PART 1 Macro Review/Rant

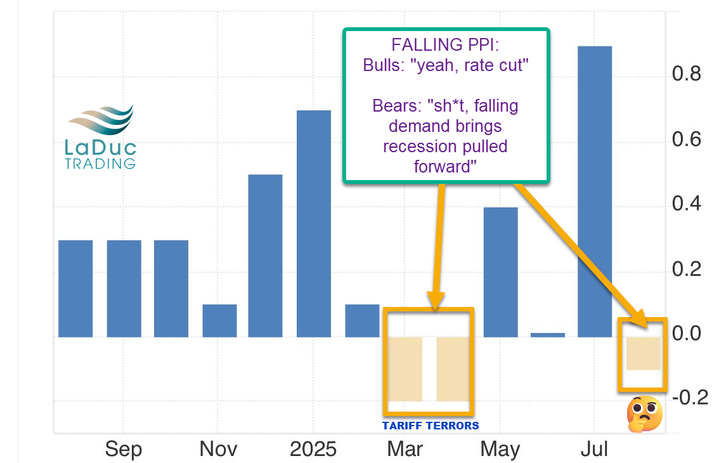

PPI miss → Algos treated weaker producer prices as bullish (rate cuts, consumer relief), but I see it more as falling demand — a recessionary impulse, especially with tariffs excluded from PPI.

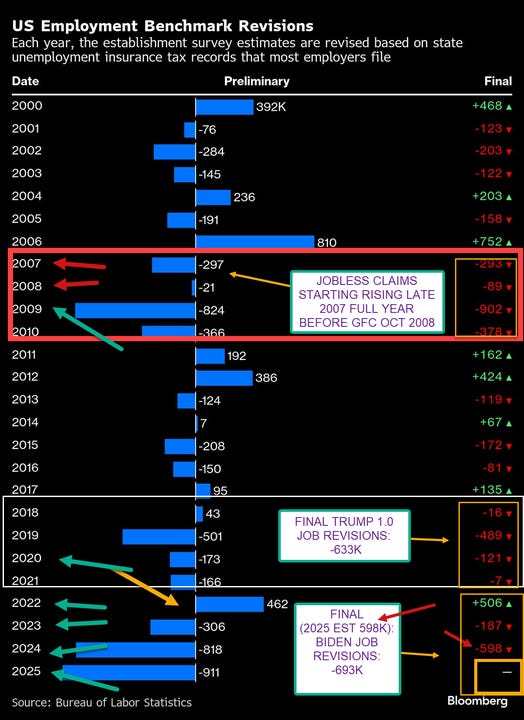

Labor revisions:

Biden → major downward job revisions in 2023–25, even while markets surged (NASDAQ doubled).

Trump 1.0 → 4 straight years of negative revisions.

Comparison to 2007–08 → jobless claims started creeping higher 2H 2007 before Oct 2008 GFC triggered with -50% crash into March 2009 at SPX 666.

The tell = jobless claims: Still in the 227k–237k range. Once above 267k and sustained, start the clock for a true market unwind.

Policy backdrop: Every job-loss cycle since 2008 has been countered with QE/stealth QE. Stimulus props up markets even as labor deteriorates UNTIL IT DOESN'T.

2. Market & Intermarket Review

Oracle’s earnings “extravaganza” → Despite technically missing, its backlog + OpenAI/NVDA tie-ins created the biggest stock shock of the year. Shares now 36% above long-term mean — unprecedented, “2000-vibes.” Analysts chasing PTs higher (up to $410).

Growth rotation still alive → Growth:Value ratio bounced strongly off 2.2; now testing soon 2.3. Above = melt-up, rejection = stall.