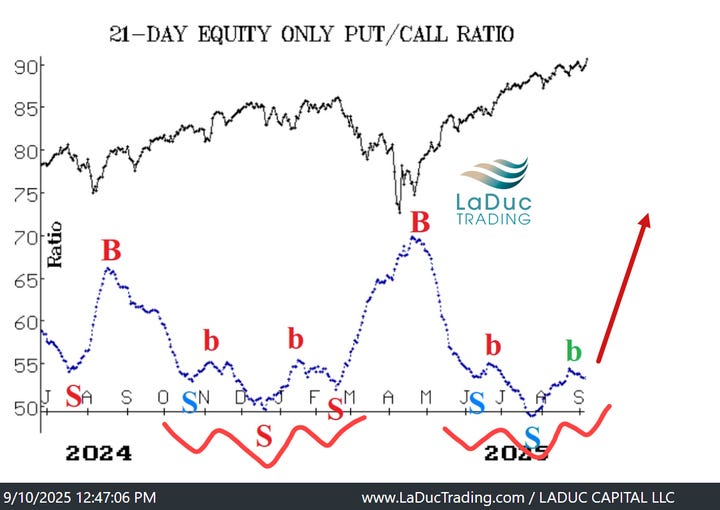

Having said that... there is a growing divergence in the 21D EQUITY ONLY PUT/CALL RATIO that Client Brian highlighted... could be setting up a bull trap similar to Feb-Mar, but I have to see some selling under the surface first and as I have reported daily: I have not.