Samantha's RECORDED Live Trading Room - 1/3/25

With #LTR Notes - by Samantha, Rithika and Mikey

Samantha’s Live Trading Room Summary - 1/3/25

LOOK AT NVDA GO! ;-)))

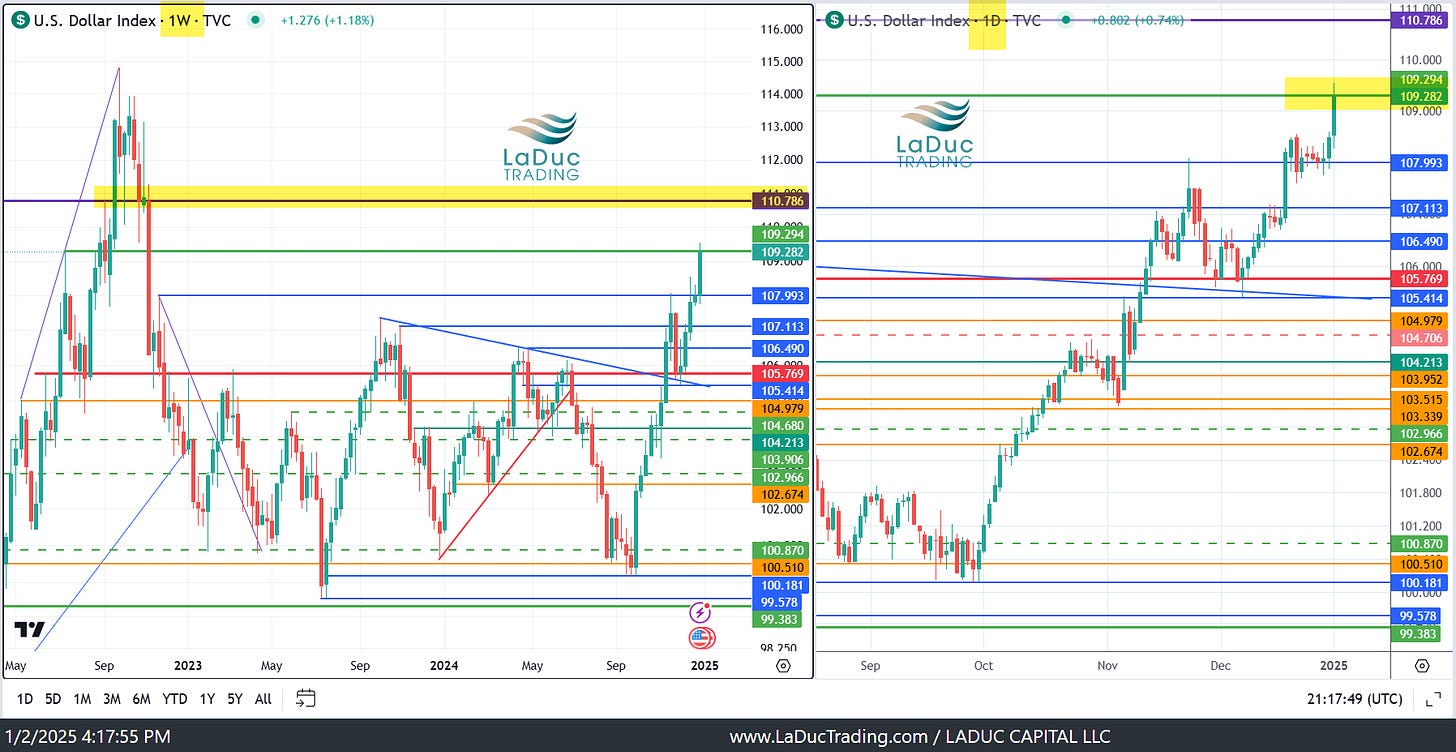

NVDA is already a financed call spread for MAR, but Jensen keynote speaking Monday at CES set free the CHASE, literally, in calls, with 145 PT on short term, but closing > 140.76 on wkly is key. Remember my warning that FinTwit-telegraphed Head&Shoulder patterns, like on NVDA on daily or SMH on wkly need to confirm; otherwise, they are a strong continuation patterns. (I repeated show this example in DXY at 104.50 breakdown level getting supported despite perfect H&S pattern - now pushing 109.30.)

QQQ - as mentioned yday, this pullback qualified for my 5bar rule, which means it’s a great place for a reversal/bounce. It bounced! Up 1.7% in large part because NVDA makes the market. Also because VIX got rejected at 19.29, AGAIN ;-)

SMH still digesting several months without falling apart in large part because of strength in NVDA, MRVL, AVGO, TSM. I’m still bullish into Q1, not withstanding the grandstanding that can take place in DC today starting at noon with Speaker of House vote and delays to Jan 6th election verification. So don’t get too short-sighted or short-dated.

AAPL has been a great short past 5 days, but it did tag its 10W today, which was my PT. As I said, I would still leave a runner into an overshoot price target of 238/237, which is STRONG wkly support.

TSLA also bounced at its 10W, which is so typical: up 7% and now above key 390 resistance.

SQ chase rec’d yday for a pop - from bullish harami on daily plus support on THREE key MAs: 55D, 10W, 200W. And not only did it gap up 4% but cont’d above $90 trigger pushing 6.5% so far.

RIVN - swing long rec’d at 12.25 with 16.50 chase & swing PT has hit!! Now, it needs to get/stay above and if/when it does (give it time!), it can double if market cooperates.

RKLB - client requested - is one super strong stock. Here’s the channel: bullish above 28.05 wkly close, bearish below 23.81 wkly close. But I see no safe way to short unless 22.55 breakdown occurs.

UBER - client requested - did indeed hold its 100W at 60 and has now formed a bullish cradle reversal formation on the wkly. Looks fabulous for more as long as it closes > 63.53.

UAL + DAL - cont’d swing shorts, just make sure you can endure the chop

USD softened right at resistance of 109.30 as expected. 10Y yields are not weak, so know your risk: above 4.69% and there will be volatility again.

WTIC cont’d higher pushing $74. Working.

IONQ is a crazy quantum play that now has a at 230x forward revenue. All yours.

CVNA is rolling over right on cue, even before Hindenburg released their short report. I mean gorgeous waterfall after breaking key $210 support, now 182 as APO (its debt financer from 2022) looks ready to take a header as well on break of 165