Samantha's RECORDED Live Trading Room - 2/7/25

Samantha's TRADING ROOM SUMMARY NOTES open to all today!!

Samantha’s Live Trading Room Summary - 2/7/25

Weekend risk came early! So last two Mondays have seen big gaps down. The prior on DeepSeek and the latter on on/off/on again tariffs. Well, as markets were digesting the NFP news this morning (lower UE rate drop of 4% but higher average hourly wages .5% MoM + 4.1% YoY) with bearish UMICH news (big drop in sentiment with big spike in 1Y inflation expectations from 3.3% to 4.3%), Trump announced that “recipricol tariffs” would start TODAY. Derisking started immediately. Peter Atwater summed it up best: This is a CAT IN THE HAT market. Total chaos but magically cleaned up in time before the parents get home. My advice, still: Zoom Out. Pace Yourself. It’s gonna be a very bumpy (min) 180 days.

Dollar is bouncing as Gold sells off. Reminder, I have warned even though precious metals are trend bullish, this choppy place for recent swing longs (last month) begs for GLD $270 sold calls.

Bonds 10Y sold off EXACTLY where I posted Wed they should soften, but that’s just the digestion I expected, not a rejection of the trend: weaker dollar, yields, oil. Watch the yen. That’s all I’ve got to say about that. Oh, and Japanese PM Ishida just entered the White House to meet with Trump. Will he be looking for some coordinated help given the JGB 10Y yield is pushing 1.3% and they may need a yen intervention but with Yellen no long in play, Ishida needs new policy intervention allies. Will he find them in Trump & Bessent & Musk? Place your bets.

Indices are a baseline chop-fest, but I did warn yday (last line of my #trading-room-notes) that: “my US30-JP30 rate spread is warning market weakness intraday can expand out to larger timeframes.”

TRADE UPDATES/STOCKS OF INTEREST

NVDA did exactly what I wanted/expected/posted. Ran from 113 strong support into 125/126 yday before ramping into my 129.80 PT for TODAY where I warned I expected it to come back into 125/122 area. I didn’t expect it would happen in a 15min candle, but whatever. The pushback is in play and this is fine for my financed call spread in APR.

TSLA CHASE short from Tues working as is the new one near open today in AMZN. Big picture, I’m still swing/trend long AMZN - this is but for a trade into 55D around Feb Opex.

SPY & QQQ formed bearish engulfing daily candles so probability is to weakness next week, but should we get a ramp higher on removal of tariffs or headline like “Trump and Xi had a great call”, then we need to get/stay above SPY 609 + QQQ 534 to run the bullish race again.

Speaking of China, yeah, the Chinese ADRs are still working. SSEC opened up 7% higher so we are above “the wall” for now.

ASTS - Tues call-out above 22 not only ran to 25PT; it gapped above it then got an upgrade and today, as if on cue, it got rejected at wkly bollinger band near 29 + fell $2. But… if it can stay > 25.18 on wkly (23 wkly close), this will still be bullish, although chaotically as it is a volatile one.

Speaking of volatile, remember BBAI - the little brother of PLTR - it has stayed in play above 2.63 breakout, not closing < 10W past 9 wks, before exploding higher on PLTR earnings Wed with follow-through today into near $9.

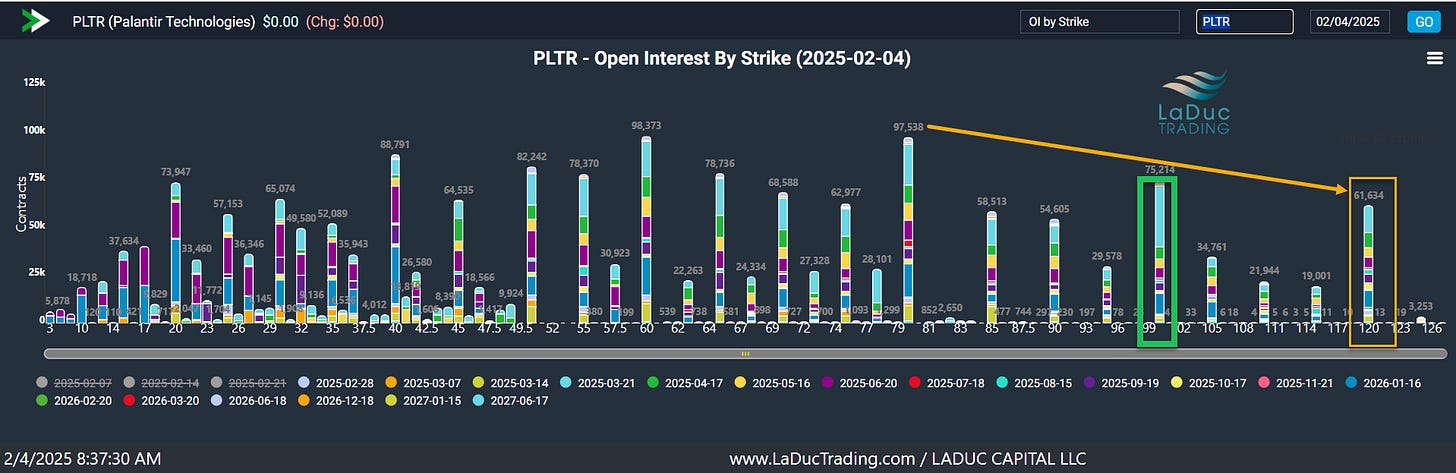

PLTR didn’t stop at 106 for long - level I gave post earnings where I expected it would digest before pushing into $120/126 where I really think it’s done. LOL

DOCS! Congrats Dr Alex & those who followed along with his trade AND detailed write-up on Doximity which resulted in an earnings beat for +37% move today!! Another friendly reminder to follow his slack member channel at #kentons-corner-of-biopharma.

X - omg whiplash!! So, I was JUST talking about bullish XME, FCX, X looked before this week & especially today. But then, news hit that Trump was AGAINST Nippon Steel buying US Steel and stock dumped -10% before reversing higher +15% off the lows on news he was just kidding. PS. Geoffrey is very bullish into ~$45.

UBER - best chase today, but more than that, it has finally chosen a direction post earnings and it is a nice swing long as rec’d > 65 wkly close on breakout ? 69.30 daily or 70 at 200D. Well, it opened at 70.35 and that’s all she wrote. My PTs have all been taken out as it raced +9.5% into 76.46. I’m expecting a move higher with much volatility. Think: If 80 then 100 potential, but in reality it MUST stay > 200D. If you want to play this one actively with options, check out Hans’ slack channel as he has it as a core position: #options-mentor-hans.

NET - no edge with earnings but it just hit my projected PT from that gorgeous scoop pattern on wkly AND measured move from breakout at $86 trendline: “If $86 then double”. We are there.

TTWO - $215 monthly resistance & PT. Should digest a lot then, pullback to $200 wouldn’t surprise one bit. Once above 215 however, it is blue skies.

FTNT & CRWD - were bullish bets from Archna. See here slack channel: #archna-advanced-options. Both are in blue skies.

INTU - Swing Short update: $580 tagged today. ‘Should’ bounce, but break of 100W here brings 558 overshoot.

Last but not least, I have a very MACRO-focused market thoughts posted that covers my past, present, future analysis of not only the “Trump Trades” based on fiscal & monetary policy clues, with focus on dollar, yields & oil, but I specifically road-map my Oct 2024 client post with an update: PEACE: The Trump Trade Revisited. Please have a look. And with that I wish you a great weekend!!