Samantha's RECORDED Live Trading Room - 12/11/24

With #LTR Notes - by Samantha, Rithika and Mikey

Samantha’s Live Trading Room Summary

SO many themes are working…

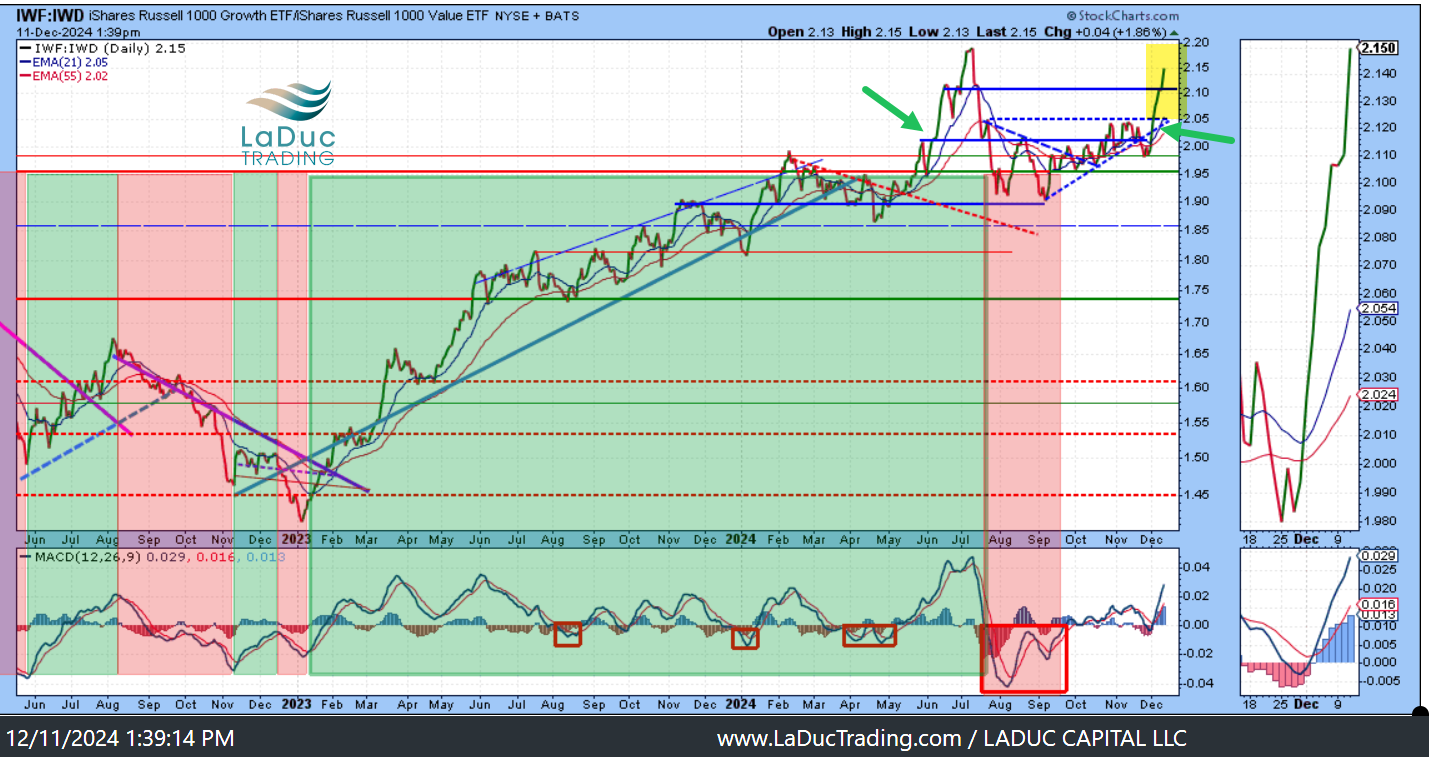

“I'm Bullish a Growth Rotation ala Summer 2024” - GROWTH rotation is in the house! What does that mean again? My thesis that MAG 7 / SPY 10 would lead and small caps would fall IS very much in play. Just like late May to early July before the yen carry trade forced de-risking in the “CONCENTRATION RISK” plays. How often in my trading room past few months have I said: “I’m not worried about AAPL, AMZN, TSLA”. “Now GOOGL”. That’s because SPY10 is in blue skies and SPY 490 are in distribution. AAPL, AMZN, TSLA, META, NFLX, WMT, COST and now GOOGL are in ATH territory while AVGO looks to be next with NVDA.

MAG7 ratio is melting-up. Remember my QQQ price target of 548!

BTC is sucking liquidity from commodities - did a big ‘ol rant on that this morning. Also posted on X: https://x.com/SamanthaLaDuc/status/1866909637683056887

Trend long retail faves are hot fire flames: WMT, COST, BJ, TJX, AMZN.

Quantum hope is the new AI hope: see GOOGL

Gold & Silver bet last week for higher into FOMC is working.

Former Parabolas breaking makes for a great swing short shopping list.

Falling shelter inflation component of CPI makes for a good case to expect core CPI to stay flat-ish and Fed to continue to justify rate cuts.

XLV under pressure as warned. LLY & NVO under pressure as warned.

Insurance plays rolling over. I’m not sure why yet, but they are and it’s not because of rates. The 10Y2Y is steepening not inverting and 10Y is in goldilocks spot for equities <4.37% but >3.8%. Bears watching.