“Selling America”, Rotation, & Gold & Silver Long Warning

So Far So Good With The Rotation Call

The Russell’ beat the S&P for 12 straight days, longest streak since 2008.

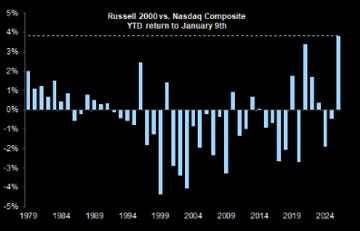

Strongest relative start for small caps over NDX since 1979.

Small-caps are leading large-caps not just this year (+7.9% vs 1.5%), but over the last six months (22% vs 12%).

Here’s another reason-for-the-season:

Going back 50 years, the forward price-to-earnings ratio of large caps versus small caps – of only profitable companies – showed that small caps are trading at about a 20% discount.

Excluding the COVID 2020 recession, this represents the cheapest small caps have traded in the 50-year period dating back to 1975.

Relative strength in small-caps means the bull market is broadening out - as discussed at length this weekend:

Earnings, Economic Data & SCOTUS

Earnings season is always the busiest as there is so much data overload, so just a reminder to PACE YOURSELF.

The high points:

Tuesday: MMM / DHI / USB / FAST / NFLX / UAL / IBKR /

Wednesday: JNJ / ABT / PLD / TRV / ASML / HAL / PNFP /

Thursday: PG / GE / FCX / UNP / INTC / COF / ISRG / AA

Friday: SLB / BAH / CMA

Key Economic Data would be market-moving if inflation was expected, but it’s not and rate cuts for January are not likely / priced in.

Tuesday: ADP Weekly Employment will provide a private-sector glimpse into labor demand stability

Wednesday: Pending Home Sales is a leading indicator for the housing market and mortgage demand

Thursday: Q3 GDP (Updated) and is estimated at 4.3%

Friday: PCE & Core PCE (Dec) is Fed’s preferred inflation gauge

SCOTUS Rulings are the real wild cards.

Supreme Court adds Tuesday, January 20th to its opinion release calendar as tariff decision looms. We don’t know if they will announce but be on alert!

Then Wednesday, January 21st the court hears arguments on whether Trump can fire Fed governor Lisa Cook. If he wins, the precedent lets him remove Powell sooner rather than later. That’s not priced in.

Options Market Structure

(I was assembling this Friday... )

According to MS last week, it’s a good time to buy cheap optionality in the market - upside or downside.

Options markets are pricing just a ~10% chance that the S&P 500 moves more than ±5% over the next month (14th percentile vs. the past five years).

One-week SPX implied vol has dropped below 10%, back to summer-2024 lows.

Volatility is suppressed; positioning looks one-sided.

Luckily, I had already warned live Friday:

Careful of weekend risk. We get a surprise every weekend from Trump.

The daily wedge was about to break and it wouldn’t surprise me if 6807 was tested next given Friday 16th monthly expiry.

Gamma just went slightly negative which allows for an air pocket type action.

SpotGamma echoed VolLand warning:

...increasing put skew and growing volatility premiums indicate traders are starting to brace for downside volatility in the face of the market’s climb.

Volatility skew shows us that defensive positioning has begun building: as SPX approached 7,000 this past week, traders began heavily selling 0DTE calls and buying longer-dated puts. This pattern suggests large players are reducing exposure rather than pressing bullish bets amidst market strength.