Samantha's RECORDED Live Trading Room - 2/12/25

With #LTR Notes - by Samantha, Rithika and Mikey

Samantha’s Live Trading Room Summary - 2/12/25

We should be down more… Given that hot CPI print this morning & 10Y yield spike & 10Y2Y bear steepener. Even my US-JP rate spread dropped as my USD-10Y ratio popped. We should have sold off more... so... that shows TGA is in the house providing liquidity, as detailed Monday premarket for clients. CAT-IN-THE-HOUSE MARKET indeed!!

What is not down, but nicely up are the bullish bets I presented pre-earnings:

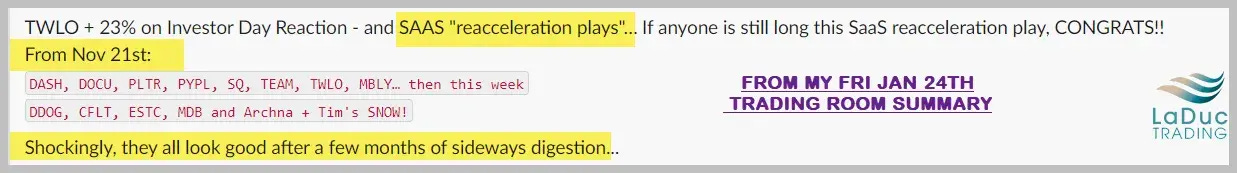

SWING UPDATES:

CFLT - Beat last night then at open when $33 I should “the scoop” and reminded what I wrote back in November: “I still like CFLT above 29; it could double from here in time.”

ESTC - has earnings 3/6 but has a similar scoop, space, SAAS story. Must stay > $105 to bring $136.

DASH - is darling. Now that’s a trend of means since August breakout with shallow pullback since Nov (never breaking its 10W) and now digesting $200 well post earnings yday. Still have 218 in play.

UBER - an update since open on Fri above key 69.30 & 200D is up $10 in 3 days, mostly on news Bill Ackman acquired $2B worth. Still looks good on all timeframes but it can be a volatile one!

UPST - had earnings last night but given success from BNPL space in general (as discussed) and AFRM in particular, not a surprise this one beat. Hitting head on monthly resistance at 88.72 likely means digestion here, but once it can get/stay above it can also double. Shocking, I know.

CSCO - I highlighted this last wk & again as Dan Niles pick as long as it stays > $60. It tagged 67.50 afterhours tonight on earnings. Nice chart indeed.

GILD - beat earnings last night AND made it above $100! But that also means it is hitting 103.10 MONTHLY resistance = likely digestion here...

Protect to 94.50 10W / 96.14 daily gap fill. But once it can get/stay above it moves higher: 113.31, 120.29, 123.37 ATH. And above 123.37 and it will be a widow-maker no more ;-) @Alex Kenton can give you the fundamental reasons why it is bullish/bearish.CONTRIBUTOR HIGHTLIGHS:

Archna: “Yesterday I sold TSLA Jun 270 puts for 15.5 credit. I took some shares of GRAB today. I have TEM call debit spread. KC calls : Chinese cloud name”

Mikey’s AIFF - yday at 5.06 ran to 11.51 and today to 14.45.

Geoffrey: With a portfolio heavily weighted with BABA, BYDDF, LU… is up +59% YTD versus the S&P +6%.

SECTOR THEMES: